Mumbai: On 16 July 2025, the Indian stock market witnessed modest gains as the Nifty 50 closed at 25,219.25, up 23.45 points (0.09%). The index opened at 25,196.60, touched an intraday high of 25,233.50, and registered a low of 25,121.05, indicating a narrow trading range.

Also Read: Indian Stock Market Ends Higher on 15 July 2025 Amid Broad-Based Gains

Other major indices also posted gains:

-

Nifty Next 50 rose to 68,777.30 (up 49.75 points or 0.07%)

-

Nifty Financial Services climbed to 26,939.05 (up 10.10 points or 0.04%)

-

Nifty Bank surged to 57,230.60, marking a strong gain of 223.95 points (0.39%)

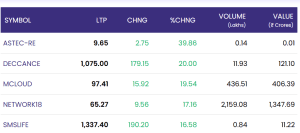

Top Gainers: Network18 and SMS Life Surge on Strong Volumes

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| ASTEC-RE | 9.65 | +2.75 | +39.86% | 0.14 | 0.01 |

| DECCANCE | 1,075.00 | +179.15 | +20.00% | 11.93 | 121.10 |

| MCLOUD | 97.41 | +15.92 | +19.54% | 436.51 | 406.39 |

| NETWORK18 | 65.27 | +9.56 | +17.16% | 2,159.08 | 1,347.69 |

| SMSLIFE | 1,337.40 | +190.20 | +16.58% | 0.84 | 11.22 |

Network18 stood out with a whopping volume of 2,159.08 lakh shares, contributing to a trade value of ₹1,347.69 crore, driven by speculation around potential media deals and digital expansion.

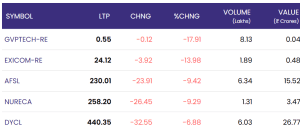

Top Losers: GVPTECH-RE, EXICOM-RE Dip Sharply

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GVPTECH-RE | 0.55 | -0.12 | -17.91% | 8.13 | 0.04 |

| EXICOM-RE | 24.12 | -3.92 | -13.98% | 1.89 | 0.48 |

| AFSL | 230.01 | -23.91 | -9.42% | 6.34 | 15.52 |

| NURECA | 258.20 | -26.45 | -9.29% | 1.31 | 3.47 |

| DYCL | 440.35 | -32.55 | -6.88% | 6.03 | 26.77 |

GVPTECH-RE recorded the sharpest percentage decline of -17.91%, possibly due to speculative correction or profit booking after prior gains.

Market Outlook on 16 July 2025

The slight uptick in Nifty 50, combined with sectoral support from financial and banking indices, suggests that investor sentiment remains cautiously optimistic amid global cues and upcoming earnings season. However, the high volatility in small caps and real estate-linked RE stocks also highlights underlying risks.

Analysts recommend watching global inflation trends and domestic policy signals closely as the earnings season progresses.

For real time stock Updates, visit NSE website.