Mumbai, 8 May 2025 — Indian equity markets faced a volatile trading session on Wednesday, closing deep in the red as rising geopolitical tensions and risk-off sentiment spooked investors. The benchmark Nifty 50 index closed at 24,273.80, down 140.60 points (-0.58%), amid a broad-based sell-off across sectors. This comes in the backdrop of renewed cross-border hostilities, following Operation Sindoor and Pakistan’s retaliatory aggression, which has rattled market sentiment and triggered a flight to safety.

Also Read: 07 May 2025 – Indian Stock Market Report (Closing Bell)

Market Overview

The Indian stock markets witnessed a turbulent session on 8 May 2025, amid a cocktail of geopolitical tensions, volatile global cues, and cautious investor sentiment. The day was marked by broad-based declines across major indices, with the benchmark Nifty 50 closing below the 24,300 mark for the first time in weeks. A heightened state of alert along the Line of Control (LoC), following India’s counter-strike under Operation Sindoor, weighed heavily on investor confidence.

Risk aversion intensified as Pakistan launched a series of drone and missile attacks on Indian military establishments during the night of 7–8 May, which India swiftly countered. While the Ministry of Defence emphasized a non-escalatory stance, the specter of further conflict led to market-wide volatility. Sectoral indices like the Nifty Next 50 and Financial Services saw pronounced losses, while select small-cap counters defied the trend on the back of high speculative interest.

Risk aversion intensified as Pakistan launched a series of drone and missile attacks on Indian military establishments during the night of 7–8 May, which India swiftly countered. While the Ministry of Defence emphasized a non-escalatory stance, the specter of further conflict led to market-wide volatility. Sectoral indices like the Nifty Next 50 and Financial Services saw pronounced losses, while select small-cap counters defied the trend on the back of high speculative interest.

Amidst the geopolitical backdrop, traders also grappled with global macroeconomic concerns including tightening US interest rate outlooks, fluctuating crude oil prices, and an overall risk-off environment. This confluence of factors triggered both profit booking in high-flying stocks and a cautious recalibration of market expectations.

🔍 Key Index Movements

-

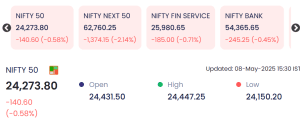

Nifty 50: 24,273.80

-

Change: -140.60 (-0.58%)

-

Open: 24,431.50

-

High: 24,447.25

-

Low: 24,150.20

-

-

Nifty Next 50: 62,760.25 ↓ -2.14%

-

Nifty Financial Services: 25,980.65 ↓ -0.71%

-

Nifty Bank: 54,365.65 ↓ -0.45%

The steepest losses were seen in the Nifty Next 50, reflecting sharper declines in the mid-to-large cap segment, while banking and financial indices also ended lower, weighed by concerns over rising bond yields and profit-taking in frontline stocks.

📈 Top Gainers: Small Caps in Spotlight

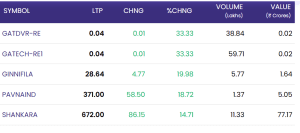

Despite the weak broader market, several small-cap and low-float stocks saw massive gains — driven possibly by speculative buying or short covering.

Despite the weak broader market, several small-cap and low-float stocks saw massive gains — driven possibly by speculative buying or short covering.

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GATDVR-RE | 0.04 | +0.01 | +33.33% | 38.84 | 0.02 |

| GATECH-RE1 | 0.04 | +0.01 | +33.33% | 59.71 | 0.02 |

| GINNIFILA | 28.64 | +4.77 | +19.98% | 5.77 | 1.64 |

| PAVNAIND | 371.00 | +58.50 | +18.72% | 1.37 | 5.05 |

| SHANKARA | 672.00 | +86.15 | +14.71% | 11.33 | 77.17 |

Notably, SHANKARA Building Products Ltd., with a market-focused surge of ₹86.15, led the pack in value terms, indicating strong investor interest — likely backed by recent fundamental developments or sector rotation in infrastructure and construction.

📉 Top Losers: Profit Booking Drags Heavyweights

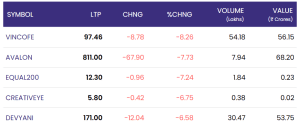

In contrast, several frontline and mid-sized stocks witnessed sharp declines — driven by profit booking, geopolitical jitters, and sector-specific pressure.

In contrast, several frontline and mid-sized stocks witnessed sharp declines — driven by profit booking, geopolitical jitters, and sector-specific pressure.

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| VINCOFE | 97.46 | -8.78 | -8.26% | 54.18 | 56.15 |

| AVALON | 811.00 | -67.90 | -7.73% | 7.94 | 68.20 |

| EQUAL200 | 12.30 | -0.96 | -7.24% | 1.84 | 0.23 |

| CREATIVEYE | 5.80 | -0.42 | -6.75% | 0.38 | 0.02 |

| DEVYANI | 171.00 | -12.04 | -6.58% | 30.47 | 53.75 |

AVALON Technologies, despite strong fundamentals, witnessed a significant decline, perhaps reflecting profit booking post-earnings or nervousness about global exposure. Similarly, VINCOFE saw heavy volumes, suggesting institutional exit or sentiment-driven sell-off.

🌐 Macroeconomic & Geopolitical Overhang

Market sentiment remained clouded by uncertainty following a flare-up along the Line of Control. On 7–8 May 2025, Pakistan reportedly launched missile and drone attacks on multiple Indian military sites. India responded proportionately with precision strikes, as confirmed by a Ministry of Defence briefing.

These events have led to increased market volatility, as investors reassess risk premiums amid fears of prolonged border tensions. Global investors are watching closely, especially given the interconnectedness of emerging markets with global capital flows.

Conclusion

Thursday’s market session served as a stark reminder of the sensitive interplay between geopolitics and financial markets. The visible drop across benchmark and sectoral indices highlights the unease prevailing among investors — both institutional and retail. While select small-cap stocks registered notable gains, possibly due to speculative trading or insider accumulation, the broader narrative was one of caution, consolidation, and defensive positioning.

As India’s Ministry of Defence continues to advocate for measured retaliation and strategic restraint, markets will closely track both the ground realities and diplomatic developments over the coming days. The Nifty 50’s decline of 0.58%, combined with a 2.14% fall in the Nifty Next 50, reflects a market that is not panicked, but certainly wary.

Moving ahead, market watchers will be paying close attention to:

-

Statements from defense and government officials

-

Global central bank policies (especially the US Fed)

-

Earnings reports and domestic inflation data

While volatility may persist in the short term, fundamentally sound companies with low debt, stable earnings, and domestic growth stories may offer safe harbors. For long-term investors, this phase could present selective buying opportunities, though timing and caution remain key.

📊 For real-time updates and verified data, visit the NSE India official website