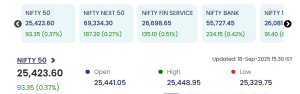

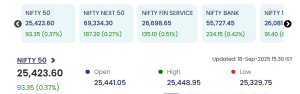

Mumbai: Indian stock markets continued their bullish streak on Thursday, 18 September 2025, with benchmark indices reaching record highs and several midcap stocks achieving impressive gains. Backed by robust trading volumes and positive sentiment across sectors, the Nifty 50 closed at 25,423.60, up 93.35 points (0.37%) from the previous close.

Market Highlights

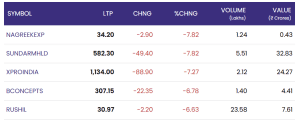

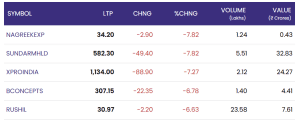

Top Gainers and Losers

Sectoral Trends

Financial services and banking remained steady, with both Nifty Fin Service and Nifty Bank underlining the sector’s sustained strength. Paints, technology, and select industrial stocks led gains, while sectors experiencing corrections included chemicals and diversified small-caps.

Market Outlook

Market participants remain optimistic about the Indian equity landscape, supported by consistent foreign inflows, policy reforms, and improving economic indicators. The day’s sharp movements in select mid-cap stocks showcased stock-specific momentum, with analysts advising prudent sector allocation and tracking of evolving global cues.

Conclusion: 18 September 2025

With the Nifty 50 achieving a fresh lifetime high and aggregate market sentiment staying robust, investors are advised to remain watchful of sectoral rotation and stock-specific fundamentals going forward. Market resilience is likely to persist, provided macroeconomic stability and liquidity conditions remain favorable.

For real time stock Updates, visit NSE website.