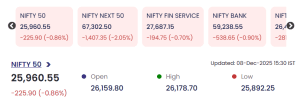

The Indian equity market extended its downward trend on 8 December 2025, with the benchmark Nifty 50 closing at 25,960.55, down 225.90 points (–0.86%) by 15:30 IST.

Broader indices recorded even steeper losses, pointing to widespread risk aversion and profit booking across the market.

Market Snapshot: Index Performance

-

NIFTY 50: 25,960.55 (–225.90 / –0.86%)

-

Open: 26,159.80

-

High: 26,178.70

-

Low: 25,892.25

-

Nifty Next 50: –2.05%

-

Nifty Financial Services: –0.70%

-

Nifty Bank: –0.90%

Weak global cues and sectoral rotation contributed to the subdued sentiment across the board.

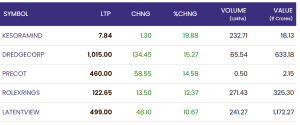

Top Gainers: Select Counters Witness Strong Momentum

Despite overall weakness, several stocks posted impressive gains driven by strong volumes and investor interest:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| KESORAMIND | 7.84 | +1.30 | +19.88% | 232.71 | 18.13 |

| DREDGECORP | 1,015.00 | +134.45 | +15.27% | 65.54 | 633.18 |

| PRECOT | 460.00 | +58.55 | +14.58% | 0.50 | 2.15 |

| ROLEXRINGS | 122.65 | +13.50 | +12.37% | 271.43 | 325.30 |

| LATENTVIEW | 499.00 | +48.10 | +10.67% | 241.27 | 1,172.27 |

Market Highlights

-

KESORAMIND surged nearly 20%, continuing its sustained upward momentum with high liquidity.

-

DREDGECORP recorded a strong rally backed by ₹633 crore in traded value, signalling institutional action.

-

LATENTVIEW posted double-digit gains with exceptionally high turnover (₹1,172 crore), reflecting robust investor confidence.

-

Mid-cap performers like PRECOT and ROLEXRINGS also defied market weakness.

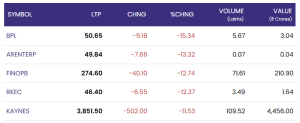

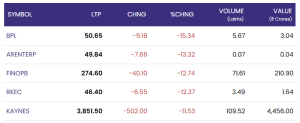

Top Losers: Heavy Selling in Select Mid- and Large-Cap Stocks

Sharp declines were witnessed in several stocks, led by steep corrections in high-volatility counters:

| SYMBOL | LTP | CHNG | %CHNG | VOLUME (Lakhs) | VALUE (₹ Cr) |

|---|---|---|---|---|---|

| BPL | 50.65 | –9.18 | –15.34% | 5.67 | 3.04 |

| ARENTERP | 49.84 | –7.66 | –13.32% | 0.07 | 0.04 |

| FINOPB | 274.60 | –40.10 | –12.74% | 71.61 | 210.90 |

| RKEC | 46.40 | –6.55 | –12.37% | 3.49 | 1.64 |

| KAYNES | 3,851.50 | –502.00 | –11.53% | 109.52 | 4,456.00 |

Key Observations

-

KAYNES Technology saw a significant decline of ₹502 per share, with massive turnover of ₹4,456 crore, reflecting strong institutional selling.

-

FINOPB and BPL dropped sharply amid high volatility and weak sentiment in small- and mid-cap pockets.

-

Across the losers’ list, all counters witnessed double-digit percentage declines, reinforcing broad-based market pressure.

Conclusion: 8 December 2025

The market on 8 December 2025 witnessed intensified selling across benchmark and broader indices. However, selective strength in mid-cap and analytics/tech-driven counters like DREDGECORP and LATENTVIEW provided some resilience.

Analysts expect volatility to remain elevated in the near term, with global cues and institutional flows likely to guide further market direction.