Mumbai, April 11, 2025 — The Indian equity markets kicked off Friday’s session with a powerful rally, fueled by strong global cues, renewed investor confidence, and optimistic sentiment surrounding India’s macroeconomic stability. The NIFTY 50 index, a benchmark for India’s top 50 listed companies, opened higher and quickly accelerated to post significant intra-day gains, reflecting robust buying interest across sectors.

Also Read: Indian Stock Markets Tumble on April 9, 2025: Nifty Slips Below 22,400 Amid Broad-Based Selling

This surge comes on the back of easing global inflation fears, favorable commentary from the U.S. Federal Reserve on interest rate stability, and encouraging domestic indicators such as healthy corporate earnings projections, moderate inflation data, and positive GDP outlook. With investor sentiment further bolstered by foreign institutional investor (FII) inflows and resilient performances in banking and financial stocks, market participants seem to be pricing in a potential bullish trend for the upcoming quarter.

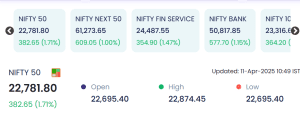

The NIFTY 50 opened at 22,695.40, gaining strong upward momentum to reach a high of 22,874.45, before settling at 22,781.80 as of 10:49 AM IST—an increase of 382.65 points or 1.71%. The index has shown a broad-based upward movement with all major indices trading in the green, underlining wide investor participation and growing confidence in India’s economic trajectory.

📈 Index-Wise Performance

| Index | Current Level | Gain (Points) | % Change |

|---|---|---|---|

| NIFTY 50 | 22,781.80 | +382.65 | +1.71% |

| NIFTY NEXT 50 | 61,273.65 | +609.05 | +1.00% |

| NIFTY FIN SERVICE | 24,487.55 | +354.90 | +1.47% |

| NIFTY BANK | 50,817.85 | +577.70 | +1.15% |

| NIFTY 100 | 23,316.65 | +364.20 | +1.59% |

In a robust start to the trading session on April 11, 2025, Indian benchmark indices surged significantly, reflecting strong investor sentiment and improved confidence in the domestic economic landscape. The NIFTY 50 opened on a bullish note and soared by 382.65 points, or 1.71%, to reach 22,781.80, marking one of its most decisive upward moves in recent weeks.

Sectorally, the rally was primarily led by financial services and banking stocks, with the NIFTY FINANCIAL SERVICES index climbing 354.90 points to 24,487.55, registering a 1.47% gain. Simultaneously, the NIFTY BANK index surged by 577.70 points, or 1.15%, to close at 50,817.85, driven by expectations of stable interest rates and continued credit growth.

The market optimism was underpinned by positive macroeconomic indicators, including robust credit demand, easing inflation concerns, and strong corporate earnings outlooks for the upcoming quarter. Institutional buying and global cues further reinforced the upward momentum across indices.

🚀 Top Gainers: Strong Momentum in Midcaps

A wave of enthusiasm swept across the midcap segment during early trade on April 11, 2025, as several stocks posted double-digit gains, signaling renewed investor appetite for value and growth plays beyond the benchmark large-cap stocks. The top five gainers showcased not only impressive price appreciation but also healthy trading volumes—an indication of both institutional participation and retail bullishness.

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| BINANIIND | 17.37 | +2.89 | +19.96% | 2.23 | 0.38 |

| GOLDIAM | 325.90 | +53.45 | +19.62% | 52.28 | 168.56 |

| GTL | 9.31 | +1.28 | +15.94% | 18.35 | 1.68 |

| UMAEXPORTS | 93.99 | +12.87 | +15.87% | 3.28 | 2.98 |

| CAMLINFINE | 153.98 | +20.55 | +15.40% | 35.32 | 53.69 |

Among the top performers, GOLDIAM INTERNATIONAL emerged as the standout gainer. The stock rallied by a whopping ₹53.45, or 19.62%, to reach ₹325.90, backed by an exceptional trading volume of 52.28 lakh shares and a total turnover exceeding ₹168 crore. This surge suggests heightened buying interest, possibly due to recent strong earnings reports, optimistic management commentary, or positive sectoral tailwinds in the gems and jewelry export space.

Other gainers like BINANI INDUSTRIES, GTL, and UMA EXPORTS delivered double-digit returns, driven by improved investor sentiment, speculative interest, and potential re-rating of their valuations.

The sharp upward movement in these midcaps underscores the ongoing rotation of capital from overvalued large caps to relatively underpriced yet fundamentally strong mid-tier companies. Analysts view this trend as a signal of growing confidence in the broader market recovery and an indicator that investors are increasingly looking beyond blue-chip counters to chase higher returns.

📉 Top Losers: Muthoot Finance Drags

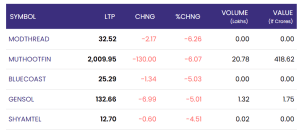

While the broader Indian equity markets displayed strong upward momentum on April 11, 2025, a few stocks bucked the trend and came under significant selling pressure. Notably, weakness was observed in select mid- and small-cap counters, with concerns ranging from sector-specific headwinds to profit booking after recent rallies.

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MODTHREAD | 32.52 | -2.17 | -6.26% | 0.00 | 0.00 |

| MUTHOOTFIN | 2,009.95 | -130.00 | -6.07% | 20.78 | 418.62 |

| BLUECOAST | 25.29 | -1.34 | -5.03% | 0.00 | 0.00 |

| GENSOL | 132.66 | -6.99 | -5.01% | 1.32 | 1.75 |

| SHYAMTEL | 12.70 | -0.60 | -4.51% | 0.02 | 0.00 |

Among the top losers, Muthoot Finance (MUTHOOTFIN) stood out with the steepest fall in absolute value terms, plummeting ₹130.00 or 6.07% to close at ₹2,009.95. The decline came despite a high trading volume of 20.78 lakh shares and a total turnover exceeding ₹418 crore, signaling strong selling pressure from both institutional and retail investors.

Other underperformers included MODTHREAD and BLUECOAST, both declining by over 5%, although they witnessed negligible trading activity, suggesting thin liquidity and low investor interest. GENSOL and SHYAMTEL also saw notable declines amid muted volumes, potentially triggered by broader sectoral volatility or lack of positive triggers.

The divergence in stock performance despite a buoyant overall market indicates a selective investment approach by market participants, emphasizing fundamentals, earnings visibility, and sector-specific dynamics in their decision-making.

Sectoral Performance Breakdown

In the broader market rally observed on April 11, 2025, the bullish sentiment wasn’t limited to frontline financial and banking stocks. A strong and diversified sectoral performance added further stability to the indices. Information Technology (IT) stocks witnessed a moderate but steady uptick, buoyed by anticipation surrounding upcoming earnings releases of global tech giants in the U.S. markets. Investors are positioning themselves for a possible surprise in revenue guidance, which has historically triggered upward revisions in Indian IT counters due to their reliance on global demand.

The pharmaceutical sector also saw increased investor interest amid reports of improved export figures and favorable developments in regulatory approvals from agencies like the USFDA and EMA. Market participants took this as a sign of stronger revenue pipelines and reduced compliance risk, prompting accumulation in quality pharma names.

FMCG and automobile stocks contributed handsomely to the day’s gains, supported by early indicators pointing to a gradual recovery in rural demand, thanks to a healthy rabi crop and favorable monsoon forecasts. Improved consumer sentiment, along with strategic price adjustments by major FMCG players, appears to be working well for margin protection. In the auto space, analysts highlighted increased retail registrations and continued momentum in EV and two-wheeler sales, especially in Tier II and III cities.

On the commodities side, energy and infrastructure stocks extended their gains, riding on the back of a dip in international crude oil prices and the Indian government’s sustained focus on capex-led infrastructure growth. Companies in the EPC and logistics space have seen a sharp rise in order inflows and tender activity, reinforcing the positive outlook for the sector. The infrastructure push, aligned with the government’s pre-election spending strategy, has further fueled optimism across construction, cement, and capital goods segments.

🌍 Global Market Influence

The strong start to Indian equities on April 11 can also be attributed to robust global market cues, which set a favorable tone for investors across Asian markets. A positive close on Wall Street, fueled by encouraging macroeconomic indicators such as better-than-expected jobless claims data and resilient service sector output, played a pivotal role. Moreover, U.S. Treasury yields remained steady, reflecting investor confidence that the Federal Reserve may not resort to aggressive rate hikes in the coming quarters.

Asian equities, including Japan’s Nikkei 225, Hong Kong’s Hang Seng, and China’s Shanghai Composite, registered early gains, lending credibility to a region-wide recovery narrative. Improved trade data from China and policy support from the Japanese government further reassured global investors.

Adding to the positive atmosphere, recent U.S. inflation data showed moderation in both headline and core readings, reducing fears of imminent monetary tightening. This global reassurance around interest rate stability not only encouraged institutional inflows into emerging markets like India but also helped support the risk-on sentiment prevalent throughout the day.

Furthermore, geopolitical stability in key regions and a relatively calm crude oil market ensured that macroeconomic uncertainties remained muted, offering a clean slate for Indian equities to capitalize on the global uptrend.

💸 FII and DII Activity

The participation of institutional investors significantly boosted confidence on Dalal Street, as Foreign Institutional Investors (FIIs) emerged as net buyers for the session. FIIs focused primarily on heavyweight financials, select banking names, and quality midcap stocks. Analysts attribute this renewed buying interest to India’s resilient economic data, consistent earnings performance, and a relatively attractive valuation compared to global peers.

The institutional flows suggest that global funds are repositioning their portfolios in favor of emerging markets, with India high on their radar due to its strong GDP growth outlook, policy continuity, and a consumption-driven economy.

At the same time, Domestic Institutional Investors (DIIs) continued to maintain a supportive stance in the equity markets. DIIs have been instrumental in providing stability during volatile sessions and are actively deploying funds into high-conviction themes such as infrastructure, manufacturing, and capital goods. Mutual funds, particularly those focused on SIP (Systematic Investment Plans), have played a significant role in absorbing supply and maintaining momentum.

The combination of synchronized institutional buying, supported by strong macroeconomic fundamentals and improving microeconomic metrics, has instilled greater confidence among retail and HNI (High Net-worth Individual) investors. This layered market participation underscores the growing depth and maturity of Indian capital markets.

Economic Indicators Update

The buoyant mood on Dalal Street is being reinforced by a favorable set of macroeconomic indicators released over the past few days. Chief among them is the Consumer Price Index (CPI) for March 2025, which came in below consensus estimates, providing much-needed relief to investors wary of prolonged inflationary pressures. The softer-than-expected inflation print significantly reduces the odds of near-term rate hikes by the Reserve Bank of India (RBI), thereby supporting market liquidity and valuation multiples, particularly in rate-sensitive sectors like banking, real estate, and auto.

Additionally, Goods and Services Tax (GST) collections remained robust for the third consecutive month, crossing the ₹1.6 lakh crore mark. This indicates strong domestic consumption and compliance levels, reinforcing the narrative of economic resilience. Policymakers and analysts alike see this as a sign that the formal economy continues to expand despite global uncertainties.

Moreover, the latest data from the Purchasing Managers’ Index (PMI) pointed to sustained expansion in both manufacturing and services sectors. The manufacturing PMI remained comfortably above the 50-mark threshold, reflecting rising output, new orders, and business confidence. Meanwhile, the services PMI showed robust growth in segments like transport, finance, and hospitality.

Lastly, the Index of Industrial Production (IIP) indicated a healthy year-on-year rise, particularly in capital goods and infrastructure-related industries — sectors often seen as early indicators of long-term investment cycles. Collectively, these macro signals paint a picture of a fundamentally strong and resilient Indian economy, giving both domestic and foreign investors added conviction in market stability and future upside potential.

📈 Technical Analysis Insights

From a technical analysis standpoint, the performance of benchmark indices on April 11, 2025, marks a critical shift in market momentum. The NIFTY 50 index decisively breached the key resistance level of 22,600, closing at 22,781.80 with significant volume backing the breakout. This confirms a bullish structure, and technical analysts are now setting sights on the 22,900–23,000 zone as the next immediate target.

The strength in the rally is further validated by technical indicators. The Relative Strength Index (RSI), currently hovering above the 70 mark, signals strong buying interest, though it also hints at short-term overbought conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) remains in bullish territory, with a widening histogram, indicating sustained upward momentum.

The Bank Nifty, which often leads broader market moves, closed above the psychological level of 50,800, with immediate support identified around 50,200. This price action suggests institutional strength in banking counters, aided by strong earnings expectations and positive credit growth data.

Market experts advise a cautious yet optimistic approach, recommending traders to maintain strict stop-loss levels, as short-term consolidation is possible given the elevated RSI and rapid gains over the past few sessions. Nonetheless, the overall market structure remains bullish, with favorable technical signals across sectors.

🔍 Stocks to Watch

As the broader indices continue their upward trajectory, attention is now shifting toward specific stock picks that are showing signs of fresh accumulation and trading activity. Market participants are monitoring companies that have reported bulk or block deals, as these often indicate the entry of institutional players or high-net-worth investors, which can lead to further upside in the short term.

Stocks exhibiting a rise in delivery volumes — a signal that investors are buying to hold rather than trade — are drawing particular interest. This metric is seen as a strong indicator of confidence in the underlying fundamentals and future earnings visibility.

Board announcements and insider activity are also guiding investor decisions. Companies where promoters or senior executives have increased their stakes are being viewed favorably, as this often reflects internal confidence in business prospects.

In light of the ongoing Q4 earnings season, stocks from banking, IT, and auto sectors are under the microscope. These sectors are traditionally early reporters, and their numbers are expected to set the tone for broader market performance. Analysts believe companies that can deliver double-digit revenue growth, margin expansion, or strong guidance will likely attract disproportionate market attention.

In conclusion, stock-specific action is expected to intensify, driven by earnings, corporate disclosures, and sectoral rotation strategies. Investors are advised to remain nimble, tracking both technical cues and fundamental triggers as the earnings calendar unfolds.

📅 Market Outlook & Expert Commentary

Experts remain optimistic about the near-term outlook, citing strong domestic fundamentals, improving global cues, and steady earnings visibility. Analysts recommend a stock-specific strategy, focusing on fundamentally strong companies with growth potential and earnings stability. As the market approaches all-time highs, some degree of profit-booking may emerge, but this is likely to be offset by buy-on-dips sentiment from long-term investors. The overall tone remains constructive, with upcoming sessions expected to be driven by earnings reports, central bank commentary, and global market developments.

📌 Conclusion: Market Outlook Remains Optimistic Amid Global and Domestic Tailwinds

Friday’s strong opening reinforces the prevailing bullish undertone in Indian equities. The synchronized uptrend across major indices—especially Nifty Bank and Nifty Financial Services—indicates a healthy market breadth and participation. The consistent rally in midcap stocks like Goldiam and Camlin FineChem further showcases investor appetite for high-growth stories outside the blue-chip domain.

Looking ahead, the Indian stock market appears poised for further gains, contingent on key macroeconomic data releases, quarterly earnings reports, and external factors such as global interest rate direction and geopolitical developments. With strong FII inflows, supportive domestic policy environment, and resilience in the banking and financial sectors, investor sentiment is likely to remain upbeat in the near term.

However, experts caution against excessive exuberance and recommend a stock-specific approach, especially as valuations in some segments inch higher. Traders and investors are advised to keep a close eye on corporate earnings guidance, crude oil price movements, and developments in the global bond markets for further cues.

In summary, the market’s spirited opening today sends a strong signal of optimism and resilience, setting the tone for what could be a robust Q2 for Indian equities.

For real-time stock prices, index movements, and detailed market updates, visit the official NSE website.