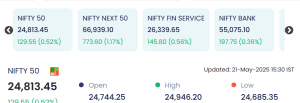

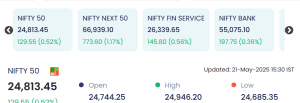

Mumbai: Indian equity markets closed on a positive note on Wednesday 21 May 2025, with benchmark indices witnessing solid gains amid bullish investor sentiment and strong performances in select sectors. The Nifty 50 index ended the trading session at 24,813.45, marking a rise of 129.55 points (0.52%), supported by notable buying in financial and mid-cap stocks.

Broader indices also reflected optimism across the board. The Nifty Next 50 surged by 773.60 points (1.17%) to close at 66,939.10, while Nifty Financial Services gained 145.80 points (0.56%) to end at 26,339.65. Meanwhile, Nifty Bank added 197.75 points (0.36%), closing at 55,075.10.

Top Gainers: TTML and GROBTEA Shine Bright

Among individual stocks, GROBTEA and ABINFRA stole the limelight with a 20% surge each. GROBTEA closed at ₹1,112.50, up ₹185.40, while ABINFRA climbed to ₹133.51, up ₹22.25.

Other notable performers included:

-

TRIDENT: Up 13.51% at ₹33.45

-

ECOSMOBLTY: Up 13.21% at ₹272.10

These stocks demonstrated strong investor interest, with ECOSMOBLTY and TRIDENT collectively clocking high trading volumes and significant value turnovers, indicating sustained momentum.

Top Losers: THEMISMED and FCL Under Pressure

Other laggards included:

-

DHUNINV: Down 8.26% to ₹1,452.00

-

GULPOLY: Down 8.08% to ₹194.00

Though these losses were limited to specific counters, they did little to dampen the broader rally in the market.

Market Highlights and Trading Metrics on 21 May

-

Nifty 50 Range: The index opened at 24,744.25, touched a high of 24,946.20, and hit a low of 24,685.35, indicating a robust intraday movement.

-

Sectoral Support: Financials, midcaps, and infrastructure-related stocks provided crucial support to the indices.

-

Investor Sentiment: Optimism around economic reforms, upcoming quarterly earnings, and global stability contributed to the market’s upbeat tone.

Conclusion: Bulls Tighten Grip Ahead of Key Economic Announcements

With the Nifty 50 nearing the 25,000 milestone, the Indian equity market appears poised for further gains, provided global cues and domestic fundamentals remain supportive. The strong performance of mid-cap stocks like TTML, TRIDENT, and GROBTEA signals a renewed interest in broader market participation.

However, market experts advise caution ahead of upcoming economic data releases and global central bank announcements, which could influence short-term market direction. For now, investor confidence remains high, and momentum looks favorable for the bulls.

For real time stock Updates, visit NSE website.