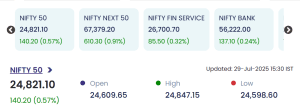

Mumbai, July 29, 2025 — The Indian equity markets continued their upward momentum on Tuesday, 29 JUly 2025 as the Nifty 50 index closed at 24,821.10, marking a rise of 140.20 points or 0.57%. Buoyed by strong sectoral performances, particularly in capital goods, chemicals, and infrastructure, the broader market sentiment remained optimistic despite global uncertainties.

Also read: July 29, 2025 (midcap) :Nifty 50 Gains 56 Points; HIRECT and JAYNECOIND Lead Top Gainers

Index Performance and Market Overview

The day’s trade opened on a positive note, driven by firm global cues and healthy buying interest in select large-cap and mid-cap stocks. Sustained foreign institutional investments (FIIs), along with robust Q1 earnings reported by several companies, contributed to the market rally. The BSE Sensex also witnessed upward movement, mirroring Nifty’s gains.

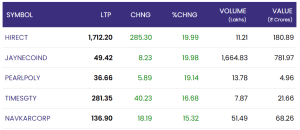

Top Gainers on NSE: Mid and Small-Cap Stocks Shine

The top gainers list was led by Hind Rectifiers Ltd. (HIRECT), which surged by 16.13%. The company’s strong quarterly performance and positive outlook on industrial and railway electrification contributed to the rally.

Other notable gainers included:

-

Niraj Cement Structurals Ltd. – up 12.67%

-

Archean Chemical Industries Ltd. – up 11.49%

-

GPT Infraprojects Ltd. – up 11.29%

These gains reflect strong market interest in companies tied to India’s infrastructure growth and industrial activity.

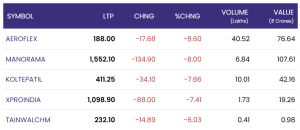

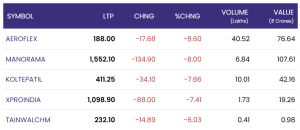

Top Losers: Profit Booking Hits Select Stocks

On the other side, Aeroflex Industries Ltd. emerged as the biggest loser of the session, falling by 6.35%, likely due to profit booking after a recent rally.

-

Manorama Industries Ltd. – down 5.58%

-

Bodhi Tree Multimedia Ltd. – down 5.49%

-

Cello World Ltd. – down 4.89%

-

Sah Polymers Ltd. – down 4.79%

These declines were largely attributed to sectoral rotation and short-term volatility in small-cap counters.

Sectoral Highlights and Market Outlook

Gains were largely led by capital goods, infrastructure, and chemical stocks. Market participants are now focusing on the ongoing earnings season, which is expected to provide clearer guidance on corporate profitability and future expectations.

Global market trends, crude oil prices, and upcoming economic data—including the U.S. Federal Reserve’s policy decisions—are likely to influence investor behavior in the coming days.

Expert Take on 29 July 2025

“India’s markets are demonstrating impressive resilience amid mixed global cues. The mid-cap rally is supported by sectoral tailwinds and promising Q1 results,” said Anup Jain, Market Analyst at EquityView. “However, investors should remain cautious as we may witness bouts of volatility with global macro events on the horizon.”

For real time stock Updates, visit NSE website.