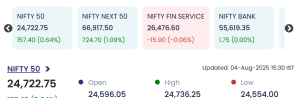

Mumbai, 4 August 2025: Indian equity markets closed in the green on Monday, with the benchmark Nifty 50 gaining 157.40 points (0.64%) to end at 24,722.75. The index opened at 24,596.05, touched an intraday high of 24,736.25, and recorded a low of 24,554.00, reflecting intraday volatility amid steady investor sentiment.

Also Read: 4 August 2025 (Midcap) : Nifty 50 Gains 0.42% to Close at 24,668.30 Amid Mixed Sectoral Performance

Top Gainers: Sarda Energy Surges 20%

-

Sarda Energy & Minerals Ltd (SARDAEN) led the gains with a significant rise of ₹87.85 (20.00%), closing at ₹527.15. The stock witnessed robust trading activity with a volume of 154.37 lakh shares, generating a turnover of ₹794.46 crore.

-

Tamilnadu Newsprint and Papers (TAINWALCHM) surged 15.58% to ₹268.33, while Peninsula Land Ltd (PENINLAND) jumped 12.86% to close at ₹38.70.

-

Ather Energy (ATHERENERG) posted a strong rally of ₹44.50 (12.81%) to close at ₹391.80 with volumes over 79 lakh shares.

-

Aditya Birla Capital Ltd (ABCAPITAL) advanced 11.27%, closing at ₹279.80, with the highest traded volume among the top gainers at 318.82 lakh shares and a transaction value of ₹866.26 crore.

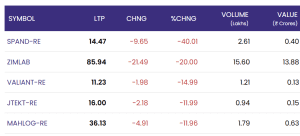

Top Losers: Spandana Sphoorty RE Down 40%

-

Spandana Sphoorty Financial RE (SPAND-RE) plunged by ₹9.65 (40.01%), ending the day at ₹14.47, making it the biggest loser of the day.

-

Zim Laboratories (ZIMLAB) fell sharply by ₹21.49 (20.00%) to ₹85.94, followed by Valiant Organics RE (VALIANT-RE) which declined 14.99% to ₹11.23.

-

Other notable losers included JTEKT India RE (JTEKT-RE) and Mahindra Logistics RE (MAHLOG-RE), both down by around 12%.

Market Outlook on 4 August 2025

The market sentiment remained cautiously optimistic, supported by positive global cues and continued retail participation. However, the underperformance of the financial services index indicates investor concerns around interest rate trends and sectoral profitability.

With the Nifty 50 maintaining its momentum above the 24,700 mark, analysts expect the index to test new highs in the coming sessions, barring macroeconomic disruptions. Market watchers advise selective stock picking as volatility persists in mid-cap and RE categories.