Mumbai: As of 1:28 PM IST on Monday, 7 July 2025, the Indian stock market is exhibiting a cautiously bullish undertone. Despite a subdued opening and continued weakness in banking and financial indices, select midcap and high-volume stocks are fueling positive momentum. The benchmark Nifty 50 is hovering around the flatline, reflecting a tug-of-war between profit-booking in heavyweight sectors and strong interest in smaller counters.

Also Read: Indian Markets End Higher on July 4: NIFTY 50 Rebounds Amidst Sharp Moves in Select Stocks

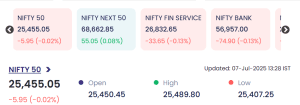

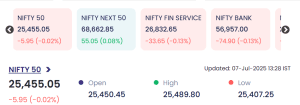

📊 Key Index Performance (Updated: 07-July-2025, 13:28 IST)

| Index | Level | Change | % Change | Sentiment |

|---|---|---|---|---|

| NIFTY 50 | 25,455.05 | -5.95 | -0.02% | ⚖️ Flat/Neutral |

| NIFTY NEXT 50 | 68,662.85 | +55.05 | +0.08% | 🟢 Mildly Bullish |

| NIFTY FIN SERVICE | 26,832.65 | -33.65 | -0.13% | 🔻 Weak |

| NIFTY BANK | 56,957.00 | -74.90 | -0.13% | 🔻 Weak |

-

Open: 25,450.45

-

High: 25,489.80

-

Low: 25,407.25

While Nifty 50 remains range-bound, Nifty Next 50 is slightly in the green, suggesting investor preference toward broader market exposure. However, sustained pressure on Bank Nifty and Financial Services is capping any upside.

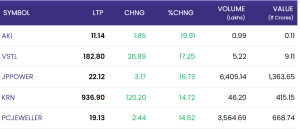

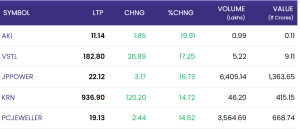

🚀 Top Gainers of the Day

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) | Market Insight |

|---|---|---|---|---|---|---|

| AKI | 11.14 | +1.85 | +19.91% | 0.99 | 0.11 | Sudden spurt in small-cap interest. |

| VSTL | 182.80 | +26.89 | +17.25% | 5.22 | 9.11 | Momentum pickup likely on earnings optimism. |

| JPPOWER | 22.12 | +3.17 | +16.73% | 6,405.14 | 1,363.65 | Massive volumes signal smart money activity. |

| KRN | 936.90 | +120.20 | +14.72% | 46.20 | 415.15 | Rally backed by strong fundamentals. |

| PCJEWELLER | 19.13 | +2.44 | +14.62% | 3,564.69 | 668.74 | Retail buzz remains strong. |

JPPOWER and PCJEWELLER are driving mid-cap rally trends, while KRN and VSTL are witnessing technical breakouts.

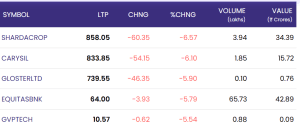

📉 Top Losers of the Day

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) | Market Insight |

|---|---|---|---|---|---|---|

| SHARDACROP | 858.05 | -60.35 | -6.57% | 3.94 | 34.39 | Likely post-rally correction. |

| CARYSIL | 833.85 | -54.15 | -6.10% | 1.85 | 15.72 | Technical selling pressure. |

| GLOSTERLTD | 739.55 | -46.35 | -5.90% | 0.10 | 0.76 | Low volume-based price drop. |

| EQUITASBNK | 64.00 | -3.93 | -5.79% | 65.73 | 42.89 | FII-led selloff likely. |

| GVPTCH | 10.57 | -0.62 | -5.54% | 0.88 | 0.09 | Weak speculative support. |

SHARDACROP, CARYSIL, and EQUITASBNK are among the worst performers, facing strong downward pressure and profit-booking.

📈 Market Sentiment and Sectoral Overview on 7 July 2025

-

The broader market sentiment remains cautiously bullish, buoyed by strong stock-specific action in power, FMCG, and retail.

-

Financials, banks, and select industrial stocks are seeing persistent pressure.

-

Strong volumes in JPPOWER and PCJEWELLER suggest robust retail and institutional participation in midcaps.

-

Investors are likely watching for global market cues, oil price fluctuations, and upcoming Q1 FY26 earnings season.

🧾 Conclusion

The Indian stock market on 7th July 2025 is navigating a delicate balance between optimism in midcaps and caution in heavyweight financials. While Nifty 50 trades flat, the action is clearly tilted toward selective stock picking and sector rotation. With earnings season around the corner and macro data awaited, market participants may remain guarded but opportunistic. Sustained momentum in midcaps could keep the broader sentiment constructively bullish, unless external headwinds escalate.

For real time stock Updates, visit NSE website.