Mumbai: The Indian stock market today, on 21 JUly 2025 witnessed a historic rally today as the Nifty 50 surged past the 25,000 mark, closing at 25,090.70, up 122.30 points (0.49%). Investors cheered positive earnings reports, strong macroeconomic indicators, and global cues, pushing key indices higher across the board.

Other major indices also showed strong performance:

-

-

Nifty Financial Services: 26,986.95 (+430.80 | +1.62%)

-

Nifty Bank: 56,952.75 (+669.75 | +1.19%)

The Nifty 50 opened at 24,999.00, reached an intraday high of 25,111.40, and a low of 24,882.30, showing a strong upward trend throughout the day.

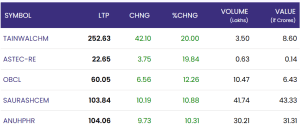

📊 Top Gainers

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| TAINWALCHM | 252.63 | +42.10 | +20.00% | 3.50 | 8.60 |

| ASTEC-RE | 22.65 | +3.75 | +19.84% | 0.63 | 0.14 |

| OBCL | 60.05 | +6.56 | +12.26% | 10.47 | 6.43 |

| SAURASHCEM | 103.84 | +10.19 | +10.88% | 41.74 | 43.33 |

| ANUHPHR | 104.06 | +9.73 | +10.31% | 30.21 | 31.31 |

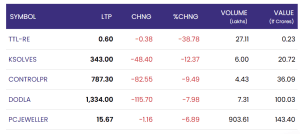

📉 Top Losers

| Symbol | LTP | Change | % Change | Volume (Lakhs) | Value (₹ Cr) |

|---|---|---|---|---|---|

| TTL-RE | 0.60 | -0.38 | -38.78% | 27.11 | 0.23 |

| KSOLVES | 343.00 | -48.40 | -12.37% | 6.00 | 20.72 |

| CONTROLPR | 787.30 | -82.55 | -9.49% | 4.43 | 36.09 |

| DODLA | 1,334.00 | -115.70 | -7.98% | 7.31 | 100.03 |

| PCJEWELLER | 15.67 | -1.16 | -6.89% | 903.61 | 143.40 |

🧾 Market Sentiment on 21 July 2025

The market sentiment remained strongly bullish, driven by a combination of:

-

Robust buying in financial and banking stocks.

-

Optimism around Q2 earnings season.

-

Stable global markets and FII inflows.

With Nifty 50 closing at an all-time high, investors remain optimistic about sustained momentum, especially in large-cap and BFSI segments.

For real time stock Updates, visit NSE website.