Mumbai: The Indian equity market experienced a turbulent trading session on 12 June 2025, as benchmark indices ended in deep red amid global jitters, weak institutional flows, and sectoral pressure. Despite the broader market weakness, select small-cap counters surged spectacularly, defying the downtrend.

🔻 Benchmark Indices Take a Hit on 12 June 2025

| Index | Closing Level | Change (Points) | % Change |

|---|---|---|---|

| Nifty 50 | 24,888.20 | -253.20 | -1.01% |

| Nifty Next 50 | 67,536.50 | -1,235.35 | -1.80% |

| Nifty Fin Service | 26,579.90 | -210.05 | -0.78% |

| Nifty Bank | 56,082.55 | -377.20 | -0.67% |

📍 Nifty 50 Trading Range:

-

Open: 25,164.45

-

High: 25,196.20

-

Low: 24,825.90

The sharp selloff was attributed to weak global cues, persistent concerns over inflation, cautious outlook by the U.S. Fed, and profit booking after recent highs.

📈 Top Performing Stocks – Bright Spots Amid Bearish Mood

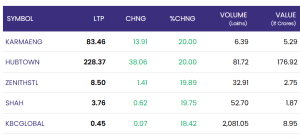

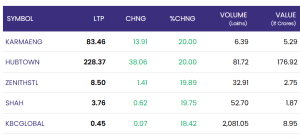

| 🔹 Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| HUBTOWN | 228.37 | +38.06 | +20.00% | 81.72 | 176.92 |

| KARMAENG | 83.46 | +13.91 | +20.00% | 6.39 | 5.29 |

| ZENITHSTL | 8.50 | +1.41 | +19.89% | 32.91 | 2.75 |

| SHAH | 3.76 | +0.62 | +19.75% | 52.70 | 1.87 |

| KBCGLOBAL | 0.45 | +0.07 | +18.42% | 2,081.05 | 8.95 |

⭐ Highlights:

-

HUBTOWN soared with high delivery volumes, indicating long-term investor interest.

-

KBCGLOBAL traded with over 2,000 lakh shares, showing massive speculative activity.

-

KARMAENG and ZENITHSTL rallied to hit their 20% upper circuits, emerging as intraday favorites.

📉 Biggest Losers – Bears Clamp Down on Mid & Small Caps

| 🔻 Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MAPMYINDIA | 1,760.00 | -193.30 | -9.90% | 23.95 | 432.06 |

| SEPC-RE3 | 1.35 | -0.26 | -16.15% | 380.91 | 6.17 |

| CINEVISTA | 19.20 | -2.16 | -10.11% | 4.59 | 0.91 |

| HAVISHA | 2.43 | -0.24 | -8.99% | 9.48 | 0.26 |

| ANTGRAPHIC | 1.38 | -0.13 | -8.61% | 43.80 | 0.63 |

⚠️ Notable Fall:

MAPMYINDIA, a heavyweight in the tech-mapping sector, saw a significant value erosion of ₹193 per share in a single session, wiping out over ₹400 crore in market capitalization.

🧠 Expert Take: What’s Driving the Market Mood?

-

Global Influence: U.S. inflation and interest rate uncertainty continued to weigh on emerging markets.

-

Profit Booking: Post-election euphoria is cooling as investors realign portfolios.

-

Sectoral Drag: Banking and financial services underperformed, dragging the broader indices.

📉 Investor Sentiment & Cautionary Signals

-

📊 Volatility Index (VIX) is likely to remain high in coming days.

-

🏦 FIIs (Foreign Institutional Investors) have turned cautious, shifting focus to defensives.

-

⚖️ Retail investors are advised to avoid high-beta stocks and focus on fundamentally strong companies.

📌 Conclusion: Market Faces Resistance While Small Caps Offer Hope

The selloff in frontline indices indicates a short-term correction phase, with heavyweights taking a breather. However, the buzz in small-cap counters like HUBTOWN and KARMAENG showcases continued retail participation and speculative interest. Going forward, market direction will depend on upcoming macroeconomic data, monsoon forecasts, and global cues.

For real time stock Updates, visit NSE website.