Mumbai — Indian equity benchmarks on 19 May 2025 witnessed a day of mixed sentiment on Monday as the benchmark Nifty 50 index slipped slightly, weighed down by losses in select heavyweights, even as broader market indices and mid-cap counters remained buoyant. The Nifty 50 closed at 24,945.45, down 74.35 points or 0.30%, reflecting caution among investors amid global uncertainty and sector-specific headwinds.

Despite the dip in the main index, other segments of the market displayed resilience. The Nifty Next 50 rose 0.49%, closing at 67,405.80, while the Nifty Financial Services and Nifty Bank indices also ended in the green, posting modest gains of 0.13% and 0.12% respectively.

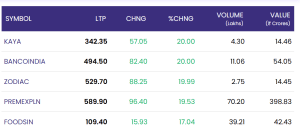

🔼 Market Movers: Gainers

Leading the gainers’ list were small- and mid-cap stocks that saw sharp upward movements on strong volume action:

-

PREMEXPLN jumped ₹96.40 to close at ₹589.90, up 19.53%, backed by a high trading volume of 70.20 lakh shares, reflecting renewed investor interest in the stock.

-

BANCOINDIA and KAYA surged by the maximum daily permissible limit of 20%, closing at ₹494.50 and ₹342.35 respectively.

-

ZODIAC also saw robust buying, ending at ₹529.70, up 19.99%, with limited but active trading.

-

FOODSIN gained 17.04% to finish at ₹109.40, continuing its positive momentum from previous sessions.

These counters likely benefited from favorable sectoral developments, speculative interest, and institutional buying in the mid-cap space.

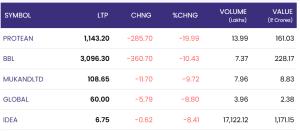

🔻 Biggest Losers: Caution in Select Counters

However, the day also witnessed significant corrections in some prominent stocks:

-

PROTEAN tumbled by 19.99%, closing at ₹1,143.20, after shedding ₹285.70. The decline came despite a turnover of over ₹161 crore, suggesting heavy offloading.

-

BBL fell sharply by ₹360.70 or 10.43%, ending the day at ₹3,096.30.

-

IDEA, although trading at a low price of ₹6.75, stood out due to its massive trading volume of 17,122 lakh shares, possibly driven by speculative trading, but declined by 8.41%.

Other notable losers included MUKANDLTD and GLOBAL, both of which declined by over 8%, reflecting bearish sentiment in selective industrial and telecom stocks.

📉 Market Overview and Outlook on 19 May

The divergence between large-cap and mid/small-cap stocks highlights ongoing sectoral rotation and investor preference for undervalued or growth-oriented companies in the broader market. Despite the headline index dipping slightly, market participation remained healthy, with several mid-cap counters hitting upper circuits.

The financial and banking sectors showed resilience amid mixed global cues, suggesting that investors are selectively optimistic while remaining cautious of valuation pressures and macroeconomic factors.

✅ Conclusion

Monday’s market action showcased a tale of two markets—while the Nifty 50 saw a mild pullback, optimism prevailed in the broader indices with stellar performances from niche players like PREMEXPLN and BANCOINDIA. As investors await further cues from global central banks and domestic macro data, markets are likely to remain volatile in the short term. Traders are advised to stay stock-specific and adopt a balanced approach, given the ongoing divergence across segments.

For real time stock Updates, visit NSE website.