New Delhi: In a significant and strategic move to bolster economic activity, the Reserve Bank of India (RBI) has recently announced a reduction of 25 basis points in its repo rate, bringing the key rate down to 6.00%. This decision marks an important turning point in India’s monetary policy, reflecting the RBI’s commitment to providing economic stimulus at a time when global uncertainties, such as ongoing geopolitical tensions, inflationary pressures, and a slowing global economy, are weighing heavily on domestic markets. Additionally, domestic liquidity concerns, as well as the need for businesses and consumers to access more affordable credit, have been crucial factors in this decision.

The repo rate, which is the rate at which commercial banks borrow funds from the RBI, directly impacts borrowing costs across the economy. A reduction in this rate makes borrowing cheaper, encouraging banks to pass on the benefit of lower interest rates to consumers and businesses. As a result, it is expected that the cost of loans, including home loans, car loans, personal loans, and business loans, will decrease, providing a much-needed boost to the economy.

Following the RBI’s announcement, major banks across the country have rapidly adjusted their lending and deposit rates in alignment with the new policy. The State Bank of India (SBI), India’s largest lender, was one of the first to announce a reduction in its lending rates, particularly for home and vehicle loans, making credit more affordable for borrowers. Other leading banks, such as Punjab National Bank (PNB), Bank of India (BOI), ICICI Bank, and Kotak Mahindra Bank, have followed suit, reducing their base rates and offering lower interest rates on loans linked to external benchmarks like the repo rate.

This rapid adjustment in lending rates is not only designed to ease the burden on borrowers but also signals a shift in the financial landscape as Indian banks strive to maintain a competitive edge. However, this reduction is not without consequences. While borrowers stand to benefit from cheaper credit, depositors may experience a reduction in returns on their savings. Banks are also likely to lower interest rates on fixed deposits and savings accounts as part of their response to the RBI’s move. This balancing act between offering attractive returns to savers and managing lower interest rates for borrowers presents a challenge for financial institutions.

In the broader context, the RBI’s decision to cut the repo rate is aligned with its accommodative stance, which aims to promote economic growth while managing inflation. By lowering the cost of credit, the central bank is hoping to stimulate investment in key sectors such as real estate, infrastructure, and manufacturing, all of which are critical to driving job creation and economic recovery. Additionally, the move is expected to encourage consumer spending, especially in sectors like automobiles and housing, where demand has been sluggish in recent months.

The impact of this policy shift, however, will likely take some time to fully materialize. The immediate effect will be seen in the reduction of EMIs (Equated Monthly Installments) for existing borrowers, and potentially lower rates for new loans, which will help ease financial pressure on consumers and businesses alike. Over the coming months, the full impact on economic growth will become clearer, especially as the economy reacts to the increased availability of credit and the reduction in borrowing costs.

Lending Rate Cuts: A Boon for Borrowers

The Reserve Bank of India’s (RBI) recent repo rate cut, reducing the key rate by 25 basis points to 6.00%, is set to provide a significant boost to borrowers across India. As a direct consequence of this policy move, several major banks have adjusted their lending rates, which is expected to make loans more affordable for both new and existing borrowers.

The most notable response comes from the State Bank of India (SBI), the country’s largest lender, which was among the first to announce a reduction in its lending rates by 25 basis points. This decision is in line with the RBI’s overarching strategy to maintain an accommodative monetary policy, aimed at stimulating economic activity through increased access to affordable credit.

SBI’s move will directly benefit borrowers by lowering the interest rates on home loans, auto loans, and education loans. For home buyers, this means reduced Equated Monthly Installments (EMIs) and lower total interest payments over the life of the loan. The reduction in loan costs is especially beneficial for first-time buyers and those looking to refinance their existing loans under more favorable terms. The cost of borrowing has a direct impact on both individual financial planning and broader market conditions, particularly in real estate and automotive sectors, which are integral to driving economic growth.

SBI’s move will directly benefit borrowers by lowering the interest rates on home loans, auto loans, and education loans. For home buyers, this means reduced Equated Monthly Installments (EMIs) and lower total interest payments over the life of the loan. The reduction in loan costs is especially beneficial for first-time buyers and those looking to refinance their existing loans under more favorable terms. The cost of borrowing has a direct impact on both individual financial planning and broader market conditions, particularly in real estate and automotive sectors, which are integral to driving economic growth.

Following SBI’s lead, other major banks have also slashed their lending rates to pass on the benefits of the RBI’s repo rate reduction to their customers. For instance, the Bank of India (BOI) has decreased its Repo-Linked Lending Rate (RLLR) from 9.10% to 8.85%, effective from April 9, 2025.

This move is expected to make credit more accessible, especially for customers in the middle and lower-income brackets, who may have previously found it difficult to secure loans due to higher interest rates. The Bank of India’s cut in RLLR will result in reduced EMIs for home loan borrowers, offering much-needed relief in a time when many consumers are facing financial pressures due to rising costs of living and uncertain economic conditions.

Moreover, other leading private sector banks such as Kotak Mahindra Bank and ICICI Bank have followed suit, reducing their respective base rates. This brings down the cost of loans, especially for existing borrowers whose loans are tied to benchmark rates. As a result, these customers will see a reduction in their monthly EMIs, which can provide significant relief to household budgets and improve disposable income for borrowers.

The impact of these lending rate cuts is most keenly felt in sectors such as real estate, automobiles, and education. The real estate sector, in particular, is expected to benefit from more affordable home loans, as reduced borrowing costs can revive demand in the housing market. Similarly, the automotive sector, which has faced fluctuating demand in recent months, could see increased purchases due to cheaper auto loans. In fact, both new car sales and home purchases typically correlate with lower borrowing rates, as consumers are more likely to invest in high-ticket items when the financing options are more attractive.

Education loans, which are often essential for students pursuing higher education, will also become more affordable. With the cost of education continuing to rise, many students and their families are seeking ways to finance their education. The reduction in lending rates by major banks will make education loans more accessible and reduce the financial burden on borrowers who are already dealing with rising tuition fees and living costs.

For businesses, particularly small and medium enterprises (SMEs), these rate cuts will provide easier access to working capital, enabling them to expand operations, hire more employees, and invest in growth initiatives. In an economy where consumption and investment are critical to recovery, the lower cost of credit plays a pivotal role in fueling growth and encouraging business activity.

However, while the rate cuts are a boon for borrowers, they also come with potential challenges for banks. The reduced lending rates may impact banks’ profitability, especially as interest margins narrow. To offset these challenges, banks will need to focus on increasing loan volumes and improving operational efficiency. Additionally, the reductions in lending rates may force banks to lower their deposit rates to maintain profitability, which could affect savers, particularly those reliant on fixed-income returns.

Deposit Rate Cuts: Balancing Liquidity

While the recent reduction in lending rates has been hailed as a boon for borrowers, the same monetary policy adjustment by the Reserve Bank of India (RBI) has triggered a wave of deposit rate cuts across major banks. The move to reduce deposit rates is an inevitable consequence of the central bank’s decision to lower the repo rate by 25 basis points. As expected, banks, including the State Bank of India (SBI), Kotak Mahindra Bank, and Bank of India, have announced reductions in their fixed deposit rates, reflecting the broader strategy to maintain liquidity and manage inflation while balancing the needs of both borrowers and savers.

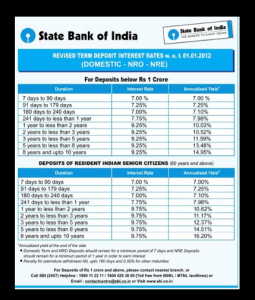

SBI, the largest lender in the country, was among the first to revise its fixed deposit rates, aligning them with the new economic reality. The bank’s reduction in deposit rates follows the RBI’s accommodative stance, which aims to stimulate economic growth by making borrowing more affordable. However, this comes at a cost for savers, particularly those reliant on fixed deposits as a source of income. For instance, lower returns on fixed deposits mean that investors will now receive smaller interest payments, reducing the overall yield on their savings.

While this may be a temporary inconvenience for some, the move is seen as necessary for the bank to maintain its net interest margins, which are the difference between the interest it pays on deposits and the interest it earns on loans.

Similarly, Kotak Mahindra Bank and Bank of India have also adjusted their deposit rates downward in response to the RBI’s rate cut. These moves are part of a broader trend across the banking sector, as financial institutions look to reduce their funding costs in order to pass on the benefits of lower borrowing costs to consumers. The reduction in deposit rates also helps banks maintain liquidity and ensure they can meet their obligations without compromising their profitability. For banks, lowering deposit rates while cutting lending rates enables them to strike a balance between encouraging borrowing and ensuring they can continue to fund loans and other credit facilities.

The primary reason for this drop in deposit rates is to maintain financial stability and manage liquidity. By lowering the interest paid on deposits, banks can ensure they remain financially sound, especially in a period of declining interest rates. When deposit rates are high, banks are forced to offer competitive returns to attract and retain customers, which can significantly strain their financial resources. In contrast, a lower deposit rate environment helps banks better manage their cash flow and lending activities while still offering competitive savings products to their customers.

For savers, however, the reduction in deposit rates could lead to a decline in returns on their investments, particularly for those relying on fixed deposits as a source of stable, predictable income. Retirees and long-term investors, who typically depend on interest income from fixed deposits, may be especially impacted. Lower returns could prompt them to reconsider their investment strategies, seeking alternative options like mutual funds, stocks, or government bonds, which might offer higher yields but come with varying degrees of risk.

Despite the lower returns on fixed deposits, there are still some advantages to maintaining savings in banks. For instance, savings accounts and fixed deposits continue to offer a higher level of security than riskier investments like equities, making them an attractive option for conservative investors. Additionally, the current economic environment presents an opportunity for individuals to explore diversified investment strategies that could offer a better return while managing risk.

The banks’ approach to reducing deposit rates while passing on the benefits of the repo rate cut to borrowers is a delicate balancing act. On one hand, banks must ensure that they offer affordable credit to consumers and businesses to stimulate economic activity. On the other hand, they must manage their funding costs, preserve profitability, and protect their liquidity position in an uncertain financial environment.

In this context, the RBI’s rate cuts are a double-edged sword. While they provide a much-needed incentive for borrowing and investment, they also put pressure on savers and banks to adjust to a new interest rate environment. The decision to reduce deposit rates reflects the ongoing challenge for banks to balance liquidity management with customer satisfaction in a time of economic flux. For depositors, this means they will likely need to explore other financial products or adjust their long-term savings goals to account for lower returns.

Economic Implications and Future Outlook

The Reserve Bank of India’s (RBI) decision to reduce the repo rate by 25 basis points to 6.00% is a deliberate part of its broader strategy aimed at stimulating economic growth. By making borrowing more affordable for businesses and consumers, the RBI hopes to foster an environment conducive to increased spending, investment, and overall demand across the economy. This rate cut is expected to have several positive effects, particularly in sectors that depend heavily on credit, such as real estate, automobiles, and small businesses. As access to cheaper credit improves, these sectors may witness a surge in demand, leading to greater economic activity and a recovery in areas where growth has been sluggish.

However, alongside these benefits, there are concerns regarding the impact of the rate cuts on the profitability of the banking sector. While reducing lending rates is beneficial for borrowers, it puts pressure on banks to maintain their interest margins, which are the difference between the interest earned on loans and the interest paid on deposits. As banks lower their lending rates, they may also be forced to reduce deposit rates to balance their finances. This creates a delicate balancing act for banks: on one hand, they must continue offering attractive credit products to stimulate demand; on the other, they need to manage their costs and protect profitability in a low-interest-rate environment.

The decrease in deposit rates could further complicate this situation. Depositors, particularly those who rely on fixed-income investments like fixed deposits, may see a reduction in their returns, which could dampen their savings behavior. For senior citizens and conservative investors who depend on fixed deposits for steady income, this could have an adverse effect on their financial well-being. Consequently, banks may face challenges in attracting and retaining depositors, especially if savers seek higher returns elsewhere, such as in equities, mutual funds, or other alternative investments.

To counterbalance this, the RBI has maintained a liquidity surplus of around 1% of deposits, which is seen as a positive step in managing financial stability. By maintaining ample liquidity in the system, the RBI aims to ensure that policy transmission is effective, meaning that the benefits of rate cuts can be felt across the economy. This liquidity is crucial for enabling banks to lend more freely, even as they face pressure to reduce interest rates. The central bank’s actions help ensure that there is no liquidity squeeze, which could hinder credit flow and stifle economic growth.

Moreover, the RBI’s continued efforts to manage inflation also play a critical role in shaping the outlook for the Indian economy. While reducing the repo rate is intended to support growth, it is essential that inflation remains under control to avoid eroding the purchasing power of consumers. If inflation rises too rapidly, the RBI may face the difficult decision of raising interest rates again to keep prices in check, which could offset the benefits of lower borrowing costs.

Looking ahead, the economic outlook will largely depend on how businesses and consumers respond to the lower lending rates and the associated drop in deposit returns. The success of the RBI’s policy will depend on the transmission of these rate cuts to the real economy. The ability of banks to adjust to the new rate environment while managing their profitability will also be a key factor in determining the long-term impact of these policy measures.

The global economic climate adds another layer of uncertainty. India, like many other nations, faces external challenges such as geopolitical tensions, supply chain disruptions, and fluctuations in global commodity prices, which could affect economic growth. Additionally, the ongoing global shift toward more restrictive monetary policies in other major economies may impact India’s trade and capital flows, further complicating the situation.

Conclusion

The recent decisions by the RBI and major Indian banks to cut both lending and deposit rates are indicative of a broader trend designed to stimulate economic activity in the face of ongoing challenges. These adjustments are expected to make credit more accessible to individuals and businesses, particularly in sectors like real estate, automobiles, and education, potentially leading to a boost in demand and overall economic activity. However, the simultaneous reduction in deposit rates means that savers will likely see lower returns on their fixed deposits and savings accounts, which could influence their investment strategies and savings behavior.

The long-term economic impact will depend on how effectively the rate cuts stimulate growth without destabilizing inflation or the banking sector’s profitability. While India’s economic fundamentals remain strong, global economic conditions and internal factors like inflation will play a significant role in shaping the future outlook.

As India navigates through this complex economic landscape, the success of the RBI’s policy will largely hinge on its ability to balance the needs of borrowers, savers, and the broader economy, ensuring that growth remains robust while financial stability is maintained. The coming months will reveal how these rate cuts play out in terms of both economic growth and financial stability, and whether the RBI’s strategy can successfully mitigate the risks posed by global economic challenges.

For more details on this development, refer to the Reserve Bank of India Press Release.

For more real time updates, visit Channel 6 Network.