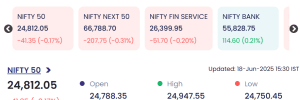

Mumbai: The Indian stock market ended the trading session on 18 June 2025 a mixed note. The benchmark Nifty 50 closed at 24,812.05, slipping by 41.35 points (-0.17%). Despite early gains, the market struggled to hold momentum through the day, with volatility observed across major sectors.

Also Read: 17 June 2025: Markets End Lower Amid Global Weakness; NIFTY 50 Closes Below 25,000

-

Nifty Next 50: Ended lower at 66,788.70, down by 207.75 points (-0.31%)

-

Nifty Financial Services: Dropped to 26,399.95, down by 51.70 points (-0.20%)

-

Nifty Bank: Outperformed by closing higher at 55,828.75, gaining 114.60 points (+0.21%)

Intraday Performance of Nifty 50:

-

Opening: 24,788.35

-

High: 24,947.55

-

Low: 24,750.45

Top Gainers on NSE (June 18, 2025):

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| EMIL | 155.00 | +20.57 | +15.30% | 525.16 | 809.59 |

| AAKASH | 9.88 | +1.12 | +12.79% | 36.70 | 3.68 |

| SILLYMONKS | 17.80 | +1.96 | +12.37% | 5.37 | 0.97 |

| AHLADA | 74.50 | +7.81 | +11.71% | 1.34 | 0.96 |

| SAKAR | 363.00 | +34.10 | +10.37% | 3.65 | 12.90 |

EMIL emerged as the star performer of the day with a surge of over 15%, driven by strong trading volume and investor interest. Other notable gainers like AAKASH and SILLYMONKS posted double-digit percentage increases, reflecting positive market sentiment for select mid- and small-cap counters.

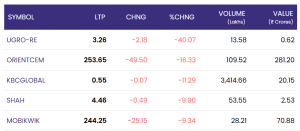

Top Losers on NSE (June 18, 2025):

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| UGRO-RE | 3.26 | -2.18 | -40.07% | 13.58 | 0.62 |

| ORIENTCEM | 253.65 | -49.50 | -16.33% | 109.52 | 281.20 |

| KBCGLOBAL | 0.55 | -0.07 | -11.29% | 3,414.66 | 20.15 |

| SHAH | 4.46 | -0.49 | -9.90% | 53.55 | 2.53 |

| MOBIKWIK | 244.25 | -25.15 | -9.34% | 28.21 | 70.88 |

UGRO-RE faced the steepest decline of 40.07%, signaling heavy sell-off pressure. ORIENTCEM and KBCGLOBAL also saw significant corrections, indicating possible profit booking or negative triggers.

Market Sentiment on 18 June 2025

Despite weakness in some indices, the banking sector’s positive performance and strong showing by select small-cap stocks offered some resilience. However, broad-based profit booking and global market cues contributed to the cautious sentiment.

Investors are advised to remain watchful of global macroeconomic indicators, oil price trends, and domestic economic data releases in the coming sessions.

For real time stock Updates, visit NSE website.