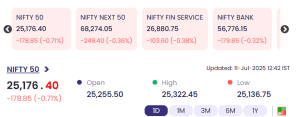

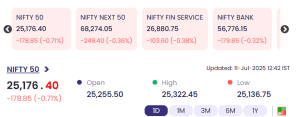

Mumbai: The Indian stock market witnessed a notable downturn on 11 July 2025, with benchmark indices closing deep in the red, reflecting weak global sentiment and continued investor caution. The NIFTY 50 ended the day at 25,176.40, down 178.85 points or -0.71%, following the previous session’s weakness. Other major indices followed suit, indicating widespread selling across sectors.

Also Read: 10 July 2025 :Indian Stock Markets Close Lower; Broader Indices in Red Amid Profit Booking

📉 Index Overview (Closing as of 12:42 PM IST)

| Index | Value | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 25,176.40 | -178.85 | -0.71% |

| NIFTY NEXT 50 | 68,274.05 | -249.40 | -0.36% |

| NIFTY FIN SERVICE | 26,880.75 | -103.60 | -0.38% |

| NIFTY BANK | 56,776.15 | -179.85 | -0.32% |

-

Opening Level: 25,255.50

-

High: 25,322.45

-

Low: 25,136.75

The trading session was marked by consistent profit booking at higher levels, and weak cues from global markets led to broad-based selling across frontline stocks. Heavyweights like banking and financials exerted additional pressure, dragging the broader indices lower.

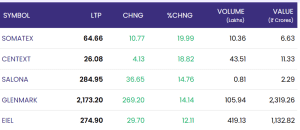

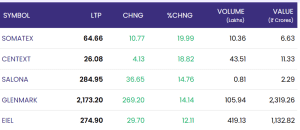

📈 Top Gainers – 11 July 2025

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| SOMATEX | 64.66 | +10.77 | +19.99% | 10.36 | 6.63 |

| CENTEXT | 26.08 | +4.13 | +18.82% | 43.51 | 11.33 |

| SALONA | 284.95 | +36.65 | +14.76% | 0.81 | 2.29 |

| GLENMARK | 2,173.20 | +269.20 | +14.14% | 105.94 | 2,319.26 |

| EIEL | 274.90 | +29.70 | +12.11% | 419.13 | 1,132.82 |

-

Glenmark gained significantly after reports of successful clinical trials in its oncology segment.

-

EIEL surged on strong volume-based buying amid expectations of improved quarterly results.

-

CENTEXT and SOMATEX continued their upward journey on positive market buzz and increased investor participation.

📉 Top Losers – 11 July 2025

| Symbol | LTP (₹) | Change (₹) | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| INTERNET | 13.39 | -1.83 | -12.02% | 6.26 | 0.84 |

| PARSVNATH | 24.11 | -2.49 | -9.36% | 45.37 | 11.32 |

| AVROIND | 151.86 | -12.21 | -7.44% | 0.68 | 1.06 |

| DBSTOCKBRO | 27.60 | -2.02 | -6.82% | 2.51 | 0.70 |

| ZOTA | 1,210.60 | -81.30 | -6.29% | 0.78 | 9.54 |

-

INTERNET and AVROIND were battered due to weak fundamentals and lack of investor interest.

-

ZOTA saw correction after a sharp rally earlier in the week, possibly due to profit booking.

-

PARSVNATH, from the realty sector, slipped due to reports of regulatory scrutiny over ongoing projects.

🔍 Market Sentiment & Key Takeaways

-

Broad Weakness: All major indices traded with a negative bias, largely influenced by global economic cues, rising crude prices, and concerns over interest rate hikes in the US and Europe.

-

Selective Strength: While large caps remained subdued, specific mid and small-cap stocks saw significant interest from retail and institutional investors.

-

Volatility Ahead: As earnings season progresses and inflation prints are due globally, market volatility is likely to stay elevated in the coming sessions.

📊 Conclusion

The Indian equity market continued its corrective phase for the second consecutive day, with major indices showing notable declines. Yet, there remained pockets of optimism among select stocks, especially in the mid-cap pharma and infrastructure-related sectors. The market breadth remained neutral to negative, and volumes were concentrated around event-driven stocks. Going forward, investors will closely watch macroeconomic data, earnings reports, and global policy announcements to gauge the direction of the market.

Despite the red close, the activity in selected counters signals that seasoned investors are strategically accumulating quality stocks during dips, positioning themselves for long-term gains.