Mumbai: As the Indian equity market continued its rollercoaster ride, May 5, 2025, brought a mixed bag of results for investors. The Nifty 50 surged by 114.45 points to close at 24,461.15, demonstrating resilience in the face of global economic uncertainties and domestic sectoral divergence. While the broader market sentiment appeared optimistic—especially in midcap and manufacturing stocks—the Bank Nifty index slipped by nearly 196 points, highlighting underperformance in the financial sector.

Also Read: May 5 Market Opening: Nifty Rises Above 24,400 as Textile Stocks Rally, Banking Lags

The Nifty Next 50 led the day’s momentum, clocking a robust 1.52% gain, signaling renewed interest in quality midcap counters. Meanwhile, concerns over banking valuations, possible interest rate adjustments by the RBI, and cautious investor positioning ahead of quarterly earnings weighed down the Bank Nifty. Analysts also observed a shift in capital flows toward sectors like IT, consumer goods, and industrials, which offered better valuation comfort and future growth visibility.

📈 Nifty Index Summary (as of 3:30 PM IST):

| Index | Value | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 24,461.15 | +114.45 | +0.47% |

| NIFTY NEXT 50 | 65,406.85 | +977.10 | +1.52% |

| NIFTY FIN SERVICE | 26,164.90 | +13.15 | +0.05% |

| NIFTY BANK | 54,919.50 | –195.85 | –0.36% |

-

Open: 24,419.50

-

High: 24,526.40

-

Low: 24,400.65

Despite a negative close in the banking sector, the benchmark NIFTY 50 recorded a solid uptick of 114.45 points, closing at 24,461.15. The Nifty Next 50 surged the most with a gain of 1.52%, indicating strong momentum in mid-to-large cap stocks.

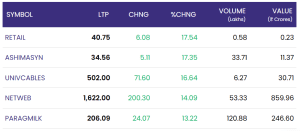

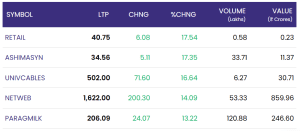

🚀 Top Gainers (May 5, 2025):

| Stock | LTP | Change | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| NETWEB | ₹1,622.00 | +200.30 | +14.09% | 53.33 | 859.96 |

| UNIVCABLES | ₹502.00 | +71.60 | +16.64% | 6.27 | 30.71 |

| PARAGMILK | ₹206.09 | +24.07 | +13.22% | 120.88 | 246.60 |

| RETAIL | ₹40.75 | +6.08 | +17.54% | 0.58 | 0.23 |

| ASHIMASYN | ₹34.56 | +5.11 | +17.35% | 33.71 | 11.37 |

-

Highlight: NETWEB stood out as a volume and value leader, clocking nearly ₹860 crore in turnover and over 14% rise.

-

Retail and textile players like ASHIMASYN and RETAIL showed impressive gains on relatively low volume, possibly due to renewed investor interest in the sector.

📉 Top Losers (May 5, 2025):

| Stock | LTP | Change | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| KSOLVES | ₹415.05 | –46.10 | –10.00% | 0.36 | 1.48 |

| SILVERTUC | ₹692.70 | –46.10 | –6.24% | 0.22 | 1.54 |

| VMART | ₹3,156.00 | –240.60 | –7.08% | 3.03 | 95.10 |

| LOTUSEYE | ₹75.30 | –6.19 | –7.60% | 2.09 | 1.64 |

| GTECJAINX | ₹20.73 | –2.31 | –10.03% | 0.92 | 0.19 |

-

Tech and retail-related stocks such as KSOLVES and VMART faced pressure, likely due to profit booking or quarterly earnings concerns.

-

GTECJAINX, a micro-cap stock, plummeted by over 10%, reflecting high volatility in low-cap counters.

🔍 Sectoral Snapshot:

-

Financial Services barely held in green with marginal gains (+0.05%).

-

Bank Nifty saw a sharp decline, led possibly by investor caution ahead of earnings or macroeconomic news.

-

FMCG and Pharma segments likely contributed to the Nifty’s rise, although individual counters are not listed here.

🧠 Analyst Insight:

Experts point to sustained institutional buying in midcaps and select large caps as a key factor driving market resilience. The volatility in the banking segment may be attributed to profit booking and global interest rate concerns.

🔚 Conclusion:

The Indian stock market closed the session on May 5, 2025, with a cautiously positive tone. The Nifty 50’s upward momentum, supported by midcap strength and select high-performing stocks, offset the drag from the banking sector, which saw significant pressure likely due to valuation concerns and uncertain global cues. The strong performance of stocks like NETWEB, UNIVCABLES, and PARAGMILK pointed to investor preference for manufacturing, dairy, and capital goods segments, all sectors expected to benefit from recent government policy support and demand revival.

Conversely, the sharp decline in counters such as KSOLVES, VMART, and GTECJAINX revealed the persistent risk in small-cap and tech-heavy counters, many of which are still adjusting to shifting demand dynamics and market sentiment post-earnings season. Despite the Bank Nifty ending in the red, the broader indices signaled stability and confidence, buoyed by strong FII inflows and consistent domestic buying in quality stocks.

Going forward, investors should remain vigilant of upcoming economic data releases, the RBI policy outlook, and global market movements. The market appears to be entering a stock-picking phase, where sector rotation and earnings will drive future momentum more than index-level movements. A balanced approach—focusing on fundamental strength while monitoring macro signals—may be the most prudent strategy as the fiscal quarter progresses.

👉 For real-time market updates, visit NSE India