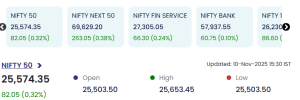

On 10 November 2025, Indian equity markets displayed mixed dynamics, with the headline Nifty 50 index registering a modest gain while several individual stocks experienced sharp swings in both directions. Broader indices echoed cautious optimism as select outperformers rallied and laggards faced steep corrections, highlighting sector rotation and profit booking amidst ongoing market volatility.

Also Read: November 7, 2025 (Midcap): Nifty 50 Rebounds by 31 Points; Strong Gains in MBEL and Interarch

Nifty 50 Posts Marginal Gain Amid Sectoral Churn

Top Gainers Power Ahead: Gallantt, Lumaxtech, and Wealth Shine

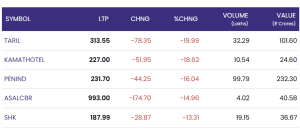

Notable Losers Drag Sentiment: ASALCBR and TARIL Face Heat

Market Value and Turnover Indicate Selective Participation

Trading volume and value data showed concentrated activity: Gallantt saw a turnover of ₹404.42 crore on 63.20 lakh shares, whereas Blissgvs reported the highest volume at 121.91 lakhs but a moderate value of ₹169.86 crore. For the losers, PENIND registered the highest traded volume at 99.79 lakhs, with significant value erosion of ₹232.30 crore. These numbers signal active investor realignment as select midcaps overshadowed others in both participation and price movements.

Conclusion: 10 November 2025

The November 10 trading session portrayed a market at the crossroads, balancing gains in key indices with pronounced volatility in midcap and smallcap counters. While headline indices provided stability, sharp rises and falls among individual stocks highlighted the ongoing churn in Indian equities. Investors and analysts alike continue to track volume and value flows keenly for signals of broader market direction in coming sessions.

For real time stock Updates, visit NSE website.