Mumbai: The Indian stock markets started the week on a cautious note as key indices slipped into negative territory on 27 May 2025, ending a volatile session in the red. The benchmark Nifty 50 fell by nearly 175 points, signaling widespread profit-booking and investor nervousness ahead of critical global economic cues. With elections approaching in major global economies and uncertainty looming over U.S. interest rate decisions, both domestic and foreign institutional investors appeared hesitant.

Also Read: 26 May 2025: Nifty Soars Past 25,000 Mark: Market Ends on a High Amid Broad-Based Rally

Market sentiment was further dampened by lackluster performance in heavyweight sectors like IT, banking, pharma, and realty. Despite a positive opening backed by short-term optimism, indices gradually lost strength throughout the day. Small- and mid-cap stocks offered a few bright spots, with selective stocks witnessing sharp rallies due to stock-specific news, earnings, or technical breakouts.

The trading day reflected a classic case of cautious optimism turning into risk-off sentiment, where gains in select segments were outweighed by losses in large-cap and institutional favorites. The decline in broader indices came despite decent trading volumes and sporadic buying interest in sectors such as chemicals, energy, and manufacturing.

MARKET OVERVIEW

Other indices also registered losses:

-

NIFTY Next 50: 67,190.75 ▼ 181.55 (-0.27%)

-

NIFTY Financial Services: 26,420.80 ▼ 171.10 (-0.64%)

-

NIFTY Bank: 55,352.80 ▼ 219.20 (-0.39%)

The session was marked by weak global cues and sectoral underperformance, especially in IT, realty, and pharma stocks.

📈 Top Gainers on NSE (27 May 2025)

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| GODAVARIB | ₹259.90 | +₹31.11 | +13.60% | 12.82 | ₹33.07 |

| DELTA MAGNT | ₹96.62 | +₹16.10 | +20.00% | 6.54 | ₹6.20 |

| NRL | ₹84.46 | +₹14.07 | +19.99% | 29.69 | ₹24.05 |

| SHRIRAMPPS | ₹97.00 | +₹12.41 | +14.67% | 314.26 | ₹300.62 |

| KRONOX | ₹168.60 | +₹20.45 | +13.80% | 8.40 | ₹13.34 |

Analysis:

These stocks rallied on strong earnings forecasts and fresh buying by retail investors. Godavari Biorefineries led the pack with a robust 13.60% surge, followed closely by Delta Manufacturing and NRL, indicating strong interest in mid-cap industrial and chemical counters.

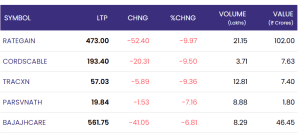

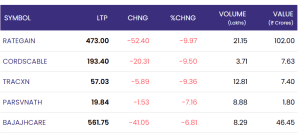

📉 Top Losers on NSE (27 May 2025)

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| RATEGain | ₹473.00 | -₹52.40 | -9.97% | 21.15 | ₹102.00 |

| CORDSCABLE | ₹193.40 | -₹20.31 | -9.50% | 3.71 | ₹7.63 |

| TRACXN | ₹57.03 | -₹5.89 | -9.36% | 12.81 | ₹7.40 |

| PARSVNATH | ₹19.84 | -₹1.53 | -7.16% | 8.88 | ₹1.80 |

| BAJAJHCARE | ₹561.75 | -₹41.05 | -6.81% | 8.29 | ₹46.45 |

Analysis:

RateGain and Cords Cable suffered steep losses due to weak Q4 numbers and profit booking pressure. Tracxn also witnessed high volatility, reflecting cautious sentiment in the tech-based SME segment.

Conclusion

In summary, 27 May 2025 proved to be a challenging session for Indian equity markets, with the Nifty 50 closing at 24,826.20, down nearly 175 points. Despite early signs of resilience, the market’s inability to hold on to gains emphasized the fragile nature of current investor sentiment. Weak global signals, coupled with valuation concerns and sector-specific disappointments, weighed heavily on indices.

While top performers like Godavari Biorefineries and NRL brought cheer to selective mid-cap investors, the broader narrative was dominated by widespread sell-offs, particularly in RateGain, Tracxn, and other high-beta counters. The divergence in stock performance underscores the importance of selective investing and risk assessment in the current environment.

As the week progresses, investor attention will be glued to macroeconomic data releases, corporate announcements, and global market cues. With volatility expected to continue, traders are likely to adopt a cautious, stock-specific approach, and investors should focus on long-term fundamentals rather than short-term market noise. A close watch on institutional activity, global bond yields, and inflation trends will remain crucial in anticipating the market’s near-term direction.

For real time stock Updates, visit NSE website.