On December 1, 2025, Indian stock markets saw a mixed trend with the NIFTY 50 index posting gains, while select stocks registered either sharp hikes or significant declines. The benchmark indices and individual stock performances reflected the volatility characteristic of this week’s trading environment.

NIFTY 50 and Key Indices Update

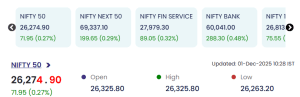

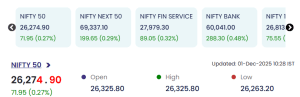

The NIFTY 50 closed at 26,274.90, up by 71.95 points or 0.27%. Other major indices also showed positive momentum: NIFTY NEXT 50 gained 199.65 points (0.29%), NIFTY FIN SERVICE rose 89.05 points (0.32%), and NIFTY BANK jumped by 288.30 points (0.48%). During the trading session, the NIFTY 50 touched a high and opening of 26,325.80, with a low recorded at 26,263.20.

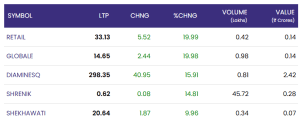

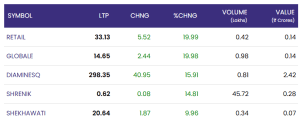

Top Gainers in Action

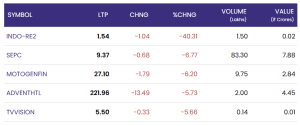

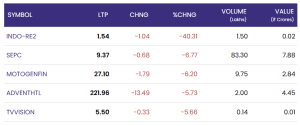

Sharp Declines: Biggest Losers

Conclusion: December 1, 2025 (opening)

December 1, 2025, showcased the dynamic nature of Indian equity markets with broad indices posting mild gains, while disparities between top gainers and losers highlighted sectoral rotation. This volatility signals continued opportunities and risks for investors in the upcoming sessions, warranting close monitoring of both broader benchmarks and individual stocks.

For real time stock Updates, visit NSE website.