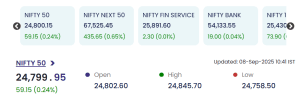

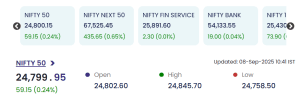

Mumbai: On 8 September 2025 at 10:41 AM IST, Indian stock market benchmarks delivered positive momentum, led by NIFTY 50 which was trading at 24,799.95, up by 59.15 points (0.24%).

The index saw intraday movement with an opening at 24,802.60, a high of 24,845.70, and a low of 24,758.50. Other prominent indices also posted gains: NIFTY NEXT 50 rose to 67,525.45 (up 435.65, or 0.65%), NIFTY FIN SERVICE traded at 25,891.60 (up 2.30, or 0.01%), NIFTY BANK posted 54,133.55 (up 19.00, or 0.04%) and NIFTY 100 at 25,430.30 (up 73.90, or 0.29%).

-

MFML led the gainers’ list, closing at ₹32.10, up ₹5.35 (20.00%), with volume at 0.25 lakhs and value ₹0.08 crore.

-

SALSTEEL hit ₹26.60, gaining ₹4.43 (19.98%), volume of 1.37 lakhs, and value ₹0.36 crore.

-

LASA rose to ₹10.65, up ₹1.77 (19.93%), with a notable volume of 9.38 lakhs and value ₹0.98 crore.

-

MICEL settled at ₹77.00, up ₹11.49 (17.54%), showing strong activity with 288.60 lakh shares traded and value at ₹217.86 crore.

-

ASMS reached ₹14.84, up ₹2.08 (16.30%), volume of 25.08 lakhs and value ₹3.68 crore.

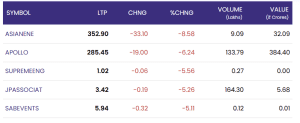

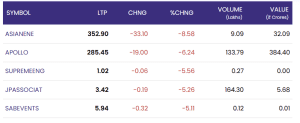

Top Losers: Key Stocks Under Pressure

-

ASIANENE slipped to ₹352.90, down ₹33.10 (-8.58%), with trading volume of 9.09 lakhs and value at ₹32.09 crore.

-

APOLLO declined to ₹285.45, losing ₹19.00 (-6.24%), volume surged to 133.79 lakhs and a value of ₹384.40 crore.

-

SUPREMEENG dropped to ₹1.02, off ₹0.06 (-5.56%), volume at 0.27 lakhs and negligible value.

-

JPASSOCIAT fell to ₹3.42, shedding ₹0.19 (-5.26%), 164.30 lakh shares exchanged hands for a value of ₹5.68 crore.

-

SABEVENTS ended at ₹5.94, down ₹0.32 (-5.11%), volume at 0.12 lakhs and a minimal value of ₹0.01 crore.

Intraday Movement on 8 September 2025

The NIFTY indices, especially the NIFTY 50, demonstrated resilience and investor optimism with broad participation across sectors. Strong buying was seen in heavy-volume counters such as MICEL, while large cap stocks like APOLLO and ASIANENE experienced significant sell-offs. Volume and value leaders for the day included MICEL on the gaining side and APOLLO among the losers, suggesting sector-specific and liquidity-driven moves.

Conclusion

The session on 8th September 2025 marked a positive overall trajectory for major indices, with pronounced gains in mid and small-cap stocks, and select heavyweights facing pressure. Persistent volatility and sectoral rotation were evident, reflecting investor strategy ahead of possible macro triggers and risk events.

For real time stock Updates, visit NSE website.