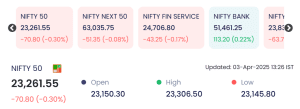

Mumbai: The Indian midcap market on April 3, 2025, presented a dynamic trading session, reflecting broader market sentiments amid global and domestic economic factors. While the NIFTY 50 and NIFTY NEXT 50 indices remained under pressure, with the former slipping 70.80 points (-0.30%) to close at 23,261.55, midcap stocks exhibited a mixed performance, with strong gains in select pharma and manufacturing stocks and sharp losses in the textile and agriculture-related sectors.

Key factors shaping today’s midcap market movements included:

🔹 Banking Sector Stability: NIFTY Bank was one of the few indices to register gains, rising 113.20 points (+0.22%), indicating investor confidence in financial institutions despite broader market declines.

🔹 Pharmaceutical and Chemical Stocks on the Rise: Several midcap pharma and chemical stocks surged as investors sought defensive plays amid global market volatility.

🔹 Textiles and Agricultural Stocks Under Pressure: The downturn in key textile and agro-based stocks suggested weaker export demand and global commodity price fluctuations.

🔹 FIIs Continue Selling Pressure: Foreign institutional investors (FIIs) remained net sellers, contributing to the weakness in midcap stocks despite domestic institutional investor (DII) support.

This article provides a comprehensive analysis of the day’s top gainers, biggest losers, sectoral performance, and investment outlook, ensuring investors stay informed about key midcap market trends.

Also Read: April 2, 2025 Indian Stock Market Closing: Shocking Drops, Surging Stocks & Expert Insights

1. Midcap Market Performance Overview

As of 1:26 PM IST on April 3, 2025, the Indian stock market exhibited mixed trends, with midcap stocks displaying varied performances across sectors. While certain defensive and consumer-oriented stocks showed resilience, profit-booking and sectoral weaknesses impacted others.

🔹 NIFTY NEXT 50 saw a 51.35-point decline (-0.08%), reflecting a wait-and-watch approach in broader markets.

🔹 NIFTY FIN SERVICE dropped 43.25 points (-0.17%), showing slight weakness in financial sector stocks.

🔹 NIFTY BANK, however, remained a bright spot, gaining 113.20 points (+0.22%), as selective banking stocks rebounded on stable lending growth and positive earnings expectations.

The midcap segment, which often mirrors broader market sentiment, experienced strong rallies in pharmaceutical and consumer stocks, while agro-based and commodity-linked stocks witnessed notable declines.

2. Midcap Top Gainers & Performance Drivers

Despite overall market caution, certain midcap stocks showed exceptional performance, primarily driven by strong sectoral tailwinds, renewed investor interest, and positive fundamental triggers.

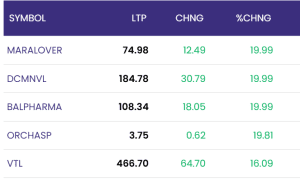

2.1. Top Midcap Performers on April 3, 2025

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) |

|---|---|---|---|---|

| MARALOVER | 74.98 | +12.49 | +19.99% | – |

| DCMNVL | 184.78 | +30.79 | +19.99% | – |

| BALPHARMA | 108.34 | +18.05 | +19.99% | – |

| ORCHASP | 3.75 | +0.62 | +19.81% | – |

| VTL | 466.70 | +64.70 | +16.09% | – |

2.2. Why These Stocks Gained?

✅ Pharmaceutical & Healthcare Strength

✅ Pharmaceutical & Healthcare Strength

The pharma sector emerged as a key performer, with BALPHARMA soaring nearly 20%, fueled by increased demand for pharmaceutical exports and growing investor confidence in defensive healthcare stocks. The Indian government’s focus on healthcare infrastructure expansion and incentives for generic drug production further supported the sector’s momentum.

✅ Consumer Demand Boost

Midcap consumer-focused stocks like MARALOVER and DCMNVL rallied on positive retail sentiment and increased discretionary spending. With the festival season approaching and rising consumer confidence, these stocks benefited from expectations of higher sales volumes.

✅ Speculative Buying & Breakout Moves

ORCHASP, trading at a lower price point, witnessed a high-percentage gain of 19.81%, indicating speculative interest and potential breakout momentum. Stocks with lower liquidity often attract short-term traders looking for quick profits, contributing to sudden spikes.

✅ Industrial Growth & Midcap Resurgence

VTL’s strong 16.09% rally was driven by growth in the industrial and textile sectors, despite the broader market’s subdued performance. Positive earnings outlooks for manufacturing-based stocks have renewed investor confidence in select midcap industrials.

3. Midcap Top Losers & Factors Behind the Decline

While certain midcap stocks outperformed, others faced steep corrections, primarily due to profit-booking, sector-specific downturns, and macroeconomic concerns.

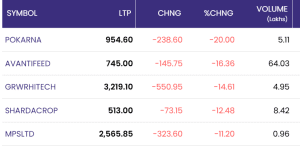

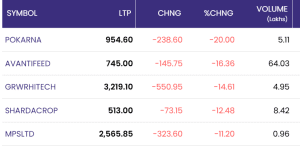

3.1. Worst-Performing Midcap Stocks on April 3, 2025

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) |

|---|---|---|---|---|

| POKARNA | 954.60 | -238.60 | -20.00% | 5.11 |

| AVANTIFEED | 745.00 | -145.75 | -16.36% | 64.03 |

| GRWRHITECH | 3,219.10 | -550.95 | -14.61% | 4.95 |

| SHARDACROP | 513.00 | -73.15 | -12.48% | 8.42 |

| MPSLTD | 2,565.85 | -323.60 | -11.20% | 0.96 |

3.2. Why These Stocks Declined?

POKARNA and GRWRHITECH suffered sharp profit-booking declines after witnessing strong gains in previous sessions. Investors, particularly institutional players, locked in profits, leading to a heavy sell-off.

🚨 Weak Commodity Prices & Export Uncertainty

AVANTIFEED, a leading agro-based stock, fell 16.36% as global agricultural commodity prices declined. Weak international demand and concerns over falling shrimp exports impacted the stock’s outlook.

🚨 Sectoral Weakness in Agro-Based Stocks

SHARDACROP’s 12.48% loss indicated broader weakness in agricultural and agrochemical stocks. Uncertain monsoon forecasts and costlier raw materials have led to cautious trading in this segment.

🚨 Lack of Institutional Buying Support

MPSLTD saw a significant 11.20% drop as institutional investors remained on the sidelines, avoiding high-volatility stocks. The stock’s recent underperformance and lack of clear growth triggers made it susceptible to selling pressure.

Key Takeaways & Market Outlook

🔹 Banking and pharma stocks remain defensive bets amid ongoing market fluctuations.

🔹 Midcap industrial and consumer stocks show resilience, making them attractive for short-term gains.

🔹 Agro-based stocks and textiles face headwinds due to global demand uncertainties and commodity price volatility.

🔹 Profit-booking is expected to continue in high-performing midcaps, leading to sectoral rotation among investors.

What Should Investors Do?

✅ Short-term traders should focus on stocks with momentum and strong sectoral trends, such as pharma and industrial midcaps.

✅ Long-term investors can consider adding quality midcap stocks on dips, particularly in banking, healthcare, and industrial manufacturing.

✅ Avoid high-volatility stocks in the textile and agro sector until global demand stabilizes.

As the midcap market continues to experience sectoral rotations, investors should remain cautious of external macroeconomic trends, global interest rate movements, and institutional trading patterns.

4. Sectoral Analysis – What’s Driving the Midcap Market?

4.1 Pharmaceuticals & Healthcare – Outperforming Amid Market Uncertainty

The pharmaceutical and healthcare sector stood out as one of the top-performing segments, with BALPHARMA gaining nearly 20%. This surge was driven by multiple factors:

✅ Strong earnings expectations – Investors anticipate robust quarterly results from midcap pharma companies, with a focus on increased exports and domestic sales.

✅ Defensive sector preference – Amid broader market fluctuations, investors seek safety in healthcare stocks, known for their consistent demand and recession-resistant nature.

✅ Government support for healthcare – The Indian government has increased healthcare expenditure, promoting domestic manufacturing and research, which directly benefits pharmaceutical stocks.

Additionally, the expansion of the Ayushman Bharat scheme and PLI (Production-Linked Incentive) benefits has boosted investor confidence in midcap pharma stocks, leading to higher institutional participation and strong volume trades.

4.2 Consumer Discretionary & Retail – Riding the Demand Wave

Stocks like MARALOVER and DCMNVL recorded significant gains, supported by:

✅ Festive demand – With the upcoming festival season, consumer sentiment remains positive, leading to increased discretionary spending on apparel, footwear, and lifestyle products.

✅ Rising disposable incomes – A strong job market and salary hikes in urban centers have led to increased consumer confidence, benefiting retail-driven midcaps.

✅ Midcap consumption stocks attracting DII inflows – Domestic Institutional Investors (DIIs) have been selectively investing in midcap consumer and retail stocks, betting on long-term growth.

Furthermore, e-commerce growth and digital penetration have fueled optimism in retail-focused stocks, with investors anticipating higher sales volumes and revenue expansion in the upcoming quarters.

4.3 Financials & Banking – Mixed Performance

The banking and financial sector presented a mixed outlook on April 3, 2025:

📈 NIFTY BANK gained +0.22%, led by strong performances in selective private and PSU banks.

📉 Midcap financial stocks saw corrections as foreign institutional investors (FIIs) pulled out capital, leading to higher volatility in NBFCs and mid-tier banks.

🔹 Concerns over Non-Performing Assets (NPAs) – While large banks remain stable, some midcap lenders are facing NPA pressures, leading to investor caution.

🔹 FII outflows affecting liquidity – Continued selling by foreign investors has resulted in reduced confidence in the financial sector, particularly in midcap NBFCs.

🔹 Domestic loan growth remains strong – Despite volatility, India’s overall credit demand remains robust, supporting selective financial stocks that cater to retail and SME lending.

Looking ahead, banking stocks will be closely watched based on RBI’s monetary policy stance and interest rate outlook.

4.4 Commodities & Agribusiness – Facing Headwinds

The commodities and agribusiness sector witnessed significant declines, with AVANTIFEED (-16.36%) and SHARDACROP (-12.48%) among the top losers.

📉 Global commodity price fluctuations – Softening agricultural commodity prices have negatively impacted agribusiness companies, leading to reduced investor interest.

📉 Export market challenges – AVANTIFEED’s sharp drop reflects uncertainty in the global shrimp market, where fluctuating demand and pricing pressures have hurt profitability.

📉 Sectoral volatility in agrochemicals – SHARDACROP’s decline highlights investor concerns over unpredictable monsoon patterns and rising input costs, which could impact profitability in the coming quarters.

With uncertainties in agricultural policies and commodity exports, midcap agribusiness stocks may continue to experience short-term volatility until global demand stabilizes.

5. Key Market Influences – Domestic & Global Factors

Apart from sectoral performance, broader macroeconomic trends and institutional trading patterns played a crucial role in shaping midcap market movements.

5.1 RBI’s Stance & Inflationary Concerns

🔹 The Reserve Bank of India (RBI) has maintained a cautious monetary policy, keeping interest rates steady amid concerns over inflation.

🔹 Core inflation pressures persist, with food and fuel prices continuing to fluctuate, impacting consumer spending patterns.

🔹 Rate hike fears have subsided, but the RBI remains watchful of economic growth versus inflation balance.

Impact on Midcaps:

✅ Banking and financial stocks remain sensitive to rate policy changes, with selective gains in well-capitalized lenders.

✅ Consumer discretionary and retail stocks benefit from stable interest rates, encouraging continued spending.

✅ Industrial midcaps may face higher borrowing costs, affecting expansion plans.

5.2 Foreign Institutional Investor (FII) Activity

Foreign institutional investors (FIIs) continued their selling spree, impacting overall market sentiment:

📉 FII outflows increased, particularly in midcaps, reflecting global risk aversion.

📉 Midcap financial and NBFC stocks faced pressure as foreign funds pulled out capital, leading to liquidity constraints.

📈 Domestic Institutional Investors (DIIs) stepped in, stabilizing certain midcap sectors like pharma and consumption.

Impact on Midcaps:

✅ Large-cap stocks are more resilient to FII trends, while midcaps remain highly volatile.

✅ Sectors like pharmaceuticals and consumer have seen DII-led stability, limiting losses.

✅ NBFCs and export-driven businesses may remain under pressure until FII inflows return.

5.3 Global Market Trends

📉 Oil price fluctuations & global uncertainty have led to investor caution, particularly in commodity-linked midcaps.

📉 Geopolitical tensions continue to impact risk appetite, leading to cautious trading.

📈 US and European markets showed mixed trends, affecting FII sentiment toward Indian equities.

Impact on Midcaps:

✅ Export-driven sectors (IT, pharma) remain stable amid global demand shifts.

✅ Sectors exposed to commodity prices (agribusiness, chemicals, metals) face higher risk.

✅ Global interest rate trends will determine midcap market liquidity in the coming months.

6. Investment Strategies Based on Market Trends

6.1 Short-Term Traders: Look for Momentum Stocks

For short-term traders and intraday investors, momentum-based strategies can be highly effective in the current market scenario. Stocks exhibiting strong breakout signals include:

✅ MARALOVER (+19.99%) – Strong buying interest, fueled by consumer demand and sectoral strength.

✅ BALPHARMA (+19.99%) – Consistent demand in the pharma sector, with institutional support driving volume spikes.

✅ ORCHASP (+19.81%) – Speculative buying, indicating strong momentum in lower-cap midcaps.

🔹 Trading Strategy:

📈 Breakout Trading: Monitor these stocks for sustained volume-driven uptrends before entering positions.

📈 Support & Resistance Trading: Look for dips toward intraday support levels to buy on weakness and sell near resistance.

📈 Stop Loss Placement: Given the volatility, traders must maintain strict stop-loss levels to prevent excessive drawdowns.

Momentum stocks tend to move fast, making real-time market tracking crucial for short-term trading success.

6.2 Long-Term Investors: Focus on Defensive & Value Stocks

For long-term investors, stability and value-driven investments remain the key focus areas.

Best Sectors for Long-Term Stability:

✔ Pharmaceuticals (BALPHARMA, ORCHASP) – Favorable government policies and sustained demand for medicines make this a strong long-term bet.

✔ FMCG (MARALOVER, DCMNVL) – As inflation stabilizes, consumer goods and discretionary spending stocks are poised for steady growth.

✔ Banking & Financials (Selective stocks in NIFTY BANK) – Despite short-term FII outflows, well-capitalized lenders and PSU banks offer strong growth potential.

🔹 Investment Strategy:

📌 Buy on Market Corrections: Look for dips to accumulate fundamentally strong midcaps.

📌 Dividend Stocks: Invest in stocks with strong cash flow and consistent dividends for passive income and stability.

📌 Long-Term Holding: Investors should focus on 3-5 year horizons to ride out volatility and gain from sectoral expansion.

In times of market uncertainty, a diversified portfolio across pharmaceuticals, FMCG, and financials offers risk-adjusted returns and stability against market downturns.

6.3 Derivatives & Options Strategies

For experienced traders looking to capitalize on volatility in midcap stocks, derivatives and options trading provide lucrative opportunities.

🔹 Recommended Strategies:

📌 Straddle Strategy (Buy ATM Call & Put Options on the Same Stock):

✔ Works well when a stock is expected to make a big move but the direction is uncertain.

✔ Ideal for stocks like BALPHARMA and MARALOVER, which are seeing high volatility.

📌 Strangle Strategy (Buy OTM Call & Put Options):

✔ Useful in stocks where market reactions are unpredictable but volatility is high.

✔ Best suited for high-volume midcaps with speculative momentum, such as ORCHASP and VTL.

📌 Hedging Portfolio with Index Options:

✔ Investors can use NIFTY MIDCAP 100 options to hedge against broader market declines.

✔ Buying put options on midcap index ETFs can help protect downside risk.

📌 Risk Management:

🚨 Stop-loss orders are essential to prevent excessive losses in derivatives trading.

🚨 Position sizing should be controlled to avoid overexposure to highly volatile stocks.

With heightened market volatility and global uncertainties, options trading strategies should be used cautiously and with a strong risk-management plan.

7. Conclusion & Market Outlook

7.1 Summary of Midcap Market Performance on April 3, 2025

The Indian midcap market displayed mixed performance, influenced by sectoral strength, profit booking, and macroeconomic factors:

✔ Pharma and consumer discretionary stocks outperformed due to strong demand and institutional interest.

✔ Banking and financials showed mixed trends, with NIFTY BANK gaining but some midcap NBFCs witnessing corrections.

✔ Commodity-linked stocks underperformed, as global price fluctuations and weak export sentiment dragged down agribusiness stocks.

7.2 Investor Outlook & Recommendations

📌 For Short-Term Traders:

💡 Focus on high-momentum stocks like BALPHARMA & MARALOVER.

💡 Use breakout and resistance trading strategies for quick gains.

💡 Maintain strict stop-losses due to increased volatility.

📌 For Long-Term Investors:

🔹 Defensive sectors like pharmaceuticals and FMCG remain the best bets.

🔹 Banking stocks with strong balance sheets offer steady growth potential.

🔹 Commodity-based midcaps may remain under pressure due to global headwinds.

📌 For Options & Derivatives Traders:

📈 Straddle and strangle strategies can be effective in volatile midcap stocks.

📉 Hedging with index put options can protect portfolios from downside risk.

⚠ Risk management is crucial when trading derivatives in the current market.

7.3 Market Factors to Watch in the Coming Days

🔹 RBI’s Monetary Policy: Inflation trends and RBI’s policy stance will impact market liquidity and investor confidence.

🔹 FII & DII Activity: Continued FII selling may weaken midcaps, while strong DII buying could stabilize selective sectors.

🔹 Global Economic Trends: Oil price volatility, US interest rate policies, and geopolitical developments could influence market trends.

🔹 Sector Rotation: Investors should watch for sectoral shifts, particularly in financials, pharma, and consumer stocks.

With these factors shaping market sentiment, earnings season, and global developments, the next few trading sessions will be critical for midcap stocks and overall market resilience.

Final Thoughts

🔷 The Indian midcap market remains a stock-picker’s game, where identifying sectoral strength and institutional support is key.

🔷 Short-term traders can benefit from momentum stocks, but must manage risk effectively.

🔷 Long-term investors should focus on stable, value-driven stocks, especially in defensive sectors like pharma and FMCG.

🔷 Derivatives traders have opportunities in high-volatility stocks, but should use proper hedging strategies.

With global and domestic factors playing a crucial role, market participants must stay vigilant, adaptive, and strategic to maximize returns while managing risks effectively.

For real-time market updates, visit the official NSE website: NSE India.