Mumbai: The Indian stock markets opened the week on a resilient and optimistic note on Monday, May 5, 2025, driven by strong performances in mid-cap and textile sectors, despite some softness in the banking space. The Nifty 50 index climbed above the 24,400 mark, gaining over 72 points in early trade, showcasing investor confidence fueled by robust corporate earnings, healthy macroeconomic indicators, and strong domestic demand.

Notably, stocks like FORCEMOT, KRYSTAL, and SPORTKING emerged as standout performers, witnessing double-digit gains and attracting substantial volumes and institutional interest. Conversely, selective pressure was seen in retail and specialty sectors, with stocks like VMART and IRISDOREME witnessing profit booking. The mixed trend among sectoral indices—where financials and banking underperformed while broader indices gained—indicates selective optimism and sectoral rotation among investors.

This market action reflects not just technical cues, but also the market’s fundamental appetite for mid-cap stories and consumption-driven plays, even as global cues remain mixed. The overall sentiment remains constructive with a tilt towards stock-specific movements.

Market Summary: 5th May 2025

📈 Top Gainers in the Equity Market

-

FORCEMOT surged impressively by ₹1,106.00, marking a 12.41% jump to trade at ₹10,020.00. This not only reflects investor optimism in the stock’s fundamentals but also accounts for a significant value turnover of ₹795.77 crores, driven by 8.10 lakh shares.

-

KRYSTAL followed with a remarkable gain of ₹88.15, touching ₹616.00—an increase of 16.70%. Its trading value reached over ₹114.15 crores, reflecting strong institutional participation.

-

SPORTKING, ZODIACLOTH, and JMA all recorded near 20% gains, indicating a broader rally in textile and manufacturing stocks. SPORTKING, in particular, saw heavy volumes at 40.25 lakhs with a total traded value of ₹43.66 crores.

The bullish surge in these counters indicates robust retail and institutional interest, possibly due to strong earnings expectations or sectoral tailwinds like export incentives, higher demand, or favorable budgetary announcements.

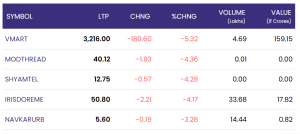

📉 Top Losers in the Equity Market

-

VMART dropped sharply by ₹180.60 to trade at ₹3,216.00—a fall of 5.32%, despite a fairly decent volume of 4.69 lakh shares and high value turnover of ₹159.15 crores. This decline could reflect weak quarterly results or negative sectoral outlook in the retail space.

-

IRISDOREME lost ₹2.21 (4.17%), while SHYAMTEL, MODTHREAD, and NAVKARURB saw cuts ranging from -3.28% to -4.36%. These losses came amidst lower volumes, indicating weak investor confidence and potential concerns over operational performance or liquidity constraints.

The decline in these specific stocks contrasts the otherwise bullish undertone in the broader market, potentially pointing toward stock-specific news or sectoral rotation.

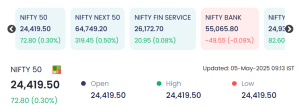

📊 Sectoral Performance: Nifty Indices

Here’s how the major indices opened today:

-

Nifty 50: 24,419.50 (+0.30%, +72.80 points)

-

Nifty Next 50: 64,749.20 (+0.50%, +319.45 points)

-

Nifty Fin Service: 26,172.70 (+0.08%, +20.95 points)

-

Nifty Bank: 55,065.80 (-0.09%, -49.55 points)

-

Nifty 100: 24,938.30 (+0.33%, +82.60 points)

While broader indices like Nifty 50, Nifty Next 50, and Nifty 100 showed gains—suggesting a widespread rally—the banking sector reflected marginal weakness with Nifty Bank declining by 49.55 points (-0.09%). This underperformance could be attributed to profit booking in heavyweight bank stocks or investor caution ahead of monetary policy expectations.

🧠 Market Insights

The positive momentum in key indices indicates a resilient domestic equity market amid global uncertainties. Investors appear to be shifting their focus towards mid-cap and textile counters, possibly due to:

-

Robust earnings in the textile sector,

-

Government-backed industrial policies,

-

Optimistic outlook for export-driven businesses,

-

Overall economic recovery pushing consumption higher.

On the other hand, some high-value and small-cap counters faced profit booking, revealing the market’s cautious optimism. The performance of FORCEMOT and KRYSTAL is particularly noteworthy given their substantial value and volume metrics.

Conclusion

In summary, the Indian equity markets kicked off the week on a strong note with broad-based buying in select mid-cap and manufacturing stocks, particularly within textiles and capital goods. While the headline indices like the Nifty 50 and Nifty Next 50 posted healthy gains, banking stocks remained subdued, reflecting investor caution ahead of upcoming macroeconomic data and policy decisions.

Today’s top performers such as FORCEMOT and KRYSTAL underline the market’s shift toward growth-centric mid-caps and sectors poised for post-pandemic expansion. On the flip side, the fall in counters like VMART signals the need for a more cautious approach toward retail-driven stocks amid changing consumer sentiment.

Going forward, investor focus will likely remain on Q4 earnings, policy clarity, and global market cues. With sectoral rotations in play and broader indices holding steady, the near-term market outlook appears stable, albeit with expected volatility in select pockets. Traders and investors are advised to continue with a stock-specific strategy and keep an eye on volume trends and sector leadership for identifying opportunities in this evolving landscape.

For real-time updates and detailed company-wise data, visit the NSE India official website.