Mumbai, 19 June 2025 — The Indian stock markets ended Thursday’s session on a cautious note, with benchmark indices displaying muted moves while specific small- and mid-cap stocks surged with impressive volumes and returns. Despite global cues suggesting consolidation and uncertainty, segments of the Indian equity space witnessed selective buying, hinting at investor preference for emerging sectoral themes.

Also Read: 18 June 2025: Nifty Closes at 24,812.05 as Market Ends Flat; Mixed Sentiment in Broader Indices

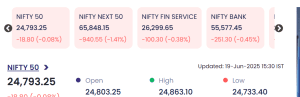

🔷 Benchmark Index Performance: Broad Market Overview on 19 June 2025

| Index | Closing Value | Change (Points) | % Change |

|---|---|---|---|

| NIFTY 50 | 24,793.25 | -18.80 | -0.08% |

| NIFTY NEXT 50 | 65,848.15 | -940.55 | -1.41% |

| NIFTY FIN SERVICE | 26,299.65 | -100.30 | -0.38% |

| NIFTY BANK | 55,577.45 | -251.30 | -0.45% |

-

NIFTY 50 opened at 24,803.25, touched a high of 24,863.10, and a low of 24,733.40 before closing marginally down at 24,793.25.

-

Notably, NIFTY NEXT 50 underperformed with a sharp 1.41% decline, reflecting pressure on broader markets.

📊 Top Gainers of the Day: Sharp Rally in Select Midcaps

| Symbol | LTP (₹) | Chng (₹) | %Chng | Volume (Lakhs) | Value (₹ Cr.) |

|---|---|---|---|---|---|

| AAKASH | 11.64 | +1.94 | 20.00% | 60.94 | 6.92 |

| ONELIFECAP | 15.18 | +1.38 | 10.00% | 2.24 | 0.34 |

| SPMLINFRA | 242.00 | +21.73 | 9.87% | 24.62 | 58.57 |

| PUNJABCHEM | 1,188.80 | +104.20 | 9.61% | 1.06 | 12.35 |

| AEROFLEX | 191.00 | +16.15 | 9.24% | 649.76 | 1,283.60 |

-

AEROFLEX was the standout in terms of traded value, surpassing ₹1,283 crore.

-

AAKASH emerged as the top percentage gainer (+20%), attracting retail interest.

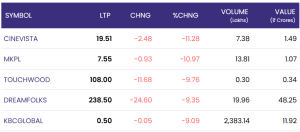

🔻 Top Losers: Selective Correction in High Beta Stocks

| Symbol | LTP (₹) | Chng (₹) | %Chng | Volume (Lakhs) | Value (₹ Cr.) |

|---|---|---|---|---|---|

| CINEVISTA | 19.51 | -2.48 | -11.28% | 7.38 | 1.49 |

| MKPL | 7.55 | -0.93 | -10.97% | 13.81 | 1.07 |

| TOUCHWOOD | 108.00 | -11.68 | -9.76% | 0.30 | 0.34 |

| DREAMFOLKS | 238.50 | -24.60 | -9.35% | 19.96 | 48.25 |

| KBCGLOBAL | 0.50 | -0.05 | -9.09% | 2,383.14 | 11.92 |

-

DREAMFOLKS saw a steep fall of ₹24.60, possibly driven by weak quarterly expectations or valuation concerns.

-

KBCGLOBAL posted high volumes but limited value, suggesting speculative activity.

🌐 Market Sentiment & Outlook

Despite the benchmark indices closing nearly flat, the trading activity in midcaps and certain speculative counters indicates a diverging market trend. Broader markets underperformed due to global volatility and FII outflows, while domestic investor interest in niche segments continued.

Key Market Drivers:

-

Uncertainty around global interest rate directions.

-

Mixed cues from international equities.

-

Sector rotation toward capital goods and defence.

Analyst Insight:

Market experts suggest that while the Nifty remains range-bound, the opportunity lies in identifying sector-specific momentum — especially in defence manufacturing, infrastructure, and midcap pharma.

📌 Conclusion

The trading session on 19 June 2025 was a classic example of a market in transition — broader indices showing signs of consolidation while investor activity in selective stocks remained strong. With ongoing global cues and policy signals expected in the coming days, volatility may persist, but opportunities remain for informed and patient investors.

For real time stock Updates, visit NSE website.