Mumbai: In a resounding affirmation of bullish investor sentiment, the Indian equity markets surged to new highs on 15 April, 2025, with the Nifty 50 skyrocketing by 500 points, closing at 23,328.55, a gain of 2.19%. This rally, which saw widespread participation across large-cap, mid-cap, and financial stocks, marks one of the most spirited single-day performances of the year so far.

The market’s stellar performance is being attributed to a confluence of favorable domestic and global cues. Domestically, optimism surrounding the upcoming Q4 earnings season, a stable rupee, and robust macroeconomic indicators—including declining retail inflation and improved industrial output—have instilled fresh confidence among institutional and retail investors alike. On the global front, easing geopolitical tensions, a dovish stance by the U.S. Federal Reserve, and signs of economic resilience in the Eurozone have collectively sparked a wave of buying in emerging markets, with India leading the pack.

Broader indices like the Nifty Next 50, Nifty Financial Services, and Nifty Bank mirrored this upbeat sentiment, recording impressive intraday gains of over 2.7% to 3%, reinforcing the belief that Indian equities are entering a new leg of a potential medium-term rally. Sectors such as green energy, public sector enterprises, financial services, and industrials emerged as top performers, while speculative selling in a few select penny and rights-issue stocks resulted in sharp losses.

The rally was further supported by strong volumes and significant capital inflows, with mid-cap and small-cap stocks also showing robust momentum. The breadth of the market was overwhelmingly positive, with advancing stocks far outnumbering decliners, reflecting a broad-based recovery rather than a sector-specific surge.

Broader Market Performance

The bullish momentum extended well beyond the Nifty 50, as other benchmark indices posted substantial gains, signaling a broad-based market rally. The Nifty Next 50 led the charge with a stellar rise of 1,900.75 points, marking a 3.09% increase to close at 63,374.30, driven largely by strong performances in PSU stocks, consumer durables, and high-beta counters.

Nifty Financial Services followed suit, registering a notable jump of 725.10 points or 2.95%, ending the session at 25,280.65. This rally was underpinned by expectations of robust quarterly earnings from NBFCs and private sector lenders, as well as growing investor confidence in the digital finance and insurance sectors.

Meanwhile, the Nifty Bank index recorded an impressive gain of 1,377.15 points or 2.70%, closing at 52,379.50, reflecting bullish bets on banking heavyweights amid expectations of improved credit growth, declining non-performing assets, and rising net interest margins.

Across the board, the market’s breadth was decisively positive, with a vast majority of stocks advancing. Heavy buying was observed in financials, industrials, infrastructure, and renewable energy, suggesting a shift in focus toward sectors poised to benefit from structural reforms, capex expansion, and sustainability initiatives. This broad rally highlights the underlying strength of the Indian equity market and growing investor conviction in India’s macroeconomic resilience.

The Nifty 50 opened strong at 23,368.35, which also marked the intraday high, indicating bullish sentiment from the outset. Despite minor fluctuations, the index maintained upward momentum and remained largely range-bound near its peak levels. The intraday low was 23,207.00, reflecting limited downside pressure. The consistency in holding near the day’s high throughout the session underscored strong buying interest and reinforced market confidence, ultimately resulting in a solid close at 23,328.55, up 2.19%.

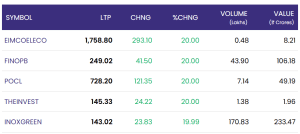

Top Gainers of 15 April’25

Several stocks hit the upper circuit with gains of nearly 20%, showcasing sharp investor interest. Among the top gainers:

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| EIMCOELECO | 1,758.80 | +293.10 | +20.00% | 0.48 | 8.21 |

| FINOPB | 249.02 | +41.50 | +20.00% | 43.90 | 106.18 |

| POCL | 728.20 | +121.35 | +20.00% | 7.14 | 49.19 |

| THEINVEST | 145.33 | +24.22 | +20.00% | 1.38 | 1.96 |

| INOXGREEN | 143.02 | +23.83 | +19.99% | 170.83 | 233.47 |

The day witnessed an impressive rally among select stocks, with several counters hitting their upper circuits, posting gains close to 20%, and drawing sharp investor attention. These stocks not only delivered strong price appreciation but also saw notable volume action, reflecting heightened institutional and retail interest.

POCL, a mid-tier industrial chemicals and alloys player, also advanced by ₹121.35 to end at ₹728.20, maintaining the 20% upper circuit level. The stock traded 7.14 lakh shares for a value of ₹49.19 crore, indicating rising institutional interest in specialty manufacturing.

THEINVEST, though a relatively smaller player in terms of market capitalization, added ₹24.22 to reach ₹145.33, with low volumes of 1.38 lakh, showing targeted buying activity.

The standout performer of the day in terms of market participation was INOXGREEN, a prominent name in the clean energy sector, which rallied ₹23.83 to close at ₹143.02, marking a 19.99% gain. With a staggering volume of 170.83 lakh shares and a total traded value of ₹233.47 crore, INOXGREEN emerged as the clear favorite among investors betting on India’s green transition and sustainable infrastructure push.

These performances signal sectoral optimism, especially in green energy, financial inclusion, and industrial manufacturing, all of which are currently aligned with long-term economic priorities and policy incentives.

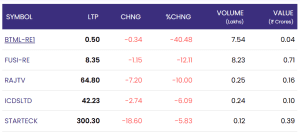

Top Losers of 15 April’25

Despite the broader rally, a few stocks ended in the red:

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| BTML-RE1 | 0.50 | -0.34 | -40.48% | 7.54 | 0.04 |

| FUSI-RE | 8.35 | -1.15 | -12.11% | 8.23 | 0.71 |

| RAJTV | 64.80 | -7.20 | -10.00% | 0.25 | 0.16 |

| ICDSLTD | 42.23 | -2.74 | -6.09% | 0.24 | 0.10 |

| STARTECK | 300.30 | -18.60 | -5.83% | 0.12 | 0.39 |

Despite the strong bullish momentum across the broader market, a handful of stocks ended the session in negative territory, reflecting stock-specific corrections, speculative unwinding, or fundamental concerns. These underperformers stood out in an otherwise jubilant trading day.

FUSI-RE, another rights entitlement counter, dropped 12.11% to close at ₹8.35, shedding ₹1.15 on volumes of 8.23 lakh shares. The correction may reflect investor uncertainty regarding the rights issue valuation or future earnings potential.

RAJTV, a regional media company, declined by 10%, losing ₹7.20 to end at ₹64.80. Though the volume was modest at 0.25 lakh shares, the sharp fall suggests profit booking or a reaction to underwhelming fundamentals amid the surge in other media stocks.

ICDSLTD, a micro-cap financial services firm, saw a 6.09% dip to ₹42.23, possibly due to low liquidity and absence of fresh triggers, with just 0.24 lakh shares traded.

Lastly, STARTECK, which operates in the real estate and infrastructure space, fell 5.83%, closing at ₹300.30 with low volumes of 0.12 lakh. The fall could be attributed to investor rotation away from speculative counters toward more fundamentally strong realty stocks.

While the overall market sentiment remained bullish, the losses in these stocks highlight the importance of stock-specific due diligence and the risks associated with low-float, speculative, or right-issue linked equities—especially during broad market rallies.

Market Outlook

The resounding bullish sentiment observed in today’s session signals sustained investor optimism in the Indian equity markets. A confluence of favorable domestic and global cues has created a positive backdrop for equities, setting the stage for potential upside in the short to medium term.

One of the primary drivers of this optimism is the anticipation of robust Q4 corporate earnings, particularly from sectors such as financial services, infrastructure, IT, and green energy. Market participants are closely watching results that could validate current valuations and justify further upside.

On the global front, softening crude oil prices have alleviated concerns about imported inflation and trade imbalances, providing a much-needed breather for the Indian economy, which is heavily reliant on oil imports. Additionally, a stable US dollar and expectations of a dovish stance by major central banks, particularly the U.S. Federal Reserve, are bolstering emerging market inflows.

Domestically, macroeconomic indicators remain strong, with GDP growth projections intact, moderate inflation, and resilient consumption patterns. Importantly, Foreign Institutional Investors (FIIs) have resumed their buying streak, further reinforcing confidence in the market’s long-term fundamentals.

However, analysts caution that while the near-term trajectory appears bullish, investors should brace for intermittent volatility, especially around global economic data releases, central bank policy updates, and geopolitical developments. Strategic stock selection and risk management remain crucial as the market tests new highs.

In essence, the outlook for Indian equities remains constructively positive, supported by a blend of strong fundamentals, global tailwinds, and liquidity revival.

Conclusion

As markets closed on a high note, the gains witnessed today not only signify a technical breakout in benchmark indices but also reflect growing investor conviction in India’s long-term growth narrative. The Nifty 50’s climb to 23,328.55—backed by strong performance in financials, infrastructure, and renewables—underscores the increasing institutional interest in India’s structural reforms, economic resilience, and its role as a global investment destination amidst global realignments.

The day’s top gainers such as EIMCOELECO, FINOPB, POCL, and INOXGREEN, many of which touched the upper circuit, indicate a shift in sentiment towards industrial innovation, green energy, and financial inclusion. Meanwhile, the few stocks that declined sharply, such as BTML-RE1 and FUSI-RE, highlight the persistent volatility in speculative counters and the need for cautious optimism in micro-cap trades.

Looking forward, market analysts are maintaining a cautiously optimistic outlook. While technical charts suggest further upside potential in the near term, supported by strong earnings expectations and macroeconomic tailwinds, experts advise investors to be selective and adopt a stock-specific strategy. Monitoring global economic trends, central bank policies, and domestic political developments will remain critical for navigating potential volatility ahead.

In summary, April 15, 2025, will be remembered as a defining day in India’s market calendar—where bullish momentum, broad-based participation, and economic optimism converged to reinforce India’s standing as a robust and resilient emerging market leader.

Investors appear optimistic about India’s economic trajectory and corporate health, as reflected in the buoyant market breadth and increased trading volumes — read more on NSE India.