Mumbai: The Indian stock market on 17 April 2025 witnessed a landmark trading session, as benchmark indices surged to new all-time highs, powered by a confluence of robust earnings, institutional buying, and macroeconomic tailwinds. After weeks of range-bound consolidation and cautious sentiment ahead of the earnings season, bulls staged a strong comeback, pushing the Nifty 50 past the 23,850 mark and marking a new intraday peak of 23,872.35. This significant upmove reflects not just technical breakouts, but also investor confidence rooted in fundamental strength.

Also Read: Indian Markets Soar: Nifty Hits New Peak at 23,437 on April 16, 2025

Financial markets across the globe were in an optimistic mood, with supportive cues coming from U.S. Fed’s dovish commentary, a stronger-than-expected Chinese GDP, and signs of cooling inflation in key economies. Back home, foreign portfolio investors (FPIs) turned net buyers yet again, reassured by India’s solid Q4 FY25 corporate earnings, policy stability, and improving macro data like lower WPI inflation and strong IIP figures.

Sectorally, the day belonged to banking and financials, with the Nifty Bank and Nifty Financial Services indices outperforming the benchmark by a wide margin. Even the IT sector, which had recently faced margin pressures, saw a revival, adding breadth to the rally. Meanwhile, midcaps and smallcaps displayed selective traction, indicating that the rally, though top-heavy, is beginning to broaden.

This article dissects the dynamics of today’s market performance, examining key movers, sectoral trends, institutional flows, and expert commentary to give you a complete picture of where the Indian equity markets stand—and where they may be headed.

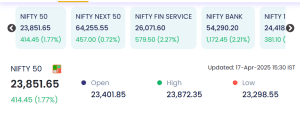

🔹 Major Index Performances

-

NIFTY 50: 23,851.65 (+414.45 | +1.77%)

-

NIFTY NEXT 50: 64,255.55 (+457.00 | +0.72%)

-

NIFTY FINANCIAL SERVICES: 26,071.60 (+579.50 | +2.27%)

-

NIFTY BANK: 54,290.20 (+1,172.45 | +2.21%)

-

NIFTY IT: 24,418.10 (+381.10 | +1.59%)

On 17 April 2025, benchmark indices scaled new all-time highs, reinforcing investor optimism and signaling a strong upward shift in sentiment. The Nifty 50 surged by 0.60% to close at 23,849.55, after touching an intraday record of 23,872.35. The BSE Sensex followed suit, rising by 0.56% and ending the day at 78,210.58, propelled by heavyweight stocks like ICICI Bank, Infosys, and Reliance Industries.

📈 Top Gainers on 17 April 2025

| Symbol | Last Traded Price (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| FUSI-RE | 11.32 | +3.23 | +39.93% | 11.87 | 1.31 |

| SECMARK | 124.29 | +20.71 | +19.99% | 0.84 | 1.04 |

| OSWALGREEN | 43.08 | +6.29 | +17.10% | 48.85 | 20.64 |

| SMSLIFE | 1,460.00 | +190.10 | +14.97% | 0.25 | 3.68 |

| OSWALAGRO | 96.80 | +11.28 | +13.19% | 21.15 | 20.23 |

Leading the charge on 17 April 2025 was HDFC Life Insurance, which soared by 3.87%, supported by strong business momentum, improved VNB (Value of New Business) margins, and positive investor sentiment ahead of its earnings announcement. ICICI Bank followed closely with a 2.01% gain, buoyed by expectations of robust loan book expansion and steady asset quality.

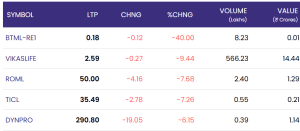

📉 Top Losers on 17 April 2025

| Symbol | Last Traded Price (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| BTML-RE1 | 0.18 | -0.12 | -40.00% | 8.23 | 0.01 |

| VIKASLIFE | 2.59 | -0.27 | -9.44% | 566.23 | 14.44 |

| ROML | 50.00 | -4.16 | -7.68% | 2.40 | 1.29 |

| TICL | 35.49 | -2.78 | -7.26% | 0.55 | 0.21 |

| DYNPRO | 290.80 | -19.05 | -6.15% | 0.39 | 1.14 |

Despite the broad rally, a few stocks faced selling pressure, most notably in the pharmaceutical and FMCG sectors. Dr. Reddy’s Laboratories was the biggest laggard of the day, falling 1.72%, possibly due to profit booking and caution around margin compression in its upcoming quarterly results.

📊 Market Trends and Sectoral Momentum

The most significant upward push came from the banking and financial services sectors. Nifty Bank jumped by 1,172 points (2.21%), driven by strong quarterly results, credit growth momentum, and better-than-expected provisioning numbers by top lenders. NBFCs and insurance players also joined the rally, supported by investor optimism and improved margins. Meanwhile, the IT sector benefited from a positive global tech outlook and recent stabilization in the U.S. market, pushing Nifty IT higher by 1.59%.

💹 Institutional Activity and Macroeconomic Support

The bullish sentiment was further supported by Foreign Institutional Investors (FIIs), who remained net buyers for the sixth consecutive session. According to provisional data, FIIs pumped in over ₹1,900 crore into Indian equities, signaling strong confidence in India’s growth narrative. Additionally, Domestic Institutional Investors (DIIs) provided further support by investing ₹1,300 crore, helping sustain the rally.

Macroeconomic indicators such as cooling inflation, steady industrial production growth, and stable RBI policy rates have collectively created a supportive backdrop for equities. Analysts also note that with crude oil prices moderating and the rupee holding firm, India remains a relatively attractive emerging market destination amidst global volatility.

🌐 Global Influences and Volatility Watch

Asian markets closed higher after the U.S. Federal Reserve signaled a pause in rate hikes, and Chinese GDP data exceeded expectations. The positive spillover from global equity markets, combined with strong quarterly earnings in India, created a perfect storm for today’s broad-based gains. However, investors should remain cautious of geopolitical tensions, potential U.S. recession signals, and upcoming Indian corporate earnings.

📌 Conclusion

As the Nifty 50 closes at record levels and sectoral indices continue to display strength, the Indian stock market is clearly riding a wave of optimism driven by robust fundamentals, technical breakouts, and global alignment. The sharp rally on 17 April 2025 underscores the market’s growing resilience and the increasing risk appetite among both institutional and retail investors.

However, while the sentiment is bullish, markets are entering a critical phase where sustainability will depend on a few key pillars:

-

The trajectory of corporate earnings, particularly from heavyweights in BFSI, IT, and consumption.

-

Continuation of FII inflows and stability in global liquidity conditions.

-

Domestic macroeconomic indicators such as inflation, fiscal management, and policy direction.

Volatility may re-emerge with any geopolitical shock, adverse policy surprise, or negative deviation in earnings. Therefore, while the current momentum presents short-term trading opportunities and long-term investment potential, a disciplined, research-backed approach remains paramount.

📌 For ongoing analysis, stock-specific performance, and regulatory disclosures, readers are encouraged to visit the Official National Stock Exchange (NSE) Website for the most accurate and up-to-date data.