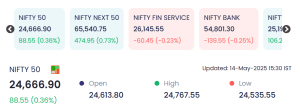

Mumbai: The Indian stock markets on May 14 2025 closed with modest gains on the benchmark front, yet action remained vibrant in the broader market, particularly among small-cap stocks. The Nifty 50 index ended the session at 24,666.90, up by 88.55 points (+0.36%), signaling cautious optimism ahead of key global economic data and domestic earnings.

Also Read: May 9 2025: Indian Markets Stumble Amid Financial Sector Selloff — Nifty Drops Below 24,050

While frontline indices showed resilience, investor sentiment was stronger in the mid and small-cap segments, as indicated by the Nifty Next 50’s sharp 0.73% surge, outperforming major sectoral indices. Market breadth leaned positively with select stocks delivering double-digit gains, hinting at rotational flows and bullish undercurrents among retail participants.

📊 Index Snapshot on May 14

| Index | Closing Value | Change | % Change |

|---|---|---|---|

| Nifty 50 | 24,666.90 | +88.55 | +0.36% |

| Nifty Next 50 | 65,540.75 | +474.95 | +0.73% |

| Nifty Fin Service | 26,145.55 | -60.45 | -0.23% |

| Nifty Bank | 54,801.30 | -139.55 | -0.25% |

| Nifty Midcap 50 | 25,185.75 | +106.25 | +0.42% |

-

Opening: 24,613.80

-

Intraday High: 24,767.55

-

Intraday Low: 24,535.55

Despite volatility, the Nifty 50 held firm above its 24,600 support zone, showing strength amid sectoral consolidation.

🔼 Top Gainers – Small-Cap Surge on Heavy Volume

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| BASML-RE1 | ₹3.00 | +0.65 | +27.66% | 4.41 | 0.12 |

| KANPRPLA | ₹175.26 | +29.21 | +20.00% | 12.15 | 20.61 |

| KHAITANLTD | ₹102.51 | +17.08 | +19.99% | 0.31 | 0.31 |

| GENCON | ₹38.13 | +6.35 | +19.98% | 10.54 | 3.92 |

| AMJLAND | ₹56.92 | +9.48 | +19.98% | 2.31 | 1.29 |

🔍 Stock-wise Insights:

-

BASML-RE1 gained a staggering +27.66%, despite its low LTP of ₹3.00. It reflects aggressive speculative buying, possibly by retail investors betting on penny stocks with upcoming restructuring or news-driven expectations.

-

KANPRPLA was not only a price gainer (+20%) but also a value leader (₹20.61 Cr) among small caps. The stock’s jump on 12 lakh+ volume indicates substantial market interest.

-

KHAITANLTD, GENCON, and AMJLAND showed identical % gains (~20%), indicating algorithmic interest or synchronized buying patterns possibly due to breakout technical levels or thematic plays.

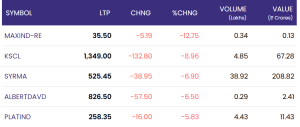

🔽 Top Losers – Midcap Weakness in Select Counters

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MAXIND-RE | ₹35.50 | -5.19 | -12.75% | 0.34 | 0.13 |

| KSCL | ₹1,349.00 | -132.80 | -8.96% | 4.85 | 67.28 |

| SYRMA | ₹525.45 | -38.95 | -6.90% | 38.92 | 208.82 |

| ALBERTDAVD | ₹826.50 | -57.50 | -6.50% | 0.29 | 2.41 |

| PLATIND | ₹258.35 | -16.00 | -5.83% | 4.43 | 11.43 |

🔍 Stock-wise Observations:

-

SYRMA stood out with ₹208.82 Cr in value traded, despite the 6.9% decline. The drop may stem from disappointing quarterly results or large institutional exit.

-

KSCL‘s 9% drop reflects potential valuation concerns or sectoral drag, especially in agri-inputs, given global uncertainties.

-

MAXIND-RE and PLATIND showed sharp declines, possibly due to short-term volatility or lack of follow-through demand post recent surges.

🧮 Sectoral and Technical View

-

Financial and banking stocks underperformed, pulling the Nifty Bank and Fin Services indices into negative territory.

-

Midcap and small-cap stocks maintained momentum, aided by liquidity flow, broader participation, and retail-driven optimism.

From a technical standpoint, Nifty 50 respected its support and maintained higher lows, indicating bullish bias intact above 24,500. Resistance could be expected around 24,800–25,000 levels.

✅ Conclusion

The market’s behavior on 14 May 2025 reflects a healthy consolidation phase, with stock-specific breakouts driving action, particularly in the small and mid-cap space. While large indices like Nifty 50 closed with a mild gain, the broader market exuberance suggests confidence among traders in select growth stocks.

However, profit booking in certain midcaps like SYRMA and KSCL reminds investors of the importance of stock selection and risk management. With earnings season underway and global cues uncertain, traders are advised to adopt a cautious yet opportunistic approach.

For more real time updates on stocks, visit NSE website.