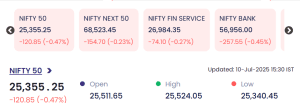

Mumbai: Benchmark indices ended in negative territory on 10 July 2025, as investors resorted to profit booking across sectors. The Nifty 50 closed at 25,355.25, falling by 120.85 points or 0.47%, as market sentiment turned cautious amidst global cues and sectoral rotation.

Also Read: July 9, 2025- Nifty Ends Lower Amid Volatility; Small-Caps Shine

Other key indices also witnessed similar declines:

-

Nifty Next 50 dropped to 68,523.45, down 154.70 points (-0.23%)

-

Nifty Financial Services closed at 26,984.35, shedding 74.10 points (-0.27%)

-

Nifty Bank fell sharply by 257.55 points (-0.45%) to settle at 56,956.00

The market opened on a soft note at 25,511.65, hit an intraday high of 25,524.05, but selling pressure dragged it down to a low of 25,340.45 before closing marginally higher than the day’s bottom.

Top Gainers: Penny Stocks and Mid-Caps Shine Bright

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SOMATEX | 53.89 | +8.98 | +20.00% | 1.31 | 0.71 |

| PENINLAND | 43.32 | +7.22 | +20.00% | 70.92 | 29.42 |

| MAMATA | 495.50 | +82.55 | +19.99% | 153.80 | 729.11 |

| DCM | 126.70 | +21.11 | +19.99% | 13.29 | 16.21 |

| NECLIFE | 19.76 | +3.29 | +19.98% | 263.82 | 48.10 |

-

MAMATA led the turnover chart among gainers with over ₹729 crore in traded value, showing strong institutional interest.

-

NECLIFE, with a volume of 263.82 lakh shares, indicated robust retail participation.

-

SOMATEX and PENINLAND hit the upper circuit at +20%, reflecting bullish sentiment in specific sectors despite broader weakness.

Top Losers: Selective Sell-Off in High-Beta and Micro-Cap Stocks

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

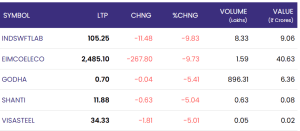

| INDSWFTLAB | 105.25 | -11.48 | -9.83% | 8.33 | 9.06 |

| EIMCOELECO | 2,485.10 | -267.80 | -9.73% | 1.59 | 40.63 |

| GODHA | 0.70 | -0.04 | -5.41% | 896.31 | 6.36 |

| SHANTI | 11.88 | -0.63 | -5.04% | 0.63 | 0.08 |

| VISASTEEL | 34.33 | -1.81 | -5.01% | 0.05 | 0.02 |

-

EIMCOELECO, a high-value engineering stock, corrected by ₹267.80, a sharp fall likely on weak quarterly earnings or sectoral outlook.

-

GODHA, despite a small absolute fall of ₹0.04, saw heavy volumes exceeding 896 lakh shares, suggesting speculative activity or exit by large retail investors.

-

INDSWFTLAB’s near 10% fall indicates possible adverse news flow or institutional profit booking.

Market Sentiment and Broader View on 10 July 2025

The markets reflected broad-based consolidation, with sector indices and major players booking profits after a prolonged rally. Despite economic optimism and robust fundamentals such as a stable inflation outlook and resilient earnings forecasts, the following factors seemed to weigh on investor confidence:

-

Anticipation of US Fed policy signals

-

Concerns over monsoon shortfall

-

Rising commodity prices, especially crude oil

-

Global geopolitical tensions impacting FIIs’ flows

The Banking, Financial Services, and Realty sectors showed relative weakness, while selective stocks in mid-caps and thematic sectors like waste management, infrastructure, and specialty manufacturing saw sharp rallies.

Looking Ahead: What to Watch

As the market enters the earnings season, investors and analysts will closely track:

-

Q1FY26 corporate results, especially from large-cap banks, IT majors, and consumer goods companies

-

Macroeconomic data including CPI inflation and IIP figures

-

Movement in global bond yields and foreign exchange markets

-

Sector-specific policy updates ahead of the monsoon session of Parliament

Investors are advised to adopt a stock-specific approach, focusing on fundamentals, earnings resilience, and management commentary, especially in volatile times like these.

Conclusion

The Indian stock market closed in the red on 10 July 2025, reflecting mixed global cues, profit booking, and prevailing caution among domestic investors ahead of key economic data. Despite the overall subdued sentiment dragging down benchmark indices like the NIFTY 50 and NIFTY BANK, the day revealed a more nuanced picture beneath the surface. Small-cap and mid-cap counters showed sharp upward momentum, indicating selective accumulation by institutional and savvy retail investors.

This trend highlights a growing appetite for theme-based and value-driven bets, particularly in sectors benefiting from structural reforms or cyclical tailwinds. The divergence between broader indices and stock-specific performances suggests that while headline indices may face short-term headwinds, the underlying tone remains constructive, especially in micro and niche segments poised for long-term growth.

For real time stock Updates, visit NSE website.