HDFC Bank, India’s largest private sector lender, has delivered a robust performance in the fourth quarter of FY25, sending its stock prices soaring to new all-time highs. The bank reported a net profit of ₹17,616 crore, marking a 6.7% year-on-year growth and a 5.3% sequential increase.

This strong quarterly showing was driven by healthy loan growth, stable net interest margins, and improved asset quality, reassuring investors and analysts alike. Following the earnings announcement, HDFC Bank’s share price jumped over 2% at the opening bell on April 21, 2025, touching ₹1,950 on the BSE, before stabilizing around ₹1,927.20 by midday. This article delves into the key financial metrics behind this surge, the market’s reaction, and what the results mean for the bank’s future trajectory.

HDFC Bank Q4 Performance: Strong Profit Growth and Healthy Loan Expansion

HDFC Bank Q4 Performance: Strong Profit Growth and Healthy Loan Expansion

HDFC Bank’s Q4FY25 earnings showcased solid financial health with a net profit of ₹17,616 crore, reflecting a 6.7% increase compared to the same quarter last year. This growth was supported by a 10.3% year-on-year rise in net interest income (NII), which reached ₹32,070 crore, underscoring the bank’s ability to generate income from its core lending activities. The net interest margin (NIM) stood at 3.54% on total assets and 3.73% on interest-earning assets, highlighting stable profitability despite challenging macroeconomic conditions.

Loan growth was a standout feature of HDFC Bank’s Q4 FY25 performance, reflecting the bank’s strategic focus on balanced expansion and prudent risk management. As of March 31, 2025, advances under management climbed to ₹27.73 lakh crore, marking a robust 7.7% year-on-year and 3.3% sequential increase. This growth was broad-based, with retail loans rising 9% year-on-year and commercial and rural banking loans surging 12.8% over the same period. Such momentum in these segments underscores sustained demand from both individual consumers and small businesses, which has been a key driver for the bank’s overall loan book expansion.

The granular breakdown of the loan mix reveals that retail advances stood at ₹13,758 crore, up 9% year-on-year, while commercial and rural banking advances reached ₹9,050 crore, up 12.8%. However, corporate and other wholesale loans saw a modest decline of 3.6%, reflecting a cautious approach in the large corporate segment amid evolving market conditions. This deliberate shift towards retail and commercial lending aligns with the bank’s strategy to prioritize quality growth and diversify risk, especially as retail and rural segments typically offer higher yields and more stable asset quality.

A key highlight was the improvement in the bank’s credit-deposit (C/D) ratio, which declined to 96% from a peak of 110% following the HDFC-HDFC Bank merger. This reduction signals enhanced liquidity and a more conservative lending approach, allowing the bank to manage funding costs effectively and strengthen its balance sheet. Management has reiterated its commitment to maintaining a healthy C/D ratio, aiming for a further reduction to the pre-merger range of 85–90 by FY27. This disciplined stance is expected to support sustainable growth while safeguarding against liquidity pressures.

Analysts have lauded HDFC Bank’s focus on quality over quantity, noting that the bank is not chasing loan volumes at the expense of margins or asset quality. The combination of strong loan growth in high-yielding segments, improved liquidity metrics, and stable credit quality places HDFC Bank in a favorable position to capture future opportunities in India’s expanding credit market. This approach not only reassures investors about the bank’s long-term prospects but also reinforces its reputation as a benchmark for stability and growth in the Indian banking sector.

Asset Quality and Capital Strength: A Pillar of Confidence

HDFC Bank’s asset quality showed encouraging signs of improvement in Q4FY25. The gross non-performing assets (GNPA) ratio declined sequentially to 1.33% from 1.42% in the previous quarter, though it remained slightly higher than the 1.24% recorded a year ago. Net NPAs stood at a low 0.43% of net advances, reflecting effective provisioning and recovery efforts. The bank’s cost-to-income ratio improved to 39.8%, indicating efficient cost management alongside revenue growth.

HDFC Bank’s capital adequacy remained robust in Q4 FY25, with the Capital Adequacy Ratio (CAR) standing at a strong 19.6% as of March 31, 2025, comfortably above the regulatory minimum requirements set by the Basel III framework. This healthy capital buffer is a critical indicator of the bank’s financial strength and its ability to absorb potential losses, thereby safeguarding depositors’ interests and maintaining overall systemic stability. The Common Equity Tier 1 (CET1) ratio, which represents the highest quality capital, was reported at 17.2%, further underscoring the bank’s solid capital foundation. These metrics highlight HDFC Bank’s prudent capital management and its preparedness to support future lending growth without compromising financial resilience.

The strong capital position is particularly significant given the bank’s expanding balance sheet, which grew to ₹39.10 lakh crore by the end of March 2025, up from ₹36.17 lakh crore a year earlier. This growth reflects increased lending and deposit mobilization activities, necessitating a strong capital base to meet regulatory norms and cushion against credit risks. Market participants and analysts have viewed these capital adequacy figures as a positive signal, reinforcing confidence in HDFC Bank’s risk management framework amid evolving economic conditions and potential headwinds in the banking sector. The bank’s ability to maintain such a high CAR and CET1 ratio while growing its assets demonstrates disciplined financial stewardship.

Moreover, HDFC Bank’s capital adequacy ratios provide it with the flexibility to pursue growth opportunities, including expanding its loan book and investing in technology and infrastructure, without the immediate need to raise additional capital. This financial strength also positions the bank well to withstand macroeconomic uncertainties and regulatory changes. The bank’s management has consistently emphasized maintaining a healthy capital buffer as a cornerstone of its strategy, which has contributed to its reputation as one of India’s most stable and well-managed private sector banks.

In summary, HDFC Bank’s capital adequacy metrics for Q4 FY25 not only reflect compliance with regulatory standards but also signify the bank’s robust financial health and strategic foresight. These strengths underpin the bank’s capacity to sustain growth, manage risks effectively, and deliver consistent value to shareholders and customers alike in a dynamic economic environment.

HDFC Bank’s strong capital position is further complemented by impressive growth in its deposit base and consistent profitability, reinforcing its financial stability and capacity for future expansion. As of March 31, 2025, the bank’s average deposits surged by 15.8% year-on-year to ₹25.28 lakh crore, with end-of-period deposits rising 14.1% to ₹27.14 lakh crore. The growth was not only robust on a yearly basis but also sequentially, with deposits increasing by ₹1.51 lakh crore (5.9%) quarter-on-quarter. Notably, the current account and savings account (CASA) deposits grew by 3.9% year-on-year, and time deposits saw a significant 20.3% rise, resulting in CASA deposits comprising 34.8% of total deposits.

This healthy deposit mobilization, coupled with a net interest margin (NIM) of 3.54% on total assets and a cost-to-income ratio of 39.8%, underscores HDFC Bank’s operational efficiency and profitability. Return on assets (RoA) stood at 1.9%, and return on equity (RoE) was 14.4% for the quarter, while earnings per share (EPS) reached ₹24.6, all of which signal strong value creation for shareholders and a solid foundation for future growth.

Market Reaction and Analyst Outlook: Bullish Sentiment Prevails

The market responded enthusiastically to HDFC Bank’s Q4 results, with the stock price rallying over 2% to hit a record ₹1,950 at the opening on April 21, 2025. Although the share price moderated slightly by midday, it remained firmly above previous levels, reflecting sustained investor optimism. Over the past year, HDFC Bank’s shares have gained 27%, and the stock has delivered a remarkable 110% return over five years, cementing its status as a blue-chip favorite.

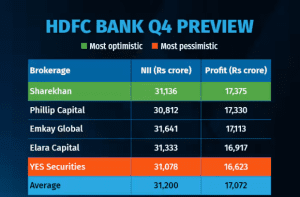

Brokerages maintained a bullish outlook on HDFC Bank following its robust Q4 results, with several leading firms raising their target prices and highlighting the bank’s operational strengths. Emkay Global Financial Services increased its target price by 5% to ₹2,200, attributing this upward revision to HDFC Bank’s better-than-expected credit growth and stable core margins. Nuvama Institutional Equities echoed this optimism, revising its target price to ₹2,195 and emphasizing the bank’s strong performance on core net interest margin (NIM) and lower quarterly slippages, both of which point to effective risk management and profitability.

Motilal Oswal Financial Services underscored the bank’s healthy business growth, particularly noting the strategic reduction in the credit-deposit ratio, which enhances liquidity and positions the bank for sustainable expansion. CLSA described the quarter as “decent,” highlighting promising trends in both loan growth and asset quality, which are critical for long-term investor confidence.

However, not all brokerages were unequivocally positive. Lakshmishree Investment advised a degree of caution, suggesting that the stock appeared overextended after its recent rally and recommending partial profit booking to capitalize on near-term gains. This nuanced view reflects a recognition of the bank’s strong fundamentals while acknowledging the potential for short-term volatility after a sharp rise in share prices.

Overall, the consensus among analysts is that HDFC Bank’s disciplined approach to growth, focus on core profitability, and improving asset quality continue to make it a preferred pick in the Indian banking sector, even as some recommend a tactical approach to booking profits in the near term.

Strategic Implications and Future Outlook: Positioned for Sustainable Growth

HDFC Bank’s Q4FY25 results not only reflect a strong quarter but also signal a positive outlook for the coming fiscal year. The bank’s management expressed confidence in India’s macroeconomic environment, especially following the Reserve Bank of India’s recent rate cuts and shift to an accommodative stance. This policy easing is expected to support credit growth and improve borrowing costs, benefiting HDFC Bank’s lending franchise.

The merger with HDFC Limited, completed in FY24, continues to influence the bank’s financial profile, particularly in terms of deposit mobilization and cost of borrowing. The bank’s ability to manage these integration challenges while maintaining profitability and asset quality will be critical going forward. Analysts expect continued improvement in return ratios driven by net interest margin expansion and operational leverage gains.

In summary, HDFC Bank’s robust Q4 performance, combined with a healthy balance sheet and positive market sentiment, positions it well to capitalize on India’s growing credit demand. Investors and stakeholders can look forward to sustained value creation as the bank navigates the evolving financial landscape with strategic prudence and operational excellence.

Follow: HDFC Website

Also Read: Stunning Milestones: Lucy Guo, 30, Triumphs as Youngest Self-Made Female Billionaire