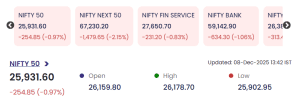

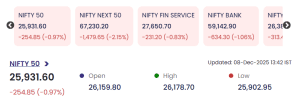

Indian equity markets continued to face selling pressure on 8 December 2025, with the benchmark Nifty 50 declining 254.85 points (-0.97%) to 25,931.60 by 13:42 IST. The fall was accompanied by deeper corrections in the broader market, with the Nifty Next 50, Financial Services, and Bank Nifty indices registering sharper declines.

Global market weakness, profit booking, and increased volatility weighed on investor sentiment, dragging major sectoral indices into negative territory.

Market Snapshot: Index Performance

-

NIFTY 50: 25,931.60 (–254.85 / –0.97%)

-

Open: 26,159.80

-

High: 26,178.70

-

Low: 25,902.95

-

Nifty Next 50: –2.15%

-

Nifty Fin Service: –0.83%

-

Nifty Bank: –1.06%

The downturn signals continued caution among investors, with selling pressure intensifying across high-beta sectors.

Top Gainers: Select Stocks Rally Despite Market Selloff

Several small- and mid-cap stocks bucked the broader market trend, registering substantial gains:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) |

|---|---|---|---|---|

| KESORAMIND | 7.84 | +1.30 | +19.88% | 219.19 |

| ARVEE | 225.63 | +28.15 | +14.25% | 2.58 |

| MATRIMONY | 529.05 | +53.35 | +11.22% | 5.61 |

| DREDGECORP | 970.35 | +89.80 | +10.20% | 29.12 |

| ROLEXRINGS | 119.98 | +10.83 | +9.92% | 146.71 |

Key Observations

-

KESORAMIND surged nearly 20% with exceptionally high volumes (219 lakh shares), indicating strong speculative interest.

-

DREDGECORP saw a sharp rise supported by significant value turnover (₹273 crore), suggesting institutional participation.

-

ROLEXRINGS, ARVEE, and Matrimony.com displayed strong upward momentum despite overall market weakness.

Top Losers: Heavy Selling Hits High-Value Counters

Several mid- and large-cap names witnessed steep declines as selling intensified:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) |

|---|---|---|---|---|

| IVP | 141.99 | –18.11 | –11.31% | 0.51 |

| KAYNES | 3,888.50 | –465.00 | –10.68% | 80.06 |

| KEYFINSERV | 304.40 | –34.45 | –10.17% | 0.52 |

| ARENTERP | 51.68 | –5.82 | –10.12% | 0.05 |

| HCC | 17.94 | –1.96 | –9.85% | 350.66 |

Key Observations

-

Kaynes Technology witnessed a major correction of ₹465 per share, with heavy trading volume exceeding 80 lakh shares.

-

HCC showed massive volume activity (350 lakh shares) but slumped nearly 10% on heightened selling.

-

Across the list, all top losers recorded double-digit percentage declines, suggesting broad-based profit booking.

Conclusion: 8 December 2025

The market on 8 December 2025 reflected heightened volatility, with benchmark indices sliding sharply and broader indices showing even deeper corrections. However, selective buying in small- and mid-cap stocks provided pockets of resilience amid the downturn.

Analysts expect short-term volatility to persist, driven by global cues and domestic institutional flows, while stock-specific action is likely to continue in the broader market space.

For real time stock Updates, visit NSE website.