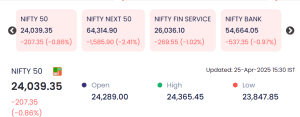

New Delhi, April 25, 2025 — On Thursday, April 25, 2025, the Indian stock markets witnessed a significant downturn as mounting geopolitical tensions, volatile global cues, and continued foreign institutional investor (FII) sell-offs dampened investor confidence. The benchmark Nifty 50 plunged over 200 points, marking one of its sharpest single-day declines in recent weeks. Broader indices, including the Nifty Next 50, Nifty Financial Services, and Nifty Bank, also posted sharp losses, highlighting the extent of the bearish sentiment across the board.

Also Read: Indian Stock Market Summary – April 22, 2025

The market’s negative trajectory was triggered by multiple risk factors—escalating regional instability due to the closure of Pakistani airspace, persistent concerns around global interest rates, and a rise in crude oil prices. These developments heightened fears of economic disruptions, especially in sectors like aviation, energy, and finance. Investors showed a clear preference for risk aversion, resulting in sharp corrections even among mid- and small-cap stocks.

Despite the broader selloff, select counters such as LFIC, Carraro, and Manaksia Steel managed to defy the market trend with double-digit gains, largely on the back of stock-specific news and robust trading volumes. However, this was overshadowed by a long list of laggards led by Mindteck, SRM, and Bhandari, which bore the brunt of panic selling and negative sentiment.

📉 Market Overview of April 25: Broad-Based Selloff Continues

Other indices mirrored the downtrend:

-

Nifty Next 50 dropped 1,585.90 points (-2.41%) to close at 64,314.90

-

Nifty Financial Services slipped 269.55 points (-1.02%) to 26,036.10

-

Nifty Bank ended at 54,664.05, down 537.35 points (-0.97%)

The selloff was mainly attributed to rising crude oil prices, escalating regional conflict, and the closure of Pakistani airspace, which sparked fears of potential disruptions in trade and aviation sectors.

📈 Top Gainers: LFIC, Carraro, Manaksia Steel Shine

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| LFIC | 203.61 | +33.93 | +20.00% | 1.68 | 3.37 |

| Carraro | 383.00 | +51.60 | +15.57% | 16.71 | 61.57 |

| ManakSteel | 73.03 | +9.26 | +14.52% | 10.21 | 7.34 |

| Butterfly | 675.05 | +64.15 | +10.50% | 3.30 | 22.47 |

| Councodos | 10.84 | +0.98 | +9.94% | 23.51 | 2.52 |

LFIC surged 20% after reports of increased institutional buying. Carraro followed with a 15.57% rise amid strong Q4 earnings guidance, and ManakSteel saw buying interest driven by favorable sectoral tailwinds.

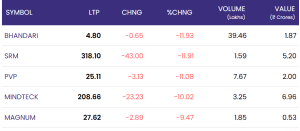

📉 Top Losers: Bhandari, SRM, Mindteck Drag

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| Bhandari | 4.80 | -0.65 | -11.93% | 39.46 | 1.87 |

| SRM | 318.10 | -43.00 | -11.91% | 1.59 | 5.20 |

| PVP | 25.11 | -3.13 | -11.08% | 7.67 | 2.00 |

| Mindteck | 208.66 | -23.23 | -10.02% | 3.25 | 6.96 |

| Magnum | 27.62 | -2.89 | -9.47% | 1.85 | 0.53 |

Mindteck saw steep selling following reports of a data breach and service disruption. SRM faced investor pullback after a regulatory inquiry dampened sentiments.

🔍 Market Sentiment & Global Outlook

Analysts point to a mix of domestic and international triggers weighing down investor sentiment. The closure of Pakistani airspace, continued tensions in Jammu and Kashmir, and global concerns over U.S. Fed interest rate policies have contributed to the current pullback.

“Markets are entering a phase of heightened caution. Unless we see clear signals of easing geopolitical tensions and better-than-expected corporate earnings, volatility will persist,” said Aastha Bhargava, Senior Market Strategist at Kotak Securities.

📌 Conclusion: Brace for Short-Term Volatility

The April 25 market session reaffirmed the vulnerability of Indian equities to global macroeconomic and geopolitical disruptions. The sharp fall in key indices, especially the Nifty 50 and banking stocks, reflects growing investor anxiety amid a complex web of uncertainties—from rising inflation and rate hikes abroad to regional instability and policy ambiguity at home.

Market experts believe that unless there is a swift de-escalation of geopolitical tensions and clear positive triggers such as strong corporate earnings or FII inflows, volatility will likely persist. The broader market weakness, combined with sectoral underperformance and regulatory pressures in key industries, could keep investors on the defensive in the near term.

Going forward, investors are advised to adopt a stock-specific and fundamentally driven strategy, focusing on quality names with strong balance sheets, consistent earnings, and low debt exposure. While short-term corrections may offer buying opportunities, especially in oversold sectors, risk management and capital preservation should remain top priorities.

In this unpredictable climate, caution is key—and patience may very well be the most profitable investment tool.

🔗 Official Market Summary: NSE India – Market Today