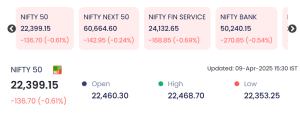

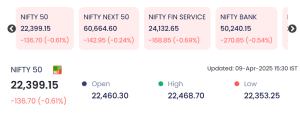

Mumbai: On April 9, 2025, the Indian stock markets witnessed a broad-based sell-off, with major benchmark indices closing in negative territory. Investor sentiment was dampened by rising global uncertainties, including concerns over geopolitical tensions and fluctuating crude oil prices. Additionally, profit booking was evident across key sectors following recent rallies, contributing to the downward pressure. The benchmark Nifty 50 index ended the session at 22,399.15, marking a decline of 136.70 points, or 0.61%, compared to the previous close. This correction reflects growing caution among market participants ahead of the upcoming earnings season and key macroeconomic data releases.

Also Read: Indian Stock Market Closes Strong on April 8, 2025: Nifty Surges 374 Points, Midcaps Shine

Key Index Performance: Sectoral Weakness Leads to Broad-Based Market Decline

On April 9, 2025, Indian equity indices experienced a sharp decline, dragged down by persistent selling in financials and banking stocks. The negative sentiment was amplified by weak cues from global markets, continued uncertainty over interest rate hikes by major central banks, and the anticipation of a mixed Q4 earnings season. Profit-taking was also seen in sectors that had recently rallied, adding to the bearish tone.

| Index | Closing Value | Change (Pts) | % Change |

|---|---|---|---|

| Nifty 50 | 22,399.15 | -136.70 | -0.61% |

| Nifty Next 50 | 60,664.60 | -142.95 | -0.24% |

| Nifty Financial Services | 24,132.65 | -168.85 | -0.69% |

| Nifty Bank | 50,240.15 | -270.85 | -0.54% |

📈 Nifty 50 Intraday Movement:

-

Open: 22,460.30

-

High: 22,468.70

-

Low: 22,353.25

-

Close: 22,399.15

The Nifty 50 opened slightly lower, in line with global cues, and traded in a narrow range before slipping deeper into the red during the second half of the session. Selling pressure intensified in banking and financial stocks, which carry significant weightage in the index, reflecting investor caution ahead of macro data releases and corporate earnings.

In contrast, the Nifty Next 50, comprising mid-to-large cap stocks outside the benchmark index, saw relatively milder losses at 0.24%, indicating that broader market sentiment remained cautious but not in panic.

Overall, the movement across indices reflected a consolidation phase in the markets, where investors are adjusting portfolios and rebalancing ahead of key triggers like inflation data, global crude oil price trends, and geopolitical developments.

Top Gainers on NSE: Select Midcaps and Smallcaps Shine Amid Broader Weakness

While the broader markets faced a bearish tone on April 9, 2025, a handful of stocks defied the trend, posting significant gains and catching investor attention. These stocks, largely from the mid-cap and small-cap segments, showcased robust intraday momentum—many even hitting their upper circuit limits.

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| BINANIIND | 14.48 | +2.41 | +19.97% | 3.13 | 0.44 |

| ONEPOINT | 55.85 | +5.66 | +11.28% | 153.94 | 85.37 |

| TECILCHEM | 40.16 | +3.65 | +10.00% | 0.32 | 0.13 |

| KEYFINSERV | 401.50 | +36.50 | +10.00% | 3.18 | 12.42 |

| CURAA | 43.93 | +3.99 | +9.99% | 0.00 | 0.00 |

🌟 Stock in Focus: ONEPOINT

Among the top performers, ONEPOINT stood out distinctly, not just for its double-digit price appreciation, but also due to extraordinarily high trading volumes. With over 153.94 lakh shares traded and a total traded value of ₹85.37 crore, the stock appears to have drawn strong buying interest from institutional and retail investors alike.

-

Announcement of strong quarterly earnings

-

Entry into a strategic partnership or acquisition

-

Positive news flow or market rumors

-

Upgrades by brokerage firms or foreign institutional interest

Given this spike, technical analysts may view the stock as entering a bullish breakout zone, especially if it sustains momentum above resistance levels in coming sessions.

🔍 Other Notable Gainers:

-

BINANIIND locked in a 19.97% upper circuit, indicating a resurgence of interest in lower-priced industrial stocks, possibly due to sectoral tailwinds or speculative buying.

-

KEYFINSERV, a financial services firm, rose by 10%, reflecting strong investor confidence, possibly due to expected robust FY25 earnings or restructuring news.

-

TECILCHEM and CURAA followed suit, both hitting near-upper circuit limits, although their relatively low trading volumes suggest more muted institutional participation.

It’s worth noting that stocks like CURAA posted gains without any recorded volume or turnover, suggesting either a lack of sellers or pending listing updates on broader platforms.

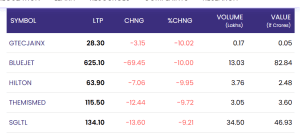

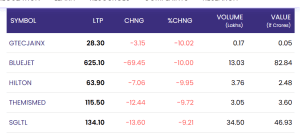

Top Losers on NSE: Select Stocks Witness Steep Sell-Off Amid Market Weakness

While the Indian stock market experienced a moderate decline overall, several individual stocks—particularly in the small-cap and mid-cap segments—suffered sharp corrections, some nearing or hitting their lower circuit limits. Investor sentiment remained fragile in certain sectors due to valuation concerns, weak earnings forecasts, and possible profit-booking after recent rallies.

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GTECJAINX | 28.30 | -3.15 | -10.02% | 0.17 | 0.05 |

| BLUEJET | 625.10 | -69.45 | -10.00% | 13.03 | 82.84 |

| HILTON | 63.90 | -7.06 | -9.95% | 3.76 | 2.48 |

| THEMISMED | 115.50 | -12.44 | -9.72% | 3.05 | 3.60 |

| SGLTL | 134.10 | -13.60 | -9.21% | 34.50 | 46.93 |

🔻 Stock in Focus: BLUEJET

The most significant drag of the day was BLUEJET, which plummeted ₹69.45, or 10%, to close at ₹625.10. With a traded volume of over 13 lakh shares and a total turnover of ₹82.84 crore, BLUEJET stood out as the heaviest loser in terms of absolute value.

-

Disappointing financial results or earnings guidance

-

A downgrade by a major brokerage or rating agency

-

Negative news flow, possibly regarding regulations, compliance, or operational issues

-

General profit-taking after a significant rally in recent months

Investors might also be reacting to industry-specific headwinds, especially if the stock is linked to the aviation, infrastructure, or services space—sectors often sensitive to oil prices, inflation, or demand fluctuations.

⚠️ Other Major Losers:

-

GTECJAINX saw a 10.02% drop, albeit on thin volumes, possibly indicating panic selling in a low-liquidity stock.

-

HILTON and THEMISMED witnessed close to 10% declines, which may have stemmed from sectoral corrections or company-specific developments, such as weak quarterly forecasts, regulatory action, or changes in management outlook.

-

SGLTL, another key loser, dropped 9.21%, with a high trading volume of 34.5 lakh shares, signaling active unloading by large participants—likely due to negative market buzz or missed expectations.

These significant cuts signal the heightened risk appetite and volatility in small and mid-cap counters, where sharp moves—up or down—are not uncommon. The sharp losses in these stocks dragged investor confidence, especially among retail participants exposed to these segments.

Market Sentiment and Insights: Cautious Undertones Ahead of Earnings and Global Triggers

The trading session on April 9, 2025, reflected a cautious and watchful market sentiment, with investors refraining from making aggressive bets ahead of critical macro and microeconomic triggers. Despite the lack of panic selling, the undertone remained negative, led primarily by sector-specific concerns and global uncertainties.

🏦 Sectoral Impact: Financials and Banking Under Pressure

The financial services and banking sectors were among the hardest hit, exerting downward pressure on the broader indices. With the Nifty Financial Services index falling 0.69% and the Nifty Bank index slipping 0.54%, it became evident that investor confidence in these segments has been temporarily shaken.

This decline could be attributed to multiple factors:

-

Rising concerns over net interest margin compression amid delayed rate cuts.

-

Fear of asset quality pressure in Q4 results due to rising retail delinquencies.

-

Possible increase in provisions or regulatory updates that could impact sector profitability.

Market experts believe that the underperformance in banking and NBFCs could continue in the near term unless backed by strong earnings surprises or supportive policy statements from the RBI.

📉 Investor Mood: Cautious Optimism Gives Way to Profit Booking

Investor sentiment turned risk-averse as markets brace for the Q4 earnings season, which begins in earnest later this week. Traders and long-term investors alike seemed to adopt a wait-and-watch approach, focusing on:

-

Corporate earnings guidance and commentary

-

Global developments, especially around crude oil prices, which remain volatile due to geopolitical unrest

-

Central bank decisions, including US Fed’s rate trajectory and RBI’s stance in the upcoming policy review

There is also apprehension that any upside surprises in inflation data, either domestic or international, could dampen hopes of a near-term rate cut, thereby tightening liquidity and slowing corporate capex cycles.

📊 Volatility and Technical Picture: Controlled but Watchful

The Nifty 50 traded in a tight band, with an intraday high of 22,468.70 and a low of 22,353.25, signaling subdued volatility during the session. While this reflects relative market stability, it also points to a lack of bullish momentum needed for a breakout above key resistance levels.

-

Resistance Zone: 22,460–22,470 – Sellers consistently emerged at higher levels

-

Support Zone: 22,340–22,360 – Buyers cautiously defended these levels, preventing deeper cuts

The narrow high-low spread suggests that markets are in consolidation mode, awaiting decisive cues. Analysts believe a break above 22,500 or below 22,300 could set the tone for the next directional move.

Conclusion: Markets Take a Breather as Uncertainty Looms Ahead

The Indian equity markets wrapped up the trading session on April 9, 2025, with a mildly negative bias, weighed down by profit-booking in key sectors and a discernible sense of caution among market participants. The Nifty 50 ended 136.70 points lower at 22,399.15, while broader indices like Nifty Next 50, Nifty Bank, and Nifty Financial Services also registered notable declines.

💼 Sectoral Divergence: Banks and Financials Weigh Heavy

The session’s underperformance was largely driven by financial and banking stocks, which succumbed to selling pressure amid concerns over upcoming earnings, interest rate uncertainty, and margin sustainability. Given the heavyweight nature of these sectors within the index, their collective weakness had a magnified impact on the benchmarks.

However, the decline was not uniform across the board. While frontline stocks corrected, selective outperformance in midcap and smallcap counters offered some relief to investors seeking alpha. Stocks like ONEPOINT, BINANIIND, and KEYFINSERV recorded strong double-digit gains, signaling that investors are still willing to take calculated risks in niche and high-potential segments, especially where positive news or earnings momentum is expected.

🌍 Global and Domestic Overhangs Keep Bulls at Bay

Traders opted for a risk-off approach ahead of several critical triggers:

-

The start of the Q4 earnings season, which is expected to reveal sectoral trends and guidance for FY26

-

Uncertainty around global crude oil prices, which remain volatile due to geopolitical tensions and production shifts

-

Anticipation of central bank commentary, especially from the US Federal Reserve and the Reserve Bank of India, which will influence liquidity and interest rate expectations

📈 Outlook: Watchful Consolidation Expected

From a market structure standpoint, the indices appear to be in a phase of consolidation, with clear support and resistance levels emerging. The lack of broad-based panic indicates that investors are not exiting en masse but are instead rotating capital selectively and preserving cash ahead of critical data points.

As earnings kick off and macroeconomic cues become clearer, market direction will likely be event-driven, with increased volatility expected in the short term.

🔔 Investor Advisory:

Given the current environment, discipline and selectivity will be key. Market participants are advised to:

-

Track corporate results and management commentary closely

-

Maintain a diversified portfolio to absorb potential sectoral shocks

-

Avoid over-leveraging during volatile phases

-

Monitor global indicators like US inflation, crude oil, and bond yields, which can influence domestic sentiment

For real-time stock prices, index movements, and detailed market updates, visit the official NSE website.