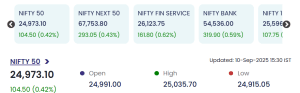

Mumbai: On 10 September 2025 at 3:30 PM, the NIFTY 50 closed at 24,973.10, up by 104.50 points (0.42%).

Also Read: 10th September 2025: NIFTY 50 Rallies; Market Movers and Sector Performance (11:04 IST)

Top Gainers: ICIL, FAZE3Q, APEX Lead the Surge

-

ICIL closed at ₹284.73, rising ₹47.45 (20.00%), volume 42.45 lakhs, value ₹117.69 crore.

-

FAZE3Q ended at ₹545.40, up ₹90.90 (20.00%), volume 5.98 lakhs, value ₹31.52 crore.

-

COASTCORP traded at ₹37.56, up ₹6.26 (20.00%), volume 2.98 lakhs, value ₹1.09 crore.

-

ATLANTAA reached ₹43.64, up ₹7.27 (19.99%), volume 45.78 lakhs, value ₹19.40 crore.

-

APEX closed at ₹254.00, gaining ₹34.53 (15.73%), highest volume at 87.07 lakhs, value ₹224.66 crore.

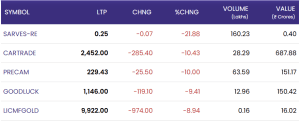

Top Losers: SARVES-RE, CARTRADE, LICMFGOLD Register Steep Declines

-

SARVES-RE dropped to ₹0.25, declining ₹0.07 (-21.88%), heavy volume 160.23 lakhs, value ₹0.40 crore.

-

CARTRADE slipped to ₹2,452.00, down ₹285.40 (-10.43%), volume 28.29 lakhs, value ₹687.88 crore.

-

PRECAM ended at ₹229.43, down ₹25.50 (-10.00%), volume 63.59 lakhs, value ₹151.17 crore.

-

GOODLUCK fell to ₹1,146.00, off ₹119.10 (-9.41%), volume 12.96 lakhs, value ₹150.42 crore.

-

LICMFGOLD declined to ₹9,922.00, losing ₹974.00 (-8.94%), volume 0.16 lakhs, value ₹16.02 crore.

Intraday Dynamics and Market Sentiment

The session closed with positive momentum across the NIFTY indices, led by robust gains in financials, banks, and select midcaps. High-volume gainers such as APEX and ICIL drove market liquidity. On the downside, counters like CARTRADE and SARVES-RE witnessed sharp corrections, indicating profit-booking and rotation into outperformers.

Conclusion: 10 September 2025

10 September 2025 saw strong index gains backed by sectoral leadership and high-volume activity in select stocks. The close reflected a bullish undertone, driven by broad participation and notable volatility among both top gainers and losers.

For real time stock Updates, visit NSE website.