Mumbai: The Indian equity markets ended flat-to-positive on 11 June 2025, as the benchmark Nifty 50 climbed marginally by 37.15 points or 0.15%, closing at 25,141.40. The broader market showed a mixed trend, with selected small-cap stocks posting stellar gains, while some large-cap and power sector stocks witnessed notable losses.

Also Read: 9 June 2025: Indian Markets Close Higher; Nifty 50 Ends Above 25,100, Midcap Rally Shines

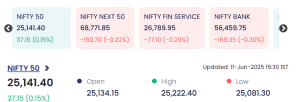

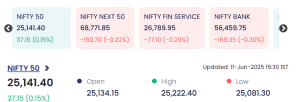

🔹 Nifty Index Snapshot on 11 June 2025

| Index | Value | Change | % Change |

|---|---|---|---|

| Nifty 50 | 25,141.40 | +37.15 | +0.15% |

| Nifty Next 50 | 68,771.85 | -150.70 | -0.22% |

| Nifty Fin Service | 26,789.95 | -77.10 | -0.29% |

| Nifty Bank | 56,459.75 | -169.35 | -0.30% |

-

Opening: 25,134.15

-

High: 25,222.40

-

Low: 25,081.30

While the Nifty 50 showed resilience, declines in banking and financial services dragged broader indices.

🚀 Top Gainers (Small & Microcap Surge)

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| KARMAENG | 69.55 | +11.59 | +20.00% | 1.36 | 0.91 |

| ENERGYDEV | 26.53 | +4.42 | +19.99% | 9.76 | 2.48 |

| GTL | 11.18 | +1.86 | +19.96% | 113.03 | 12.26 |

| GTLINFRA | 1.81 | +0.30 | +19.87% | 4911.05 | 84.47 |

| ANTGRAPHIC | 1.51 | +0.25 | +19.84% | 43.02 | 0.63 |

GTL Infra witnessed massive volumes, signaling potential accumulation by speculative and retail investors.

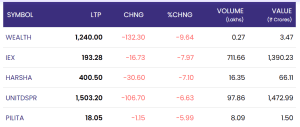

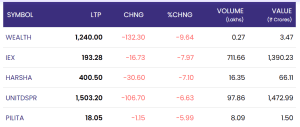

📉 Top Losers (Profit Booking Hits Heavyweights)

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| WEALTH | 1240.00 | -132.30 | -9.64% | 0.27 | 3.47 |

| IEX | 193.28 | -16.73 | -7.97% | 711.66 | 1390.23 |

| HARSHA | 400.50 | -30.60 | -7.10% | 16.35 | 66.11 |

| UNITDSPR | 1503.20 | -106.70 | -6.63% | 97.86 | 1472.99 |

| PILITA | 18.05 | -1.15 | -5.99% | 8.09 | 1.50 |

Indian Energy Exchange (IEX) and UNITED SPR witnessed heavy profit booking despite high liquidity, dragging sentiment in the power and industrial segments.

📊 Market Outlook

The modest uptick in Nifty 50 reflects cautious optimism ahead of upcoming macroeconomic data and global monetary policy cues. While large-cap indices remained subdued, micro-cap and turnaround stocks saw heavy participation.

Market participants are advised to remain vigilant of high valuations in small-caps and monitor key levels of Nifty support near 25,000 and resistance around 25,300.

📝 Conclusion

June 11 trading session underlined the divergent trends in the Indian stock market—while frontline indices remained steady, speculative action in penny and micro-cap counters kept the broader market abuzz. Key eyes will now be on upcoming inflation data, US Fed commentary, and domestic fiscal cues.

For real time stock Updates, visit NSE website.