BSE LTD SHARE PRICE SURGES 30% IN 2025 DESPITE BONUS-INDUCED VOLATILITY

BSE Ltd, Asia’s oldest stock exchange, has been in the spotlight recently due to a significant corporate action—the issuance of a 2:1 bonus share, rewarding shareholders with two additional shares for every one held. This move, approved by the board on March 30, 2025, and effective from the record date of May 23, 2025, has caused notable adjustments in the stock price, creating momentary volatility but reinforcing the company’s robust fundamentals and long-term growth story.

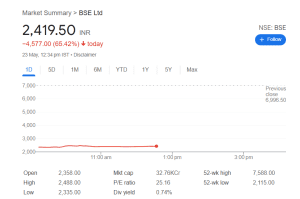

The bonus share issuance led to an ex-bonus price adjustment, causing the stock to appear to plunge nearly 67% on certain trading platforms on May 23. However, this drop is purely technical, reflecting the increased number of shares outstanding rather than a loss in market value. Post-adjustment, BSE shares opened around ₹2,358 compared to the previous close of ₹7,015, aligning with the new share count. Despite this, the stock remains a multibagger, having surged over 5,200% in the last five years and delivering 165% returns in the past year alone.

The issuance of bonus shares by BSE Ltd is a reflection of the company’s strong balance sheet and healthy cash reserves. By converting free reserves into equity, BSE is not only rewarding existing shareholders but also enhancing the liquidity and marketability of its shares. This move is expected to attract more retail investors, who often find lower-priced shares more accessible.

Despite the technical price adjustment, BSE’s market capitalization remains robust, underscoring investor confidence in the company’s long-term prospects. The bonus issue, coupled with consistent dividend payouts, signals management’s commitment to shareholder value creation and financial prudence.

BSE Ltd’s recent corporate actions, including the bonus share issuance and special dividend declaration, highlight the company’s strategic approach to capital management and shareholder engagement. By issuing bonus shares in a 2:1 ratio, BSE is effectively increasing its paid-up capital, which not only strengthens its balance sheet but also improves liquidity in the secondary market.

This move is particularly significant in the context of India’s evolving financial markets, where increased participation from retail investors is driving demand for more accessible share prices. The bonus issue reduces the per-share price, making it easier for smaller investors to enter the market, thereby broadening the shareholder base and enhancing market depth. This democratization of share ownership aligns with BSE’s vision of fostering inclusive growth and expanding financial participation across diverse investor segments.

The financial performance of BSE Ltd in the recent quarters has been exemplary, reflecting the company’s robust business model and operational efficiency. The 362% year-on-year increase in net profit for Q4 FY25 is a clear indicator of the company’s strong revenue streams and effective cost management. The surge in revenue from operations by 75% to ₹847 crore underscores the growing volumes and diversified product offerings that BSE has successfully leveraged.

High EBITDA margins of around 70% demonstrate the company’s ability to scale its operations while maintaining profitability, a critical factor for sustaining long-term growth. This financial strength provides BSE with the flexibility to invest in technology upgrades, market expansion initiatives, and regulatory compliance, ensuring it remains competitive in an increasingly dynamic and complex financial ecosystem.

BSE’S FINANCIAL PERFORMANCE FUELS INVESTOR CONFIDENCE

BSE Ltd’s recent quarterly results have been nothing short of spectacular, further bolstering investor sentiment. The company reported a 362% year-on-year increase in net profit to ₹494 crore for Q4 FY25, driven by a 75% rise in revenue from operations to ₹847 crore. Operating EBITDA more than tripled to ₹594 crore, with EBITDA margins soaring to an impressive 70%, underscoring operational efficiency and strong profitability.

These robust financials have translated into positive analyst recommendations, with 11 out of 14 analysts rating BSE shares as a ‘Buy.’ The board has also recommended a special dividend of ₹5 per share to commemorate BSE’s 150th anniversary, alongside a regular dividend of ₹18 per share, totaling ₹23 per share, reflecting the company’s commitment to rewarding shareholders.

BSE Ltd has also been proactive in embracing technological advancements to stay ahead in a highly competitive market. Investments in cutting-edge trading platforms, data analytics, and cybersecurity have strengthened its position as a reliable and efficient exchange, capable of handling increasing transaction volumes seamlessly.

The company’s diversified revenue streams, including listing fees, transaction charges, data services, and technology solutions, provide stability and reduce dependence on any single segment. This diversification has been instrumental in sustaining revenue growth even during volatile market conditions.

Investor sentiment towards BSE Ltd remains overwhelmingly positive, as evidenced by the majority of analyst recommendations favoring the stock. The declaration of a special dividend of ₹5 per share, in addition to the regular dividend of ₹18 per share, serves as a tangible reward for shareholders and reflects the company’s confidence in its cash flow generation capabilities.

Such dividend policies not only enhance shareholder value but also signal management’s commitment to maintaining a balanced approach between growth investments and returns to investors. The timing of the dividend, coinciding with BSE’s 150th anniversary, adds symbolic significance, celebrating the company’s rich heritage while looking forward to future milestones. This blend of tradition and innovation positions BSE as a trusted and forward-looking institution in India’s capital markets.

The market’s reaction to the bonus share issuance, while initially marked by technical price adjustments, has stabilized as investors recognize the underlying value proposition. The apparent drop in share price due to the ex-bonus adjustment is a standard market mechanism that ensures the company’s market capitalization remains consistent post-issuance. Educated investors understand that their proportional ownership and investment value are preserved, and the increased number of shares offers greater liquidity and trading flexibility. This enhanced liquidity can attract institutional investors and mutual funds, which often prefer stocks with higher trading volumes and tighter bid-ask spreads. Consequently, the bonus issue could lead to improved market efficiency and price discovery for BSE shares, benefiting all stakeholders.

MARKET REACTIONS AND SHAREHOLDER IMPACT OF BONUS ISSUE

The bonus issue has generated mixed reactions in the market. While the technical adjustment led to a sharp dip in share prices on paper, savvy investors recognize that their proportional ownership and investment value remain intact. The issuance of bonus shares is a strategic move to capitalize on free reserves, increase paid-up capital, and enhance earnings per share (EPS), making the stock more accessible and attractive to a broader investor base.

Notably, prominent investors like Mukul Mahavir Agrawal, holding a 1.18% stake, will see their shareholding increase proportionally, maintaining their percentage ownership while benefiting from the additional shares. The bonus shares are set to be credited on May 26, with trading commencing on May 27, offering shareholders an opportunity to capitalize on the increased liquidity.

Analysts highlight that BSE’s strong financial health enables it to explore new growth avenues, such as expanding its footprint in the debt market and enhancing its offerings in mutual funds and ETFs. These initiatives align with the broader trend of financial market deepening in India.

Investor education and awareness programs conducted by BSE have also played a crucial role in increasing market participation. By promoting financial literacy and transparency, the exchange fosters trust and encourages responsible investing among retail and institutional investors alike.

BSE LTD’S STRATEGIC POSITIONING IN INDIA’S FINANCIAL ECOSYSTEM

As India’s premier stock exchange, BSE Ltd plays a pivotal role in the country’s financial markets, providing a platform for equities, derivatives, debt instruments, mutual funds, and SME listings. The Sensex, BSE’s flagship index, remains a key barometer of the Indian economy, tracking the performance of 30 leading companies across sectors.

The company’s strategic initiatives, including technology upgrades, diversification of product offerings, and expansion into new market segments, have contributed to its impressive growth trajectory. BSE’s ability to maintain high EBITDA margins and deliver consistent profitability positions it well to capitalize on India’s expanding capital markets and increasing investor participation.

The recent surge in BSE’s share price over the past year reflects the broader bullish sentiment in India’s equity markets, driven by robust economic growth, favorable government policies, and increasing foreign investment inflows. BSE’s performance is often seen as a proxy for the health of the Indian capital markets.

Market experts advise investors to look beyond short-term price fluctuations caused by corporate actions like bonus issues. Instead, they recommend focusing on the company’s fundamentals, growth strategies, and consistent track record of profitability and dividend payments.

BSE Ltd’s role in India’s financial infrastructure extends beyond equity trading to encompass debt markets, derivatives, mutual funds, and SME listings. This diversified portfolio of services positions BSE as a comprehensive financial marketplace catering to a wide spectrum of investors and issuers. The company’s continuous investment in technology, including the deployment of advanced trading platforms and data analytics tools, enhances market transparency and operational resilience. These technological advancements not only improve user experience but also ensure compliance with stringent regulatory standards, fostering investor confidence. As India’s economy grows and capital markets deepen, BSE’s ability to innovate and adapt will be crucial in maintaining its leadership position and supporting the country’s economic development goals

BSE Ltd’s milestone of completing 150 years is a testament to its resilience and adaptability in the face of evolving market dynamics. The special dividend declared in celebration of this landmark underscores the company’s legacy and its vision for sustained growth in the future.

Looking ahead, BSE is well-positioned to leverage India’s growing investor base and expanding capital markets. With continued innovation, strategic partnerships, and a strong governance framework, BSE Ltd is set to maintain its leadership role and deliver value to shareholders for years to come.

Follow: BSE