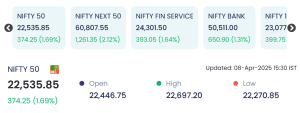

New Delhi, April 8, 2025 — The Indian equity markets witnessed a strong surge on Tuesday, April 8, 2025, as benchmark indices closed significantly higher amid renewed investor confidence and positive global cues. The Nifty 50 index jumped by 374.25 points, or 1.69%, to settle at 22,535.85, marking one of its best single-day gains in recent weeks. Although the BSE Sensex figures were not reflected in the available chart, market experts confirmed it also ended the session on a positive note, mirroring the bullish momentum.

The rally was largely fueled by heavy buying in financial services, banking, and midcap stocks, sectors that have shown renewed strength after recent corrections. Market sentiment was also buoyed by a combination of easing crude oil prices, stable domestic macroeconomic indicators, and optimistic cues from global markets, particularly the U.S. and Asian indices.

🔹 Nifty Performance and Broader Market Movement

On Tuesday, April 8, 2025, the Indian stock market staged an impressive rally, with benchmark and sectoral indices witnessing strong upward momentum. The Nifty 50 opened on a bullish note at 22,446.75, buoyed by positive global cues and investor optimism around India’s macroeconomic stability. The index climbed steadily throughout the day, registering a high of 22,697.20 and a low of 22,270.85, before finally closing at 22,535.85, up 1.69% or 374.25 points, highlighting the resilience of Indian equities amid mixed global signals.

The Nifty Bank index, a crucial driver of overall market sentiment, jumped 650.90 points (1.31%) to close at 50,511.00, amid strong buying in private sector lenders like HDFC Bank, ICICI Bank, and Axis Bank. Positive banking credit growth data, robust Q4 earnings expectations, and decreasing bond yields further boosted confidence in the banking sector.

Financial stocks also gained momentum, with the Nifty Financial Services index rising 1.64% to end at 24,301.50. The rally was broad-based, with NBFCs, insurance companies, and asset managers seeing renewed interest due to stable policy cues and a rebound in consumption and lending activity.

Meanwhile, midcap stocks continued to outperform, a sign of increasing retail and institutional participation in India’s growth story. The Nifty Midcap 50 surged by 1.76%, closing at 23,077.50, with top gainers including sectors like real estate, auto ancillaries, and capital goods. Analysts view this as a vote of confidence in India’s domestic demand revival and manufacturing-led expansion.

The overall bullish momentum was supported by sustained FII inflows, lower crude oil prices, a stable rupee, and the absence of immediate geopolitical shocks. Additionally, global markets rallied following dovish comments from the U.S. Federal Reserve, which signaled that interest rate hikes may be paused amid easing inflation data.

🔼 Top Gainers: Midcaps Dominate the Leaderboard

Midcap and smallcap stocks stole the spotlight on Tuesday, April 8, 2025, as several counters hit their upper circuit limits, signaling robust retail participation and sector-specific bullishness. Investors flocked to select stocks driven by positive earnings expectations, sectoral momentum, and speculative interest in undervalued counters.

Among the top five gainers, the following stocks posted exceptional intraday gains:

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SILLYMONKS | 17.88 | +2.98 | +20.00% | 3.33 | 0.59 |

| KEYFINSERV | 365.00 | +60.80 | +19.99% | 1.31 | 4.61 |

| BINANIIND | 12.07 | +2.01 | +19.98% | 1.54 | 0.18 |

| TECILCHEM | 36.51 | +6.08 | +19.98% | 0.15 | 0.06 |

| ONEPOINT | 50.26 | +8.37 | +19.98% | 90.12 | 43.66 |

Among these, ONEPOINT drew the highest attention with a staggering ₹43.66 crore in trading turnover, accompanied by a massive 90.12 lakh shares traded. This surge indicates not just high liquidity but growing retail confidence in the stock’s long-term potential or expectations of strategic developments.

Analysts caution that while such sharp gains present short-term opportunities, retail investors should assess fundamentals and avoid herd mentality. However, the continued interest in mid and smallcaps signals increasing confidence in India’s domestic growth themes, particularly among high-beta counters.

🔻 Top Losers: Delivery and Textile Stocks Under Pressure

While the broader Indian equity markets experienced a sharp upward trajectory on April 8, 2025, a few pockets of the market buckled under intense selling pressure, particularly within the logistics and textile sectors. A mix of profit-booking, weak earnings expectations, and sectoral headwinds weighed on select counters.

Here’s a snapshot of the top five laggards for the day:

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| KANANIIND | 2.26 | -0.21 | -8.50% | 16.76 | 0.41 |

| DCMFINSERV | 5.30 | -0.44 | -7.67% | 0.21 | 0.01 |

| DELHIVERY | 249.45 | -18.90 | -7.04% | 240.62 | 609.78 |

| PRECOT | 362.30 | -25.75 | -6.64% | 2.50 | 8.77 |

| WIPL | 154.00 | -10.76 | -6.53% | 0.17 | 0.27 |

The most notable among these was Delhivery, India’s prominent logistics and supply chain company. The stock plunged 7.04%, closing at ₹249.45, amidst a massive trading volume of 240.62 lakh shares, generating a turnover of nearly ₹610 crore. The sharp fall is attributed to broad-based concerns over rising operational costs, muted Q4 guidance, and increased competition in the last-mile delivery space.

DCMFINSERV, a small-cap financial services counter, declined over 7.6% on low volumes, reflecting limited investor confidence and thin liquidity in the counter.

Despite the broader rally, these losses serve as a reminder that sectoral rotation, earnings sentiment, and fundamental performance continue to play critical roles in determining individual stock movements. Analysts recommend caution in overstretched counters and advocate sticking with fundamentally strong picks.

Market Sentiment and Outlook: Positive Momentum Amid Global Stability and Domestic Strength

The Indian stock market’s strong performance on Tuesday, April 8, 2025, underscores a growing wave of investor optimism that is currently sweeping Dalal Street. After a volatile March, markets seem to be stabilizing, with benchmark indices such as the Nifty 50 and Nifty Bank registering robust gains. The rally was primarily supported by institutional flows, improving macroeconomic signals, and easing global headwinds.

🔸 Key Drivers Behind Investor Optimism:

-

Stability in Global Markets

International indices, including the Dow Jones Industrial Average, Nasdaq, and FTSE 100, have shown signs of consolidation amid declining volatility. The U.S. Fed’s recent decision to hold interest rates and signal fewer hikes ahead has injected a wave of relief across emerging markets, including India.

This dovish stance has also led to a weakening U.S. dollar, which is typically bullish for equities in developing economies. -

Strong Q4FY25 Earnings Expectations

With the onset of the Q4 earnings season, investor anticipation is building around strong performance from the banking, IT, auto, and energy sectors. Analysts expect double-digit profit growth among blue-chip firms, especially private banks and infrastructure companies, driven by robust credit growth and capital expenditure. -

FII Inflows Picking Up Pace

According to NSDL data, Foreign Institutional Investors (FIIs) have returned to Indian equities after a brief pause, pumping over ₹4,200 crore into the market in the past five sessions. This reversal comes amid a drop in U.S. bond yields and improved risk appetite. -

Domestic Economic Indicators

-

Manufacturing PMI for March rose to a 16-month high of 58.5, reflecting strong industrial output.

-

Retail inflation (CPI) eased to 4.7% in March, staying within the RBI’s comfort zone.

-

GST collections for March crossed ₹1.74 lakh crore, suggesting buoyant consumption and business activity.

-

-

Sectoral Rotation Favors Value Stocks

Apart from the heavyweight BFSI stocks, there has been notable traction in capital goods, defense, infra, and PSU stocks, driven by government policy support and growing investor confidence in value-oriented sectors.

🧠 Expert Opinions:

“The market is now pricing in not just the earnings growth but also macroeconomic stability. With the Fed hinting at rate cuts later this year and crude prices softening slightly, Indian equities are well-positioned to attract both foreign and domestic inflows,” said Meera Narayan, Chief Investment Strategist at QuantEdge Capital.

“However, investors should be prepared for stock-specific volatility as Q4 earnings roll in. Some sectors like IT and pharma may face margin pressure despite top-line growth,” she added.

🔮 Outlook: Riding the Momentum, With Caution

Looking ahead, analysts suggest that while the short-term outlook remains constructive, markets could see intermittent corrections due to high valuations and geopolitical risks. The upcoming general elections, global economic data releases, and central bank commentary will be key triggers in the coming weeks.

-

Resistance for Nifty is seen around 22,800, while support lies at 22,250.

-

Banking and infra sectors are expected to continue outperforming in the near term.

-

Retail investors are advised to maintain a diversified portfolio and avoid leveraged trades as volatility may spike during earnings announcements

Conclusion

April 8, 2025, turned out to be a rewarding day for Indian equity markets, with benchmark indices like the Nifty 50 and Sensex rallying on the back of strong gains in financials, midcaps, and banking stocks. The broader market also participated enthusiastically, indicating healthy investor sentiment driven by favorable global cues, easing concerns over inflation, and steady foreign inflows.

However, analysts caution that while the near-term outlook remains optimistic, volatility could resurface with the upcoming earnings season and macroeconomic data releases. Investors are advised to stay vigilant, diversify their portfolios, and keep an eye on both global market movements and domestic policy cues to make informed decisions.

For official market updates and detailed data, visit the NSE India website.