Mumbai: The Indian equity markets witnessed a broad-based decline on Friday, 13 June 2025, amid weak global cues and sector-wide selling pressure. Benchmark indices ended in the red, with the Nifty 50 falling 169.60 points (-0.68%) to settle at 24,718.60. The index opened at 24,473.00, touched an intraday high of 24,754.35, but failed to sustain gains and closed below the day’s peak.

🔻 Sectoral Performance: Bloodbath in Financials & Banks on 13 June 2025

-

Nifty Next 50: 66,979.05 (▼ 557.45 / -0.83%)

-

Nifty Financial Services: 26,335.60 (▼ 244.30 / -0.92%)

-

Nifty Bank: 55,527.35 (▼ 555.20 / -0.99%)

The sharp correction in banking and financial stocks was the primary drag on market sentiment, compounded by weak investor confidence and limited positive triggers.

🔼 Top Gainers – Stocks That Defied the Market Trend

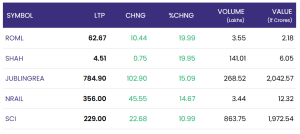

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Turnover (₹ Cr) |

|---|---|---|---|---|---|

| ROML | 62.67 | +10.44 | +19.99% | 3.55 | 2.18 |

| SHAH | 4.51 | +0.75 | +19.95% | 141.01 | 6.05 |

| JUBLINGREA | 784.90 | +102.90 | +15.09% | 268.52 | 2,042.57 |

| NRAIL | 356.00 | +45.55 | +14.67% | 3.44 | 12.32 |

| SCI | 229.00 | +22.68 | +10.99% | 863.75 | 1,972.54 |

JUBLINGREA and SCI stood out with high trading volumes and turnover exceeding ₹2,000 Cr and ₹1,900 Cr respectively, signaling strong investor interest and possibly institutional participation.

🔻 Top Losers – Stocks That Took a Hit

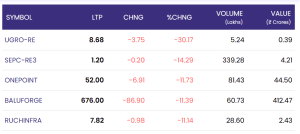

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Turnover (₹ Cr) |

|---|---|---|---|---|---|

| UGRO-RE | 8.68 | -3.75 | -30.17% | 5.24 | 0.39 |

| SEPC-RE3 | 1.20 | -0.20 | -14.29% | 339.28 | 4.21 |

| ONEPOINT | 52.00 | -6.91 | -11.73% | 81.43 | 44.50 |

| BALUFORGE | 676.00 | -86.90 | -11.39% | 60.73 | 412.47 |

| RUCHINFRA | 7.82 | -0.98 | -11.14% | 28.60 | 2.43 |

UGRO-RE witnessed the steepest fall, losing over 30%, while BALUFORGE saw a significant erosion of value with a decline of ₹86.90, closing at ₹676.

📊 Market Sentiment & Expert Commentary

Analysts suggest that the downturn reflects profit booking at higher levels, compounded by concerns over global inflation data and possible changes in interest rate outlooks by major central banks. The banking sector, which had seen a rally in recent weeks, faced selling pressure amid valuation concerns.

Experts also highlight:

-

Weak institutional flows and muted global market cues.

-

Volatility ahead of Q1 FY26 earnings season.

-

Concerns over oil prices and geopolitical tensions that may further weigh on market sentiment.

📌 Outlook

Going forward, markets are expected to remain range-bound with a watchful eye on global indicators, macroeconomic data releases, and monsoon progress in India. The next few sessions will be crucial in determining near-term direction, especially in heavyweight sectors like banking, IT, and FMCG.

For real time stock Updates, visit NSE website.