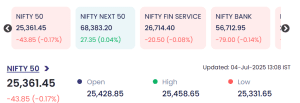

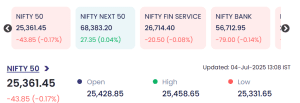

Mumbai: On 4 July 2025, the Indian stock market saw mixed movements, with major indices like the NIFTY 50 and NIFTY BANK ending in the red, despite gains in specific stock counters. The broader market sentiment remained cautious as key sectors witnessed minor sell-offs, while a few mid-cap and small-cap counters experienced sharp rallies and steep declines.

NIFTY 50 Closes Lower by 43 Points on 4 July 2025 (Mid-cap)

-

NIFTY FIN SERVICE: 26,714.40 (↓20.50 / -0.08%)

-

NIFTY BANK: 56,712.95 (↓79.00 / -0.14%)

-

NIFTY NEXT 50, however, offered some relief, rising marginally by 27.35 points (0.04%) to close at 68,383.20.

The sluggish performance of heavyweight financial and banking stocks weighed heavily on the broader indices.

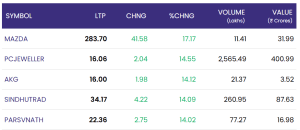

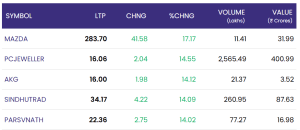

Top Gainers: MAZDA Leads With a 17% Surge

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| MAZDA | 283.70 | +41.58 | 17.17% | 11.41 | 31.99 |

| PCJEWELLER | 16.06 | +2.04 | 14.55% | 2,565.49 | 400.99 |

| AKG | 16.00 | +1.98 | 14.12% | 21.37 | 3.52 |

| SINDHUTRAD | 34.17 | +4.22 | 14.09% | 260.95 | 87.63 |

| PARSVNATH | 22.36 | +2.75 | 14.02% | 77.27 | 16.98 |

MAZDA stole the spotlight with a 17.17% rise, followed by PC Jeweller, which saw robust buying interest amid heavy volumes crossing 2,500 lakh shares.

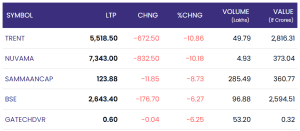

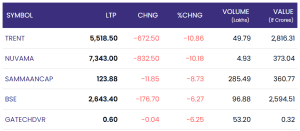

Top Losers: TRENT, NUVAMA, and BSE Among Major Drags

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| TRENT | 5,518.50 | -672.50 | -10.86% | 49.79 | 2,816.31 |

| NUVAMA | 7,343.00 | -832.50 | -10.18% | 4.93 | 373.04 |

| SAMMAANCAP | 123.88 | -11.85 | -8.73% | 285.49 | 360.77 |

| BSE | 2,643.40 | -176.70 | -6.27% | 96.88 | 2,594.51 |

| GATECHDVR | 0.60 | -0.04 | -6.25% | 53.20 | 0.32 |

TRENT and NUVAMA witnessed double-digit percentage declines, with investors locking in profits amid high valuations. Notably, BSE also faced substantial selling pressure despite its high trade value exceeding ₹2,500 crores.

Investor Sentiment: Mixed But Watchful

The market’s direction appears to be influenced by global cues, sectoral rebalancing, and selective profit booking. High-volume counters like PC Jeweller and SAMMAANCAP reflect active retail interest, while institutional flows may be shifting out of certain high-beta stocks like TRENT and BSE.

Investors are advised to stay cautious and follow a stock-specific strategy, particularly amid rising global uncertainties and domestic earnings season.

For real time stock Updates, visit NSE website.