Washington D.C. – The United States has imposed comprehensive sanctions targeting several individuals, entities, and vessels, with US sanctions Indian firms being a significant component of this enforcement action. The Treasury Department’s Office of Foreign Assets Control (OFAC) announced it was sanctioning 50 individuals, entities, and vessels involved in facilitating Iranian oil and liquefied petroleum gas sales and shipments.

In addition to Indian entities, the sanctions also target a Chinese independent refinery and terminal, demonstrating the broad international scope of the enforcement action. The US sanctions Indian firms form part of a larger strategy to disrupt Iran’s energy export network and its associated shadow fleet operations.

Iranian Oil Network and Funding Concerns

The United States maintains that Iran utilizes income from its oil networks to fund nuclear and missile programs while supporting militant proxies throughout the Middle East. This belief provides the foundation for the US sanctions Indian firms and other entities involved in Iranian petroleum trade.

According to official US assessments, disrupting Iran’s energy export capabilities directly impacts the country’s ability to finance activities deemed threatening to regional and global security. However, Iran consistently maintains that its nuclear program serves peaceful purposes, rejecting allegations of military applications.

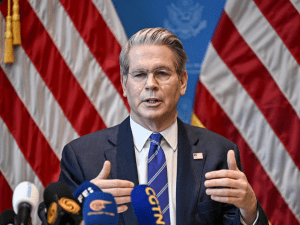

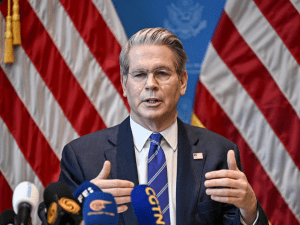

Treasury Secretary’s Statement on Sanctions

Treasury Secretary Scott Bessent explained the rationale behind the US sanctions Indian firms and associated entities, emphasizing the department’s commitment to degrading Iran’s cash flow. He stated that the action aims to dismantle key elements of the Iranian energy export machine.

Bessent emphasized that the move was specifically designed to disrupt Iran’s ability to fund terrorist groups with billions of dollars’ worth of petroleum-related exports. This statement frames the US sanctions Indian firms within the broader context of counter-terrorism efforts and national security priorities.

Indian Companies Targeted in Sanctions

The US sanctions Indian firms specifically include three entities with Indian connections involved in petroleum transportation activities. Varun Pula’s Bertha Shipping Inc., registered in the Marshall Islands, represents one of the primary targets of the enforcement action.

Iyappan Raja-owned Evie Lines Inc. constitutes another entity affected by the US sanctions Indian firms announcement. Additionally, Soniya Shreshtha’s India-based Vega Star Ship Management Private Limited faces sanctions for its role in transporting Iranian petroleum products.

These three companies represent the Indian component of a larger international network allegedly facilitating Iranian oil and LPG exports in violation of existing US sanctions regimes.

Shadow Fleet Vessel Operations

The Treasury Department revealed it had targeted more than a dozen vessels from Iran’s so-called shadow fleet, which operates to evade existing sanctions. These vessels play crucial roles in the networks affected by US sanctions Indian firms and associated penalties.

Also Read: Critical US Troops Israel Clarification: White House Corrects Deployment Reports

Specific vessels identified include Kongm, Big Mag, and Voy, which the department claims transport several million barrels of Iranian oil to Rizhao. The shadow fleet represents a sophisticated attempt to circumvent international sanctions through vessel registration manipulation and operational obfuscation.

Presidential Statement on Iran Policy

President Donald Trump addressed the sanctions during a White House cabinet meeting, providing broader context for the US sanctions Indian firms and related enforcement actions. Trump stated that the United States would “like to see” Iran rebuild but emphasized that the country “can’t have a nuclear weapon.”

This presidential statement frames the sanctions as part of a comprehensive Iran policy balancing potential engagement with firm red lines regarding nuclear weapons development. The US sanctions Indian firms thus serve as enforcement mechanisms for this broader strategic approach.

Bertha Shipping Operations Details

The US sanctions Indian firms include specific allegations against Bertha Shipping Inc., owned by Varun Pula and based in the Marshall Islands. The company owns and manages the Comoros-flagged PAMIR vessel, which allegedly transported nearly four million barrels of Iranian LPG to China since July 2024.

This substantial volume of petroleum product transportation demonstrates the scale of operations that prompted the Treasury Department’s enforcement action. The PAMIR’s activities represent a significant component of the Iranian export network targeted by sanctions.

Evie Lines Sanctioned Activities

Evie Lines Inc., another entity affected by US sanctions Indian firms, owns and operates the Panama-flagged SAPPHIRE GAS vessel. According to Treasury Department allegations, this vessel has been responsible for transporting over one million barrels of Iranian LPG to China since April 2025.

The relatively recent timeline of these operations suggests ongoing and active involvement in Iranian petroleum exports at the time of sanctions imposition, making Evie Lines a priority target for enforcement actions.

Vega Star Ship Management Violations

The US sanctions Indian firms specifically identify India-based Vega Star Ship Management Private Limited for its role in petroleum transportation activities. The company owns and operates the Comoros-flagged NEPTA vessel, which has allegedly transported Iranian LPG to Pakistan since January 2025.

This Pakistan route represents a regional dimension to Iranian petroleum exports, with US sanctions Indian firms targeting not only China-bound shipments but also products destined for South Asian markets.

Administration’s Counter-Terrorism Objectives

Treasury Secretary Bessent emphasized that under President Trump, the administration is actively disrupting the Iranian regime’s ability to fund terrorist groups threatening the United States. This objective provides the strategic framework for US sanctions Indian firms and other enforcement measures.

The sanctions represent tools in a broader counter-terrorism strategy that seeks to limit financial resources available to groups the United States designates as terrorist organizations. By targeting petroleum export networks, the administration aims to reduce funding streams supporting such activities.

Implications for International Trade

The US sanctions Indian firms carry significant implications for international petroleum trading and shipping industries. Companies involved in oil and gas transportation must now exercise enhanced due diligence to avoid inadvertently facilitating sanctioned activities that could result in similar enforcement actions against their operations and assets.