Mumbai: Indian stock markets continued their upward trajectory on Monday, 9 June 2025, closing with notable gains across key indices. The Nifty 50 surged by 100.15 points (0.40%) to settle at 25,103.20, signaling strong investor confidence across both large-cap and mid-cap segments. The broader market sentiment remained bullish, with Nifty Next 50 posting an impressive gain of 850.65 points (1.25%).

🔹 Market Highlights on 9 June 2025

| Index | Closing | Change (Pts) | % Change |

|---|---|---|---|

| Nifty 50 | 25,103.20 | +100.15 | +0.40% |

| Nifty Next 50 | 68,843.50 | +850.65 | +1.25% |

| Nifty Financial Svcs | 26,992.85 | +143.95 | +0.54% |

| Nifty Bank | 56,839.60 | +261.20 | +0.46% |

Nifty 50 opened the day at 25,160.10, touching an intraday high of 25,160.10 and a low of 25,077.15, before closing slightly below the opening mark.

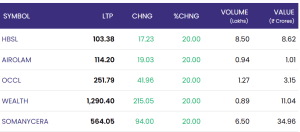

📈 Top 5 Gainers – Locked at 20% Upper Circuit

| Stock | Last Traded Price (₹) | Gain (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| HBSL | 103.38 | +17.23 | +20.00% | 8.50 | 8.62 |

| AIROLAM | 114.20 | +19.03 | +20.00% | 0.94 | 1.01 |

| OCCL | 251.79 | +41.96 | +20.00% | 1.27 | 3.15 |

| WEALTH | 1,290.40 | +215.05 | +20.00% | 0.89 | 11.04 |

| SOMANYCERA | 564.05 | +94.00 | +20.00% | 6.50 | 34.96 |

These companies saw strong buying interest with trading volumes picking up in anticipation of potential upside triggers such as earnings growth, sectoral demand, or speculative interest.

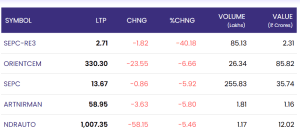

📉 Top 5 Losers – Under Pressure

| Stock | Last Traded Price (₹) | Loss (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SEPC-RE3 | 2.71 | -1.82 | -40.18% | 85.13 | 2.31 |

| ORIENTCEM | 330.30 | -23.55 | -6.66% | 26.34 | 85.82 |

| SEPC | 13.67 | -0.86 | -5.92% | 255.83 | 35.74 |

| ARTNIRMAN | 58.95 | -3.63 | -5.80% | 1.81 | 1.16 |

| NDRAUTO | 1,007.35 | -58.15 | -5.46% | 1.17 | 12.02 |

While the broader market remained buoyant, these counters faced selling pressure due to weak fundamentals, profit booking, or negative sentiment in their respective sectors.

🗣️ Expert Take

Market analysts attribute Monday’s rally to positive global cues, strong buying in midcap stocks, and investor optimism ahead of macroeconomic data releases. “The Nifty 50’s resilience above the psychological 25,000 mark along with bullish momentum in the Nifty Next 50 indicates strong participation from institutional investors,” said Rajesh Batra, Senior Equity Strategist.

The consistent performance of financial services and banking sectors also contributed to market stability, backed by favorable quarterly results and credit growth indicators.

📌 Conclusion

With the Indian equity market maintaining a steady upward trend, the rally was largely driven by the performance of mid-cap and lesser-known stocks locking in upper circuit gains. Investors are advised to remain cautious amidst the volatility and keep a close watch on global markets, crude oil prices, and upcoming inflation and industrial output data.

For real time stock Updates, visit NSE website.