Mumbai: The Indian equity market ended on a positive note on 24 June 2025, driven by strength in midcap and financial counters. The Nifty 50 rose by 72.45 points (0.29%), closing at 25,044.35, while the Nifty Next 50 surged 0.85% to settle at 67,349.35.

-

Nifty Fin Service climbed 193.90 points (0.73%) to end at 26,750.40

-

Nifty Bank jumped 402.55 points (0.72%) to close at 56,461.90

Nifty 50 moved between an intraday high of 25,317.70 and low of 24,999.70, with opening at 25,179.90.

🔼 Top Gainers of the Day

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MUKANDLTD | 137.40 | +22.90 | +20.00% | 40.77 | 54.31 |

| BAJAJCON | 202.90 | +33.81 | +20.00% | 209.67 | 410.19 |

| WIPL | 173.00 | +28.27 | +19.53% | 1.39 | 2.32 |

| FOODSIN | 115.00 | +11.93 | +11.57% | 50.22 | 58.53 |

| EIEL | 234.30 | +22.87 | +10.82% | 457.42 | 1,086.88 |

🔹 EIEL emerged as a volume and value leader among gainers with over ₹1,000 crore in trade value, signaling strong investor interest in the counter.

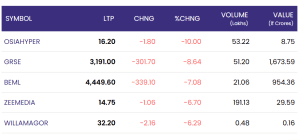

🔻 Top Losers of the Day

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| OSIAHYPER | 16.20 | -1.80 | -10.00% | 53.22 | 8.75 |

| GRSE | 3,191.00 | -301.70 | -8.64% | 51.20 | 1,673.59 |

| BEML | 4,449.60 | -339.10 | -7.08% | 21.06 | 954.36 |

| ZEEMEDIA | 14.75 | -1.06 | -6.70% | 191.13 | 29.59 |

| WILLAMAGOR | 32.20 | -2.16 | -6.29% | 0.48 | 0.16 |

🔻 GRSE and BEML, despite being high-value defense stocks, saw steep declines amid possible profit booking following recent rallies.

🧾 Market Sentiment and Outlook on 24 June 2025

Overall, the broader sentiment remained optimistic with financials and midcaps leading the gains. However, select profit-booking in defense and media stocks capped further upside. Analysts attribute today’s positive movement to strong institutional buying and moderating global crude oil prices, which helped contain inflation fears.

📌 Conclusion

As Indian markets head into the final week of June, investor focus will remain on macro indicators, crude prices, and global cues. The strong performance by midcap names and a steady close by frontline indices indicates resilience in investor sentiment, though volatility is expected to persist in the near term.

For real time stock Updates, visit NSE website.