New Delhi, May 3, 2025 – In a diplomatically significant step with potential implications for South Asian geopolitics and international finance, the Indian government has formally approached the International Monetary Fund (IMF), urging a comprehensive review of the financial assistance being extended to Pakistan. A senior Indian government official, speaking on condition of anonymity, confirmed that the communication highlights concerns regarding the potential misuse of IMF funds, especially amid Pakistan’s ongoing internal instability and growing military expenditure.

🔍 The IMF-Pakistan Loan Context

🔍 The IMF-Pakistan Loan Context

Pakistan has been a repeated recipient of IMF bailout packages. As of 2025, the country is still under a $3 billion Stand-By Arrangement (SBA) sanctioned in mid-2023. Aimed at stabilizing its macroeconomic framework, the loan was meant to support Pakistan’s efforts in reducing fiscal deficits, controlling inflation, and replenishing foreign reserves.

Despite the program’s intent, India has questioned the accountability mechanisms governing how these funds are actually being used. The Indian submission to the IMF reportedly cites credible concerns that the funds might be diverted toward defense spending, debt servicing from opaque Chinese loans, and other non-developmental expenditures—rather than toward economic stabilization and poverty alleviation.

🧾 India’s Formal Concerns: The Core of the Argument

According to the Indian official:

“The IMF has a responsibility to ensure its funds are used solely for economic recovery and public welfare. With mounting evidence of financial opacity and regional aggression, it becomes critical to re-evaluate how and where these funds are allocated.”

India’s letter, addressed to IMF Executive Directors, outlines four primary concerns:

-

Lack of Transparency in Fiscal Management: India has highlighted that Pakistan’s public financial disclosures are incomplete and sometimes inconsistent with ground realities.

-

Rising Defense Expenditure: Despite receiving IMF support, Pakistan has reportedly increased its defense budget by over 15% in FY2024–25, raising doubts about its prioritization of economic recovery.

-

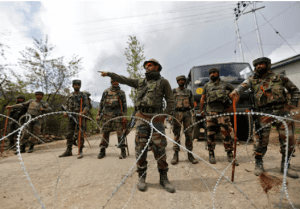

Geopolitical Misuse: India fears IMF-backed funds could indirectly support actions hostile to regional peace, including military activity along the LoC (Line of Control) or supporting non-state actors.

-

Debt Trap Risks: With growing Chinese influence in Pakistan through CPEC (China-Pakistan Economic Corridor), India believes IMF funds may indirectly help Islamabad service unsustainable bilateral debt, contrary to IMF’s lending principles.

🏛️ Broader Strategic and Geopolitical Implications

This move by India is more than a bilateral issue—it is a strategic message to international institutions. India, currently a key player in the G20, BRICS, and other multilateral frameworks, is positioning itself as a responsible stakeholder in global governance. By pushing for stringent checks on IMF lending, it also asserts influence over South Asian financial accountability.

This is not the first time New Delhi has raised such concerns. Similar unease was conveyed in 2019 during another IMF bailout to Pakistan, although no formal IMF response was issued at the time.

🇵🇰 Pakistan’s Position and Potential Fallout

Economic analysts, however, caution that India’s influence within the IMF—while not decisive—is not negligible. India holds voting shares as a member of the IMF Board and is often aligned with Western donor countries that provide a significant portion of IMF capital. If enough IMF stakeholders echo similar concerns, it could lead to:

-

Delays in future disbursements

-

Stricter lending conditions (conditionalities)

-

Enhanced audit and compliance checks

-

Post-program monitoring after loan closure

🌍 IMF’s Expected Response

The IMF, governed by technical and economic criteria, rarely reacts directly to geopolitical demands unless they reflect broader donor consensus. However, it has been increasingly under pressure from multiple nations—including the U.S. and EU—to enforce stronger accountability in high-risk countries, particularly in regions vulnerable to conflict or debt unsustainability.

India’s letter reportedly draws attention to IMF guidelines on “good governance” and “fiscal responsibility,” urging that further loan tranches be paused until:

-

Pakistan presents a transparent expenditure audit.

-

There is greater parliamentary oversight of fiscal plans.

-

Military and non-developmental expenditures are frozen during the loan period.

📊 Economic Impact: What’s at Stake for Pakistan?

Pakistan’s economy continues to teeter on the edge of crisis. Foreign reserves hover below $8 billion (barely covering two months of imports), and the Pakistani rupee has depreciated over 30% since 2022. With inflation above 25% and unemployment surging, IMF funds are crucial for preventing default, rebuilding market confidence, and unlocking further bilateral and multilateral assistance.

If IMF support is delayed or reduced due to India’s push, it could further deteriorate investor sentiment and hinder Islamabad’s ability to negotiate future aid packages.

✅ Conclusion: Diplomacy, Development, and Responsibility

India’s call for an IMF loan reassessment to Pakistan represents a rare intersection of economic diplomacy and geopolitical strategy. While India’s motivations may include regional security concerns, the move underscores a growing trend where rising powers like India are increasingly demanding greater transparency and accountability in global financial operations.

Whether or not the IMF acts immediately, this development could shape future discussions around lending in politically volatile regions. It also sets a precedent for using multilateral institutions as tools of diplomatic influence—something India seems increasingly prepared to do.

🔗 Explore IMF Governance and Lending Policies

For more Real time updates, visit Channel 6 Network.