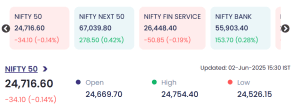

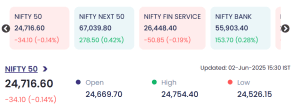

Mumbai: The Indian stock market began the month of June on a volatile note, reflecting mixed global cues and investor indecisiveness. On Monday, 2 June 2025, key benchmark indices showcased a tug-of-war between gains in banking and midcap stocks and losses in heavyweight financial and FMCG segments. The Nifty 50 closed marginally in the red, down 0.14%, as investors exercised caution amid a backdrop of rising U.S. Treasury yields, weakening dollar sentiments, and persistent global inflationary pressures.

At the same time, broader market indices such as Nifty Next 50 and Nifty Bank posted modest gains, signaling underlying strength in select sectors. The market also saw significant action in small-cap and mid-cap counters, with multiple stocks hitting their upper circuits, while some high-volume counters witnessed sharp selloffs, contributing to the day’s market divergence.

Domestic factors such as speculation around the Reserve Bank of India’s upcoming monetary policy, anticipation of new government economic announcements post-election, and renewed Foreign Institutional Investor (FII) activity added to the market’s cautious tone. Furthermore, traders remained watchful of geopolitical tensions and oil price fluctuations that could influence foreign exchange and inflation dynamics in the coming weeks.

This complex interplay of global headwinds and domestic optimism defined Monday’s trade, setting the tone for a week where stock-specific performance and macro signals are likely to dominate investor sentiment.

📉 Nifty 50 Ends Lower, Banking & Midcap Sectors Show Strength on 2 June 2025

-

Open: 24,669.70

-

High: 24,754.40

-

Low: 24,526.15

Other indices performed relatively better:

-

Nifty Next 50: 67,039.80 (+278.50 | +0.42%)

-

Nifty Bank: 55,903.40 (+153.70 | +0.28%)

-

Nifty Financial Services: 26,448.40 (-50.85 | -0.19%)

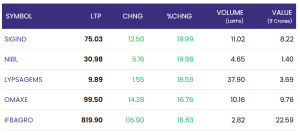

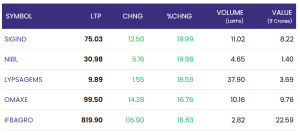

🔼 Top Gainers: Small Caps Shine Bright

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SIGIND | ₹75.03 | +₹12.50 | +19.99% | 11.02 | ₹8.22 |

| NIBL | ₹30.98 | +₹5.16 | +19.98% | 4.65 | ₹1.40 |

| LYPSAGEMS | ₹9.89 | +₹1.55 | +18.59% | 37.90 | ₹3.69 |

| OMAXE | ₹99.50 | +₹14.28 | +16.76% | 10.16 | ₹9.76 |

| IFBAGRO | ₹819.90 | +₹116.90 | +16.63% | 2.82 | ₹22.59 |

Key Insights:

-

SIGIND and NIBL hit upper circuits, reflecting strong buying momentum.

-

IFBAGRO saw notable interest with high value turnover despite low volume.

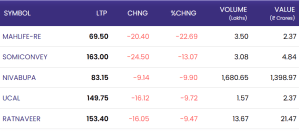

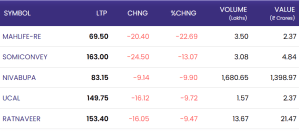

🔻 Top Losers: Heavy Selling in Select Counters

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MAHLIFE-RE | ₹69.50 | -₹20.40 | -22.69% | 3.50 | ₹2.37 |

| SOMICCONVEY | ₹163.00 | -₹24.50 | -13.07% | 3.08 | ₹4.84 |

| NIVABUPA | ₹83.15 | -₹9.14 | -9.90% | 1,680.65 | ₹1,398.97 |

| UCAL | ₹149.75 | -₹16.12 | -9.72% | 1.57 | ₹2.37 |

| RATNAVEER | ₹153.40 | -₹16.05 | -9.47% | 13.67 | ₹21.47 |

Key Observations:

-

NIVABUPA witnessed massive volume-led selloff, possibly institutional exits.

-

MAHLIFE-RE plunged over 22%, hitting lower circuits due to investor jitters.

📊 Market Sentiment: Cautious Optimism Amid Global Cues

While broader markets showed signs of recovery in select pockets, overall sentiment was muted due to concerns over:

-

Rising US Treasury yields

-

Currency volatility and dollar weakness

-

Upcoming RBI policy review

-

Global fund flow uncertainties

🧾 Conclusion: Mixed Close Reflects Uncertain Outlook

The Indian equity markets ended the day on a mixed note, with stock-specific action dominating over index-wide trends. With global macro indicators sending mixed signals, traders and investors are advised to stay cautious and track upcoming central bank commentary and inflation data. While headline indices ended in red due to profit-taking and cautious global cues, the day witnessed some bright spots in midcap counters like LumaxTech and Lordschlo, which outperformed significantly. Going forward, market participants are likely to stay focused on global macroeconomic data and the RBI’s upcoming policy meeting.

For real time stock Updates, visit NSE website.