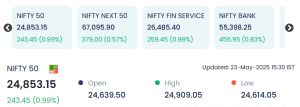

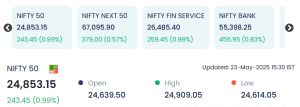

Mumbai: Indian stock markets witnessed a strong surge on 23 May 2025, with major indices posting solid gains, reflecting robust investor sentiment and optimism over economic stability and earnings growth. The benchmark Nifty 50 climbed 243.45 points or 0.99%, closing at 24,853.15, driven by significant rallies in banking, financial services, and mid-cap stocks.

Also Read: 22 May 2025: Indian Stock Markets Dip Amid Global Uncertainty | Nifty Ends Below 24,700

Indices Post Robust Gains on 23 May

-

Nifty Next 50 gained 379.00 points (0.57%), ending at 67,095.90.

-

Nifty Financial Services rose 259.45 points (0.99%), settling at 26,485.40.

-

Nifty Bank saw a strong rally, closing at 55,398.25, up 456.95 points (0.83%).

The Nifty 50 opened the day at 24,639.50, made an intraday high of 24,909.05, and touched a low of 24,614.05, before settling just shy of the 25,000 mark.

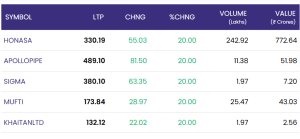

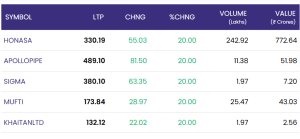

Top Gainers: Stocks That Hit the 20% Upper Circuit

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| HONASA | 330.19 | +55.03 | +20.00% | 242.92 | 772.64 |

| APOLLOPIPE | 489.10 | +81.50 | +20.00% | 11.38 | 51.98 |

| SIGMA | 380.10 | +63.35 | +20.00% | 1.97 | 7.20 |

| MUFTI | 173.84 | +28.97 | +20.00% | 25.47 | 43.03 |

| KHAITANLTD | 132.12 | +22.02 | +20.00% | 1.97 | 2.56 |

HONASA (Mamaearth) led the volume and value charts among top gainers, with turnover crossing ₹772 crore and volume nearing 243 lakh shares.

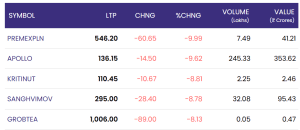

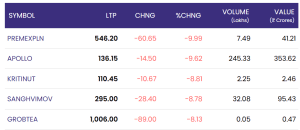

Top Losers: Selective Selling Pressure Persists

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GROBTEA | 1,006.00 | -89.00 | -8.13% | 0.05 | 0.47 |

| PREMEXPLN | 546.20 | -60.65 | -9.99% | 7.49 | 41.21 |

| APOLLO | 136.15 | -14.50 | -9.62% | 245.33 | 353.62 |

| KRITINUT | 110.45 | -10.67 | -8.81% | 2.25 | 2.46 |

| SANGHVIMOV | 295.00 | -28.40 | -8.78% | 32.08 | 95.43 |

APOLLO Tyres witnessed heavy trading activity with over 245 lakh shares exchanged, even as the stock dipped nearly 10%.

Market Sentiment and Outlook

The overall positive performance was driven by:

-

Improved quarterly results from key corporates.

-

Global cues indicating stability in U.S. and Asian markets.

-

Foreign institutional inflows picking up pace ahead of anticipated reforms and policy clarity.

-

Domestic macroeconomic resilience, with inflation under control and improved GDP forecasts.

Analysts believe that if the Nifty 50 decisively crosses the 25,000 threshold, it could trigger another round of buying, particularly from momentum investors.

Conclusion

Today’s market movement highlights the strength of investor confidence in India’s economic trajectory. While pockets of weakness remain, particularly in a few small-cap counters, the broader indices are marching ahead, signaling robust participation across sectors. With the Nifty Bank and Financial Services playing a leadership role, the markets are well-poised for further gains, especially if domestic fundamentals continue to support the uptrend.

As always, market watchers advise caution and strategic allocation as volatility can return with global developments or policy announcements. For now, though, the bulls are firmly in control.

For real time stock Updates, visit NSE website.