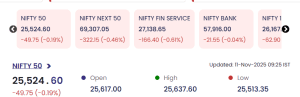

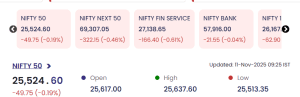

The Indian stock market opened in negative territory on 11 November 2025, with benchmark indices facing mild downward pressure during the morning session. While the Nifty 50 slipped by 0.19%, the trading landscape highlighted both aggressive losers and pockets of resilience as top gainers posted double-digit percentage returns despite overall sentiment remaining subdued.

Nifty 50 Sees Measured Decline

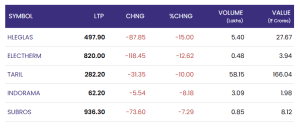

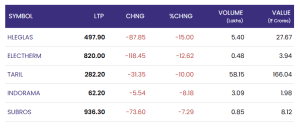

Top Losers Experience Steep Corrections

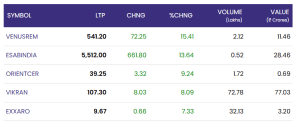

Morning Gainers: Venusrem, Esabindia Spark Optimism

Volume and Value Patterns Underscore Mixed Participation

The session’s trade flows demonstrated mixed participation. Vikran topped the volumes with 72.78 lakh shares and a traded value of ₹77.03 crore, whereas TARIL led in midcap turnover. Among gainers, Esabindia accounted for a substantial value of ₹28.46 crore, underlining focused buying interest. Such trends highlight active intra-day strategies and the shifting preference of investors between defensives and emerging outperformers.

Conclusion: 11 November 2025

The 11 November morning session illustrated a cautious yet dynamic market as indices drifted lower in early trade, but select stocks continued to rally sharply and outperform. With volatility defining participation and major names oscillating between gains and losses, investors remained alert for cues ahead of the next phase of trade. The contrasting fortunes of top gainers and losers reaffirmed the importance of stock-specific strategies amid a broadly range-bound market.

For real time stock Updates, visit NSE website.