Mumbai: The Indian equity markets traded on a cautious note during the first half of Thursday’s, 17 July 2025 session, with benchmark indices witnessing mild declines amid subdued global cues and weakness in key sectors, particularly financial services and banking.

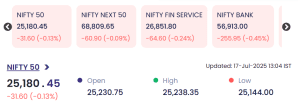

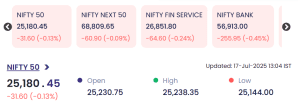

Benchmark Index Performance:

At 13:04 IST, the NIFTY 50 index was trading at 25,180.45, down 31.60 points or 0.13%, while the NIFTY Bank slipped by over 255 points to 56,913.00, reflecting investor caution in the financial sector. The broader NIFTY Financial Services index also dropped 0.24%, indicating a sector-wide drag.

| Index | Value | Change (Pts) | % Change |

|---|---|---|---|

| NIFTY 50 | 25,180.45 | ▼ -31.60 | -0.13% |

| NIFTY Next 50 | 68,809.65 | ▼ -60.90 | -0.09% |

| NIFTY Financial Services | 26,851.80 | ▼ -64.60 | -0.24% |

| NIFTY Bank | 56,913.00 | ▼ -255.95 | -0.45% |

The NIFTY 50 opened at 25,230.75 and touched an intraday high of 25,238.35, but persistent selling pressure dragged it to a low of 25,144.00.

Top Gainers: Small & Midcaps in Focus

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh Shares) | Turnover (₹ Cr.) |

|---|---|---|---|---|---|

| ASTEC-RE | 13.50 | ▲ 3.85 | ▲ 39.90% | 0.11 | 0.01 |

| VIJIFIN | 3.18 | ▲ 0.53 | ▲ 20.00% | 28.35 | 0.86 |

| Radhika Jewelers | 99.96 | ▲ 13.85 | ▲ 16.08% | 146.01 | 144.39 |

| MIRC Electronics | 19.20 | ▲ 2.66 | ▲ 16.08% | 128.19 | 24.18 |

| IXIGO | 206.22 | ▲ 27.26 | ▲ 15.23% | 521.93 | 1,053.11 |

Key Observations:

-

IXIGO was the star performer, rallying over 15% with massive turnover exceeding ₹1,000 crore. Positive investor sentiment is being driven by its strong Q1 performance and bullish outlook in the travel-tech segment.

-

Radhika Jewelers surged over 16%, backed by strong retail buying and sectoral optimism ahead of the festive season.

-

Microcap and rights entitlement counters like ASTEC-RE and VIJIFIN witnessed speculative interest, although these remain high-risk, low-volume plays.

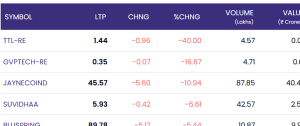

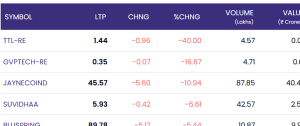

Top Losers: Sharp Corrections in Select Counters

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh Shares) | Turnover (₹ Cr.) |

|---|---|---|---|---|---|

| TTL-RE | 1.44 | ▼ 0.96 | ▼ 40.00% | 4.57 | 0.01 |

| GVPTECH-RE | 0.35 | ▼ 0.07 | ▼ 16.67% | 4.71 | 0.01 |

| JAYNECOIND | 45.57 | ▼ 5.60 | ▼ 10.94% | 87.85 | 40.44 |

| SUVIDHAA | 5.93 | ▼ 0.42 | ▼ 6.61% | 42.57 | 2.55 |

| BLUSPRING | 89.78 | ▼ 5.17 | ▼ 5.44% | 10.87 | 9.65 |

Key Observations:

-

TTL-RE and GVPTECH-RE plummeted sharply as investors booked profits or exited due to uncertainty in rights entitlement valuations.

-

JAYNECOIND and SUVIDHAA declined on high volumes, reflecting broader concerns around fundamentals and speculative trading.

Sectoral Overview:

-

Banking & Financials: The primary drag on markets today, with both public and private sector banks facing selling pressure. Rising bond yields and profit booking in heavyweight stocks like HDFC Bank and ICICI Bank are key contributors.

-

Travel & Technology: Stocks like IXIGO saw renewed interest as domestic air traffic rebounded and analysts maintained positive ratings.

-

Jewelry & Retail: A surge in Radhika Jewelers highlighted investor optimism on festive-driven demand in the coming quarters.

Investor Sentiment & Market Outlook on 17 July 2025:

While benchmark indices remain rangebound, the underlying market is seeing selective buying in midcap and smallcap names. Investors appear to be rotating portfolios towards high-growth, undervalued, or recent debut stocks like IXIGO. However, caution prevails due to global uncertainties, upcoming earnings, and FII activity.

Experts advise retail investors to:

-

Avoid speculative counters unless backed by research.

-

Focus on fundamentally strong companies during market dips.

-

Watch sector rotation patterns as earnings season progresses.

Conclusion:

The Indian markets traded with a mildly negative bias during midday hours on 17 July 2025, weighed down by financial stocks but supported by pockets of strength in midcap and travel-tech names. The action remains stock-specific, with retail investors driving volume in newly listed and low-priced equities. All eyes now turn to post-lunch trends and global cues that could set the tone for the closing bell.