Mumbai: The Indian equity markets entered the new month on a cautious note as investors grappled with a mixed set of cues on both domestic and global fronts. On May 1, 2025, the benchmark NIFTY 50 index ended virtually unchanged, reflecting the indecision among market participants ahead of crucial macroeconomic events. Despite a strong start, gains were quickly capped by weakness in financial and banking stocks, which underperformed amid rising uncertainty around the upcoming RBI monetary policy announcement and global rate cycle developments.

At the same time, the broader market, particularly midcaps and specific thematic sectors such as logistics, IT, and retail, exhibited strength, driven by strong earnings and positive management commentary. The divergent trend between large-cap underperformance and midcap resilience underlined a stock-specific trading environment. With foreign institutional investors (FIIs) adopting a risk-averse approach and retail investors actively participating in niche opportunities, market breadth remained slightly positive, despite the lack of directional cues in the frontline index.

Also Read: April 30 Indian Markets End Flat as Nifty 50 Holds Ground; Broader Indices Show Mixed Trends

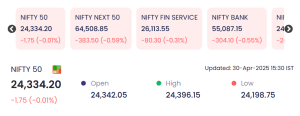

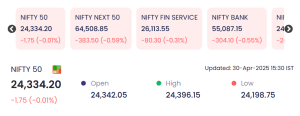

Benchmark Indices on May 1: NIFTY 50 Treads Water Amid Choppy Trade

This flat closing comes amid global headwinds, anticipation over macroeconomic indicators, and mixed quarterly results from Indian corporates. The broader trend indicated stock-specific action, especially in midcap counters, rather than across-the-board buying.

🏦 Sectoral Indices: Financials, Banks Weigh on Market Momentum

Major sectoral indices displayed a mixed trend:

| Index | Closing Value | Change (Pts) | % Change |

|---|---|---|---|

| NIFTY Financial Services | 26,113.55 | -80.30 | -0.31% |

| NIFTY Bank | 55,087.15 | -304.10 | -0.55% |

| NIFTY Next 50 | 64,508.85 | -383.50 | -0.59% |

-

Banks and NBFCs witnessed broad-based selling, driven by profit booking and caution ahead of the RBI’s monetary policy review.

-

IT and logistics sectors, however, saw significant traction due to favorable Q4 numbers and sustained demand outlook.

🔼 Top 5 Gainers: Midcaps Lead the Rally

-

LTP: ₹417.00 | Gain: ₹41.00 (▲10.90%)

-

Volume: 399.94 lakh | Turnover: ₹1,628.92 crore

Reason: Strong Q4 earnings, new IT contract wins, and analyst upgrades pushed the stock higher. Increased investor interest in scalable midcap IT players further fueled momentum.

2. Global Vectra Helicorp (GlobalVect)

-

LTP: ₹220.90 | Gain: ₹20.08 (▲10.00%)

-

Volume: 1.35 lakh

Reason: Rising demand for helicopter logistics services in the infrastructure and defense sectors. Institutional buying buzz lifted sentiment.

3. Vasundhara Mining & Minerals (VMM)

-

LTP: ₹118.48 | Gain: ₹10.77 (▲10.00%)

-

Volume: 1,060.37 lakh

Reason: Speculative buying after a significant mineral resource announcement. Potential inclusion in commodity ETFs has further stirred investor interest.

4. Jet Freight Logistics

-

LTP: ₹14.77 | Gain: ₹1.34 (▲9.98%)

-

Volume: 2.8 lakh

Reason: Improved quarterly shipment volumes and cost control measures have helped improve margins. Growing logistics demand post-election season also supported momentum.

5. Go Fashion India Ltd (GoColors)

-

LTP: ₹794.45 | Gain: ₹61.85 (▲8.44%)

-

Volume: 22.07 lakh

Reason: Robust retail sales in Tier-2 cities and increased brand presence contributed to bullish sentiment. Reports of expansion into the Middle East markets further boosted confidence.

🔻 Top 5 Losers: Profit Booking Hits Agro and Defense Stocks

-

LTP: ₹414.05 | Loss: ₹53.25 (▼11.40%)

Reason: Sharp correction after a recent rally. Weak order inflows and execution delays in defense contracts may have dampened sentiment.

2. Jainex Aamcol Ltd (GTECJAINX)

-

LTP: ₹25.35 | Loss: ₹2.79 (▼9.91%)

Reason: Thinly traded counter saw panic selling amid low volumes. Weak Q4 numbers contributed to the decline.

3. Praj Industries (Prajind)

-

LTP: ₹463.70 | Loss: ₹44.65 (▼8.78%)

Reason: Despite long-term bullishness on biofuels, Q4 earnings failed to meet analyst expectations. Investors trimmed exposure.

4. Oswal Agro Mills

-

LTP: ₹77.41 | Loss: ₹7.17 (▼8.48%)

Reason: Global agrochemical input cost pressures and a potential margin squeeze affected sentiment.

5. GSS Infotech

-

LTP: ₹37.40 | Loss: ₹3.39 (▼8.31%)

Reason: Continued selling pressure after a recent rise. Weak guidance and concerns over digital transformation pipeline raised red flags.

🔍 Market Insights: What’s Driving the Sentiment?

✅ Positive Triggers:

-

Midcap IT resilience and select retail strength.

-

Stable global markets; Dow Jones and FTSE steady.

-

Robust retail participation in low-cap stocks.

⚠️ Concerns:

-

Monetary policy uncertainty ahead of RBI’s credit policy next week.

-

Rising crude oil prices hovering above $89/barrel could fuel inflationary concerns.

-

FII outflows as global investors adopt a risk-off stance ahead of US Fed rate decision.

📊 Technical View: Caution Persists

Analysts note that 24,400 remains a stiff resistance for NIFTY, while 24,200 is acting as immediate support. Breakouts in either direction are likely only after the RBI and Fed policy cues.

“Markets are in a wait-and-watch mode. Stock-specific moves in midcaps are likely to continue, but broader momentum will return only post policy clarity,” said Rajesh Pal, Head of Research at Axis Securities.

📅 Looking Ahead

Traders and investors are advised to remain stock-specific with a bias toward sectors like:

-

Midcap IT

-

Retail & Apparel

-

Defensive FMCG

Keep an eye on:

-

RBI MPC outcome next week

-

Q4 results of major banks and FMCG players

-

US Fed commentary on inflation trajectory

📈 Final Word

The flat close of the NIFTY 50 on May 1 underscores the market’s current state of consolidation and hesitation. While frontline indices remained stagnant, the underlying activity hinted at selective accumulation in midcap and sector-specific stories, especially those benefiting from domestic consumption, digital transformation, and logistics.

Investor focus is now firmly set on the forthcoming RBI Monetary Policy Committee (MPC) meeting, which will offer clarity on the central bank’s inflation and rate outlook. Additionally, global economic signals, particularly from the U.S. Federal Reserve, and the movement in crude oil prices will continue to influence market dynamics in the coming sessions.

In the near term, traders should brace for volatility and avoid aggressive bets on benchmark indices. Instead, a stock-specific approach with a fundamental backing appears to be the more prudent strategy. As the Q4 earnings season unfolds further, bottom-up stock selection will remain the key to alpha generation in an otherwise directionless market phase.

For real time stock updates, visit NSE Official Website.