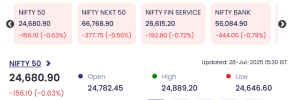

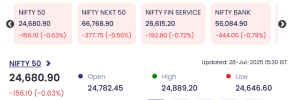

Mumbai: Indian equity markets ended the trading session on a sharply negative note on Monday, 28 July 2025 with broad-based selling across sectors. Nifty 50 tumbled by 156.10 points (0.63%) to close at 24,680.90, amid weak global cues and profit-booking in heavyweight financial and banking stocks. Other key indices, including Nifty Next 50, Financial Services, and Bank Nifty, also saw steep declines.

🔻 Market Highlights – Major Indices Performance

| Index | Closing Value | Change (Points) | % Change |

|---|---|---|---|

| Nifty 50 | 24,680.90 | -156.10 | -0.63% |

| Nifty Next 50 | 66,768.90 | -377.75 | -0.56% |

| Nifty Financial Services | 26,615.20 | -192.80 | -0.72% |

| Nifty Bank | 56,084.90 | -444.00 | -0.79% |

The benchmark Nifty 50 opened at 24,782.45 and made an intraday high of 24,889.20. However, it slipped during the afternoon session to touch a low of 24,646.60, weighed down by sharp losses in banking and mid-cap stocks.

📈 Top 5 Gainers on NSE

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| VIMTALABS | 680.00 | +95.05 | +16.25% | 281.38 | 1,786.75 |

| TIMESGTY | 242.00 | +21.12 | +9.56% | 4.74 | 11.75 |

| ACMESOLAR | 296.00 | +25.55 | +9.45% | 134.01 | 392.80 |

| JAGSNPHARM | 287.80 | +24.51 | +9.31% | 75.30 | 221.21 |

| OMAXAUTO | 132.00 | +10.87 | +8.97% | 34.22 | 44.74 |

Vimta Labs emerged as the standout performer of the day, skyrocketing over 16% on the back of strong institutional buying and robust quarterly guidance. Acme Solar and Jagsonpal Pharma also attracted bullish interest, signaling a shift in focus towards mid-cap pharma and green energy stocks.

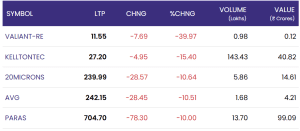

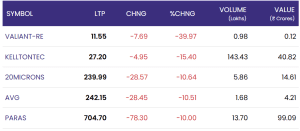

📉 Top 5 Losers on NSE

| Stock | LTP (₹) | Change (₹) | % Change | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|---|---|---|

| VALIANT-RE | 11.55 | -7.69 | -39.97% | 0.98 | 0.12 |

| KELLTONTEC | 27.20 | -4.95 | -15.40% | 143.43 | 40.82 |

| 20MICRONS | 239.99 | -28.57 | -10.64% | 5.86 | 14.61 |

| AVG | 242.15 | -28.45 | -10.51% | 1.68 | 4.21 |

| PARAS | 704.70 | -78.30 | -10.00% | 13.70 | 99.09 |

Valiant Organics – Rights Entitlement (VALIANT-RE) continued to nosedive, plunging nearly 40% for the second consecutive session. IT services player Kellton Tech also dropped over 15% amid sell-off pressure and negative sentiment in tech mid-caps.

🔎 Key Takeaways and Market Sentiment on 28 July 2025

-

Broader market weakness reflects rising investor caution ahead of upcoming central bank rate decisions and macroeconomic data.

-

Heavy profit-booking was observed in financial services and banking stocks, leading the overall decline.

-

High volumes in select pharma and green energy stocks suggest a shift in market interest toward defensives and sustainable sectors.

-

Volatility expected to persist through the week due to global cues and earnings season reactions.

✅ Conclusion: Market Enters Cautious Zone

With major indices posting significant losses and mid-cap stocks witnessing polarizing moves, market sentiment has turned cautious. While individual stock momentum remains intact for select sectors like pharma and renewable energy, broader selling pressure highlights the need for investors to tread carefully. Analysts recommend portfolio rebalancing with a defensive tilt and close tracking of global indicators.