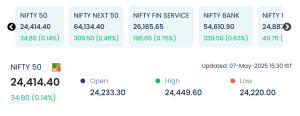

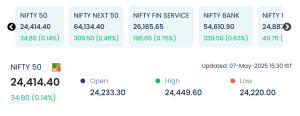

Mumbai: On 07 May 2025, Indian equity markets closed with modest gains, extending their winning streak for a third consecutive session. The benchmark indices—NIFTY 50 and SENSEX—moved in a narrow range throughout the day, reflecting cautious optimism among investors ahead of key global economic data releases and domestic earnings season developments. While the NIFTY 50 settled at 24,414.40 with a gain of 34.80 points (0.14%), broader indices like NIFTY NEXT 50 and NIFTY BANK outperformed, signaling renewed institutional interest in select sectors, especially banking, financial services, and pharmaceuticals.

The day was dominated by selective stock action, particularly in the mid-cap pharma and textile export segments, while some speculative scrips in the rights entitlement (RE) category hit upper circuits. Market sentiment remained cautiously constructive, supported by stable crude prices, a resilient rupee, and expectations of favorable monetary policy outcomes globally. However, volatility in small-cap IT and infrastructure stocks reflected pockets of concern around valuations and corporate earnings.

Market Summary: Broad Indices Performance on 7 May 2025

| Index Name | Closing Price | Change (pts) | Change (%) | Day’s Low | Day’s High |

|---|---|---|---|---|---|

| NIFTY 50 | 24,414.40 | ▲ +34.80 | +0.14% | 24,220.00 | 24,449.60 |

| NIFTY NEXT 50 | 64,134.40 | ▲ +309.50 | +0.48% | 63,180.75 | 64,296.00 |

| NIFTY FIN SERVICE | 26,165.65 | ▲ +196.65 | +0.76% | 25,755.70 | 26,186.10 |

| NIFTY BANK | 54,610.90 | ▲ +339.50 | +0.63% | 53,836.25 | 54,705.00 |

| NIFTY 100 | 24,887.70 | ▲ +49.75 | +0.20% | 24,595.55 | 24,921.10 |

🔎 Key Insights:

-

Benchmark indices ended marginally higher for the third consecutive session, led by banking and pharma.

-

Banking and financial stocks outperformed, signaling renewed investor optimism on rate stability.

-

Broader markets mirrored the benchmarks, with selective mid-cap and pharma stocks gaining traction.

📈 Top 5 Gainers (NSE): In-depth Overview

| Symbol | LTP (₹) | Change (₹) | % Change | Volumes (Lakh) | Traded Value (₹ Cr.) | Sector |

|---|---|---|---|---|---|---|

| GATDVR-RE | 0.03 | ▲ 0.01 | ▲ 50.00% | 2.41 | 0.00 | Rights Entitlement |

| GATECH-RE1 | 0.03 | ▲ 0.01 | ▲ 50.00% | 10.64 | 0.00 | Rights Entitlement |

| AARTIDRUGS | 419.85 | ▲ 69.95 | ▲ 19.99% | 81.53 | 325.17 | Pharmaceuticals |

| BHARATSE | 90.39 | ▲ 15.06 | ▲ 19.99% | 3.22 | 2.80 | Specialty Chemicals |

| SPAL | 848.95 | ▲ 120.55 | ▲ 16.55% | 6.66 | 56.84 | Textiles & Apparel |

📌 Notable Movements:

-

Aarti Drugs Ltd (AARTIDRUGS) surged nearly 20%, driven by strong quarterly results and positive brokerage upgrades.

-

SPAL (S. P. Apparels) gained on strong export guidance and retail sentiment amid rising global apparel demand.

-

Rights Entitlement stocks (RE) such as GATDVR-RE and GATECH-RE1 hit upper circuits, suggesting speculative trading on low float scripts.

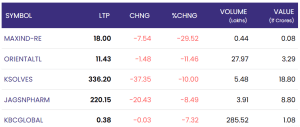

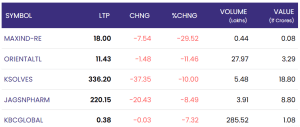

🔻 Top 5 Losers (NSE): In-depth Overview

| Symbol | LTP (₹) | Change (₹) | % Change | Volumes (Lakh) | Traded Value (₹ Cr.) | Sector |

|---|---|---|---|---|---|---|

| MAXIND-RE | 18.00 | ▼ 7.54 | ▼ 29.52% | 0.44 | 0.08 | Rights Entitlement |

| ORIENTALTL | 11.43 | ▼ 1.48 | ▼ 11.46% | 27.97 | 3.29 | Infrastructure |

| KSOLVES | 336.20 | ▼ 37.35 | ▼ 10.00% | 5.48 | 18.80 | IT / Tech Services |

| JAGSNPHARM | 220.15 | ▼ 20.43 | ▼ 8.49% | 3.91 | 8.80 | Pharmaceuticals |

| KBCGLOBAL | 0.38 | ▼ 0.03 | ▼ 7.32% | 285.52 | 1.08 | Real Estate |

📌 Analysis:

-

KSOLVES hit the lower circuit, likely due to profit-booking and muted results.

-

MAXIND-RE crashed nearly 30% as investor interest dried up post-record date.

-

JAGSNPHARM fell on reports of regulatory concerns and margin pressure in APIs.

🔍 Sectoral Performance Snapshot

| Sector | Trend | Remarks |

|---|---|---|

| Banking & Finance | 📈 Bullish | Rally in NIFTY BANK (+0.63%) and FIN SERVICE (+0.76%) due to strong credit growth outlook |

| Pharmaceuticals | 📈 Bullish | Aarti Drugs & Jagsonpal volatility highlighted renewed focus on defensive sectors |

| IT / Tech | 🔻 Bearish | KSOLVES and other small-cap IT stocks saw heavy profit booking |

| Infrastructure | 🔻 Weak | Oriental Trimex led declines amid thin volumes |

| Textiles | 📈 Strong | SPAL’s rally shows export optimism, especially in US/EU demand |

📊 Technical & Sentiment Indicators

-

Nifty RSI (Relative Strength Index): ~64 – Slightly overbought territory, indicating potential consolidation.

-

India VIX (Volatility Index): Mildly up – Suggests caution ahead of inflation data and global cues.

-

Advance-Decline Ratio: Positive – More stocks gained than declined on both NSE and BSE.

🌐 Global Market Cues

| Region | Status | Remarks |

|---|---|---|

| US Futures | Flat | Awaiting Fed commentary and Q1 job data |

| Asian Markets | Mixed | Hang Seng and Nikkei show mixed trends amid US-China trade uncertainty |

| Crude Oil | $83.75 | Stable; no major geopolitical disruption |

| INR/USD | ₹83.12 | Rupee stable; positive for IT exporters |

📌 Investor Takeaway

-

Momentum remains positive for large-cap indices especially in financials and pharma.

-

Volatility persists in small-cap and speculative trades, particularly rights entitlements.

-

Investors are advised to maintain a sector-rotation strategy, favoring banking, pharma, and select export-driven stocks.

-

Caution advised ahead of global inflation numbers and central bank commentary this week.

Conclusion

The Indian markets ended the session on a steady note, with sectoral rotation and stock-specific momentum continuing to drive short-term trends. Gains in frontline banking and pharma counters helped offset weakness in select small- and mid-cap names. While index benchmarks have shown resilience near record highs, the market breadth remains selective, emphasizing the need for disciplined stock picking and risk management.

Looking ahead, investors will closely monitor global inflation data, US Fed commentary, and the ongoing Q4 earnings announcements. With the India VIX mildly elevated and technical indicators hovering near overbought levels, short-term consolidation or profit booking cannot be ruled out. Nonetheless, the medium-term outlook stays positive, underpinned by strong macro fundamentals, robust domestic demand, and improving corporate balance sheets. For now, market participants are advised to remain cautiously optimistic, with a focus on high-conviction sectors like financials, pharma, and export-driven businesses.

For real-time market updates, visit NSE India