In a dramatic turnaround for global markets, the S&P 500 soared to a new record high on Friday, propelled by the conclusion of high-stakes trade negotiations led by President Donald Trump. The index, which tracks the performance of 500 leading U.S. companies, closed at an all-time high of 6,173.07, eclipsing its previous peak set in February. This surge marks a stunning recovery from the market’s steep declines earlier this year, when tariff threats and geopolitical tensions sent stocks tumbling and threatened to tip the U.S. into a bear market.

The S&P 500’s record-breaking rally has injected a fresh wave of optimism into global financial markets, with investors and analysts alike marveling at the speed and strength of the recovery. Many attribute this surge not only to the resolution of trade tensions but also to the underlying resilience of the U.S. economy, which has continued to post strong employment and GDP growth figures despite external headwinds. The end of trade hostilities has allowed companies to resume long-term planning and capital investments, fueling expectations of sustained corporate earnings growth in the quarters ahead.

Institutional investors, who had adopted a cautious stance during the height of trade uncertainty, are now reallocating capital into equities, particularly in sectors poised to benefit from revived global trade flows. Technology, industrials, and consumer discretionary stocks have emerged as major beneficiaries, reflecting renewed confidence in both domestic demand and international expansion. This sectoral rotation has broadened the market’s gains, making the rally more robust and less reliant on a handful of mega-cap stocks.

Retail participation in the stock market has also surged, as individual investors seek to capitalize on the bullish momentum. Trading platforms have reported record account openings, and mutual funds focused on U.S. equities have seen substantial inflows. The “fear of missing out” phenomenon is palpable, with many retail investors viewing the current environment as a rare opportunity to build wealth. Financial advisors, however, are urging clients to maintain a balanced approach and avoid overexposure to high-flying sectors.

The positive sentiment is not limited to the U.S. alone. Emerging markets, which had suffered from capital outflows during the trade dispute, are now witnessing renewed interest from global investors. Currencies in Asia and Latin America have stabilized, and stock indices in countries like India, Brazil, and South Korea have posted impressive gains. The prospect of smoother trade relations and stable commodity prices is expected to further support growth in these regions.

Corporate executives are expressing relief at the improved outlook, with many resuming expansion plans that were put on hold during the trade standoff. Multinational firms are ramping up hiring, increasing research and development budgets, and exploring new markets, all of which bode well for job creation and innovation. The sense of uncertainty that had clouded boardrooms has lifted, replaced by a cautious but growing confidence in the future.

Trump’s Tariff Pause and Trade Deal Fuel Rally

Just a few months ago, few analysts could have predicted such a swift rebound. In April, the S&P 500 had plunged nearly 20% from its February peak, rattled by President Trump’s aggressive tariff announcements on major trading partners. Investor anxiety ran high as fears of a global trade war and surging inflation dominated headlines. However, the market’s fortunes began to change in early April when Trump announced a pause on the most severe tariffs and signaled willingness to negotiate with China and other key partners.

This strategic shift reassured investors that the administration would not allow trade tensions to derail economic growth. The subsequent trade talks, which concluded this week with a tentative agreement, further cemented market optimism. Trump’s decision to delay new tariffs and seek common ground with China and the European Union was seen as a major de-escalation, prompting a wave of buying across global equities.

Tech Rally and AI Boom Add Fuel

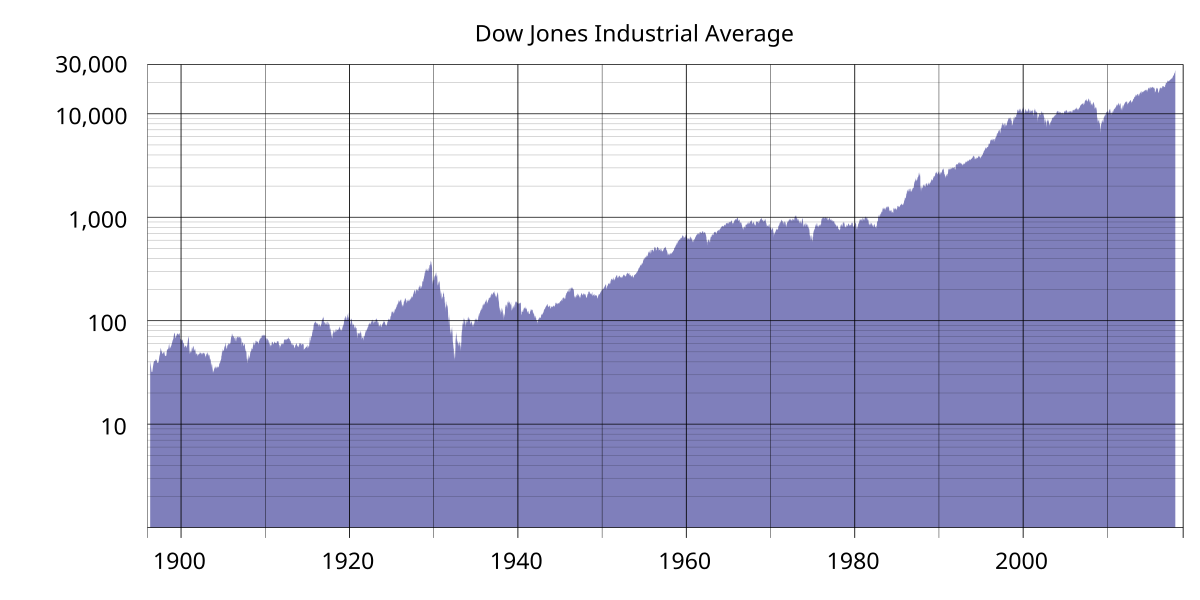

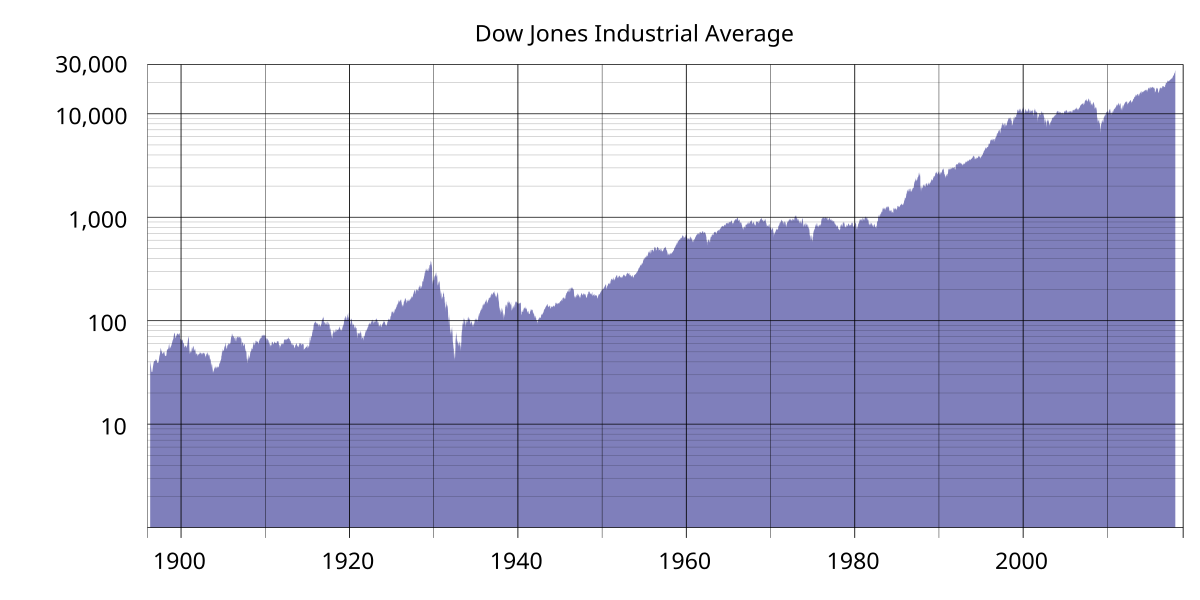

The rally was further boosted by renewed enthusiasm for technology stocks, particularly those linked to artificial intelligence. Companies in the semiconductor and software sectors reported strong earnings and outlooks, sparking a tech-led surge that lifted the Nasdaq Composite to its own record high. The S&P 500’s gains were mirrored by a jump in the index and a rise in the Dow Jones Industrial Average, which added significant points on the day.

Investor Sentiment: From Pessimism to Euphoria

“Buy the Dip” Mentality Returns

The market’s rapid recovery has reignited the “buy the dip” strategy among investors, who have been rewarded for their resilience during periods of volatility. The S&P 500’s surge since early April has erased all losses from the spring downturn, restoring confidence in the U.S. economy’s underlying strength. Analysts credit the turnaround to a combination of policy clarity from the White House, easing geopolitical tensions, and robust corporate earnings.

Wall Street Forecasts Brighten

As the S&P 500 reached new heights, Wall Street strategists revised their outlooks upward. Entering 2025, the consensus forecast was for a significant gain in the index, with some projecting further increases. The sharp reversal from spring lows has surprised even seasoned market watchers, who now see further upside if trade relations remain stable and inflation stays in check.

Global Impact: Positive Ripples Across Markets

International Markets Rally

The S&P 500’s record close sent positive signals to markets worldwide, with Asian and European equities also posting gains. The end of the U.S.-China trade standoff removed a major source of uncertainty for global investors, leading to a broad-based rally in emerging markets and export-driven economies. The technology sector’s strength, driven by advances in AI and chip manufacturing, has also buoyed sentiment in markets across the globe.:max_bytes(150000):strip_icc()/GettyImages-1207642273-2486c195b8c94c9da77e426e678b1133.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1207642273-2486c195b8c94c9da77e426e678b1133.jpg)

Oil Prices and Geopolitical Risks Ease

Recent military tensions in the Middle East, which had sent oil prices soaring, subsided following diplomatic efforts and ceasefire agreements. The de-escalation led to a sharp drop in crude prices, alleviating fears of a renewed inflation spike and further supporting equity markets. Investors shrugged off earlier concerns, focusing instead on the improving outlook for global trade and economic growth.

What’s Next: Cautious Optimism Amid Uncertainties

Rate Cut Hopes and Monetary Policy

Another key factor behind the S&P 500’s record run is growing speculation that the Federal Reserve may soon cut interest rates. Dovish comments from Fed officials and softer inflation data have fueled hopes of a more accommodative policy stance, which would provide additional support to stocks and risk assets. Traders are now closely watching upcoming economic releases and central bank meetings for further guidance.

Valuation Concerns and Potential Headwinds

Despite the euphoria, some analysts warn that the S&P 500’s lofty valuation could limit further gains. The index’s rapid ascent has pushed price-to-earnings ratios to elevated levels, raising questions about sustainability if earnings growth slows or new geopolitical risks emerge. Market veterans caution that while the current momentum is strong, investors should remain vigilant as uncertainties persist around fiscal policy, global trade, and the U.S. presidential election cycle.

Conclusion: A Defining Moment for U.S. and Global Markets

The S&P 500’s explosive rally to a record high following the end of Trump’s trade talks marks a defining moment for financial markets in 2025. It underscores the resilience of the U.S. economy, the power of policy shifts to reverse investor sentiment, and the enduring appeal of equities amid technological innovation. As global markets celebrate this milestone, attention now turns to whether the rally can be sustained in the face of evolving economic and political dynamics.

Despite the prevailing optimism, some market veterans are sounding notes of caution. They point to the elevated valuations in certain segments of the market, warning that expectations for earnings growth may be overly optimistic. There are also concerns about potential policy shifts in the run-up to the U.S. presidential election, as well as the possibility of renewed geopolitical tensions. These factors could introduce volatility and test the durability of the current rally.

The Federal Reserve’s next moves will be closely watched, as investors look for signals on interest rates and liquidity conditions. While the prospect of a rate cut has buoyed markets, any unexpected tightening or hawkish commentary could dampen sentiment. Inflation trends, wage growth, and consumer spending data will also play a critical role in shaping the market’s trajectory in the second half of the year.

Market strategists are advising investors to remain vigilant and diversified, emphasizing the importance of risk management in an environment where sentiment can shift rapidly. While the S&P 500’s ascent has been impressive, history shows that markets are prone to corrections, especially after extended rallies. Prudent asset allocation, regular portfolio reviews, and a focus on long-term goals are being recommended as ways to navigate the evolving landscape.

The psychological impact of the S&P 500’s new high cannot be understated. It has restored faith in the power of markets to recover from adversity and has reinforced the narrative that disciplined investing pays off over time. For many, the rally is a testament to the adaptability of the global economy and the enduring appeal of the U.S. as a destination for capital and innovation.

As the dust settles on the latest round of trade talks and markets adjust to the new reality, attention will gradually shift to the next set of challenges and opportunities. Whether the S&P 500 can sustain its momentum will depend on a complex interplay of economic data, corporate performance, policy decisions, and geopolitical developments. What is clear, however, is that the events of the past few months have ushered in a new era of cautious optimism, with investors around the world watching closely for the next chapter in this remarkable market story.

Follow: Dow Jones