Mumbai: The Indian equity markets faced a day of consolidation and correction on Thursday, 22 May 2025, as global concerns and profit-booking in key sectors dragged benchmark indices lower. Amid concerns surrounding inflationary trends and potential central bank actions globally, investor sentiment remained muted. This led to the Nifty 50 shedding over 200 points to end below the 24,700 mark, reflecting cautious behavior among institutional and retail participants.

Despite the overall weakness, pockets of strength were visible in the mid- and small-cap space where select counters recorded impressive gains. However, the broader tone of the market was bearish, with sectoral indices mostly ending in the red.

📉 Nifty Market Wrap-up of 22 May 2025:

| Index | Closing Value | Net Change | % Change |

|---|---|---|---|

| NIFTY 50 | 24,609.70 | -203.75 | -0.82% |

| NIFTY NEXT 50 | 66,716.90 | -222.20 | -0.33% |

| NIFTY FIN SERVICE | 26,225.95 | -113.70 | -0.43% |

| NIFTY BANK | 54,941.30 | -133.80 | -0.24% |

-

📈 Day High: 24,737.50

-

📉 Day Low: 24,462.40

-

🕒 Updated at: 15:30 IST

🚀 Top Gainers: Outperformers Defy Weak Sentiment

| Symbol | Last Price (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|

| COSMOFIRST | ₹794.70 | +20.00% | 18.93 | ₹144.37 |

| INTERARCH | ₹2,058.00 | +13.87% | 16.55 | ₹326.20 |

| RAMCOSYS | ₹440.25 | +19.99% | 18.22 | ₹77.04 |

| NAHARPOLY | ₹265.65 | +20.00% | 2.29 | ₹5.88 |

| JAYBARMARU | ₹84.18 | +20.00% | 5.26 | ₹4.20 |

👉 Stocks like COSMOFIRST and INTERARCH saw strong buying on robust quarterly numbers and green sector tailwinds.

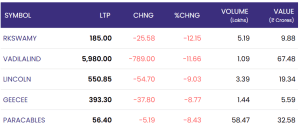

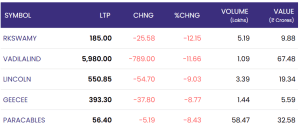

📉 Top Losers: Profit Booking Hits Select Counters

| Symbol | Last Price (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|

| VADILALIND | ₹5,980.00 | -11.66% | 1.09 | ₹67.48 |

| RKSWAMY | ₹185.00 | -12.15% | 5.19 | ₹9.88 |

| LINCOLN | ₹550.85 | -9.03% | 3.39 | ₹19.34 |

| GEECEE | ₹393.30 | -8.77% | 1.44 | ₹5.59 |

| PARACABLES | ₹56.40 | -8.43% | 58.47 | ₹32.58 |

📉 VADILALIND and RKSWAMY led the losers, seeing double-digit percentage declines.

🧾 Conclusion: A Day of Profit Booking and Selective Buying

The trading session on 22 May 2025 reflects the complex dynamics of a maturing market grappling with global uncertainties, domestic valuations, and investor expectations. While frontline indices corrected in response to risk-off sentiments, the resilience of mid- and small-cap segments signals continued retail interest and stock-specific opportunities.

Looking ahead, market participants will closely monitor:

-

Global inflation cues

-

US Fed commentary

-

FII/DII flows

-

Domestic macroeconomic indicators

Short-term caution may prevail, but long-term investors are advised to focus on fundamentally strong counters, especially those aligned with India’s green transition, digital innovation, and manufacturing resurgence.

For real time stock Updates, visit NSE website.